By MICHAEL FLITTON

and OSCAR MACKERETH

At Cerno Capital, we are optimistic about the opportunities for investment in Artificial Intelligence.

Over the past three years we have written extensively on its potential and how it relates to our portfolio holdings[i]. While AI as a technology has many imperfections, we take the view that identified challenges will prove surmountable. The main reason we are excited is the growing evidence of value creation from companies utilising AI.

Until recently, our focus has been on the infrastructure layer, primarily semiconductors. However, we are seeing increasing opportunity in implementation; companies using AI to improve the way a business runs or the products and services it provides. This year we have introduced several such firms into the Global Leaders portfolio. In this journal we will discuss these use cases as well as how we internally frame the evolving investment landscape in AI.

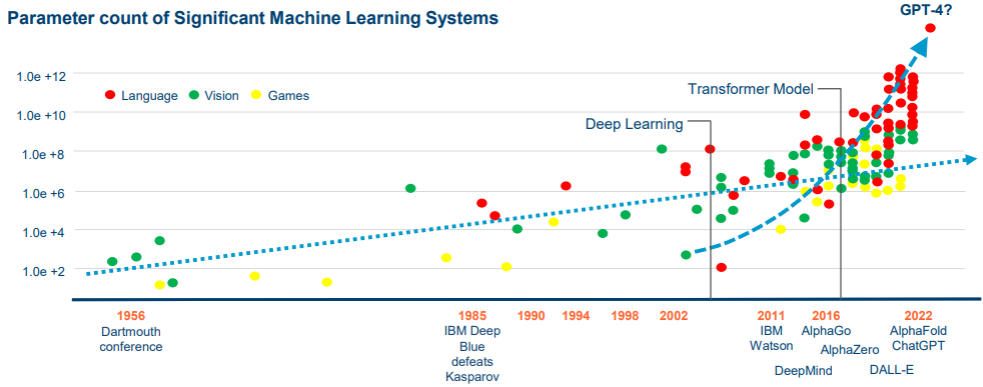

The transformational promise of AI has been the subject of countless books. DeepMind co-founder Mustafa Suleyman states that “AI is like a tsunami that comes out of the deep, blue ocean” bringing with it “an unprecedented moment of exponential innovation and upheaval”[ii]. The tectonic shift that started this wave was the introduction of transformer architecture in 2017. An emergent property of these systems is the ability to ‘generate’ original thought in the form of text, video, or image. The evolving capability, proxied here by the model parameter count over time, potentially unlocks a vast array of real-world applications for AI.

Source: Polar Capital

Source: Polar Capital

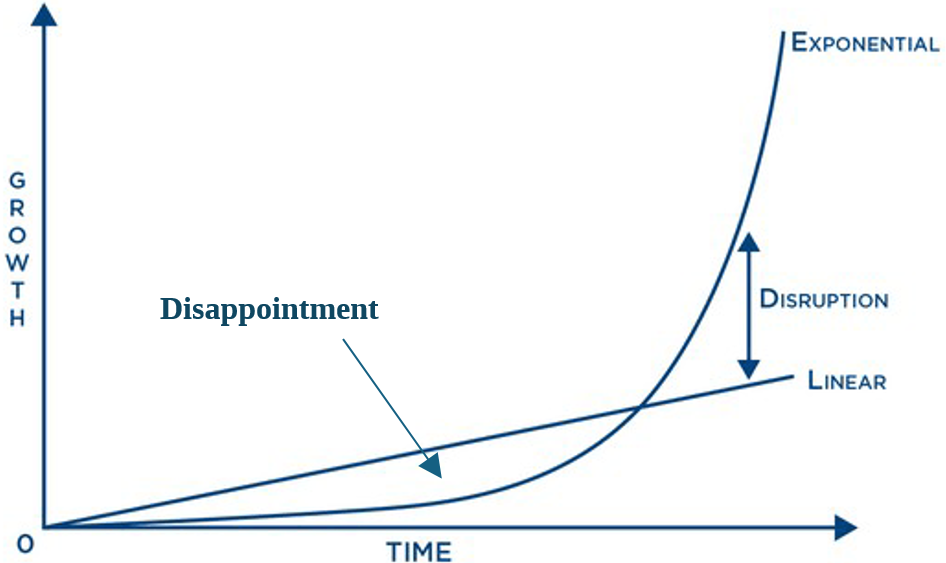

However, this step change in computing power takes time to translate into tangible products and services. Technology must meet available capital, industry application knowledge, and ready customer demand to proceed to a product. This takes time. This unavoidable friction means that a technology’s evolution tends to be non-linear, tracing out a long arc of apparent incrementalism before an explosion in growth. As we humans tend to think linearly, this leads to an initial phase of disappointment.

The emergence of AI into the public consciousness has followed this trajectory closely, particularly given the initial excitement about its long-term potential. Since ChatGPT, a certain degree of disillusionment has become evident. This stems from two things. Firstly, the reality that these models remain a long way from human level intelligence and the concern that in their current architecture they may never reach it. Secondly, that whilst Large Language Models such as ChatGPT are impressive, they are actually constrained by being language models, unable currently to interact fully with symbol laden universes (whether mathematical, chemistry based or other universes). That second set of connections lies ahead.

Fixating on this Utopia of Artificial General Intelligence is more appropriate to academia than investment, in our view. For investors, as for Voltaire; “perfect is the enemy of the good”. Much of the progress in applying AI, as we will discuss later, is ‘hidden’ within the structures of established companies. The places with existing capital, industry know-how, and knowledge of customer demand are incumbent businesses. The AI tools employed by these firms do not need to be ‘human intelligence’ to be incredibly powerful. Ignoring progress because it may not yet be the ‘killer app’ risks missing the value already being created with ‘good’ products that may not yet be ‘perfect’. These products are improving company revenue streams, productivity, and the relationship with their customers.

The stages of investible opportunities in AI

We find it convenient to visualise the AI opportunity in three phases:

- AI Architecture

- AI as an Accelerator

- AI White Space

We view these as progressive stages, but they are unlikely to be discrete. There are already businesses creating exciting white space applications for AI. What delineates between the three from our perspective is how investable they are at a given time. As a quality equity manager, we are concerned with not just growth, but also the resilience of business models and the supporting competitive structure of the industry in which the company operates. Technological advances in AI have led to a proliferation of use cases over the past few years. However, many emerging applications go hand in hand with fragmented competitive environments and demand generous assumptions around growth runways to justify high rates of cash burn. This is common amongst the cutting edge of newly emerging industries, but it is simply not a pond we think we can profitably fish in. As the industry matures, the opportunity to invest will expand across the phases.

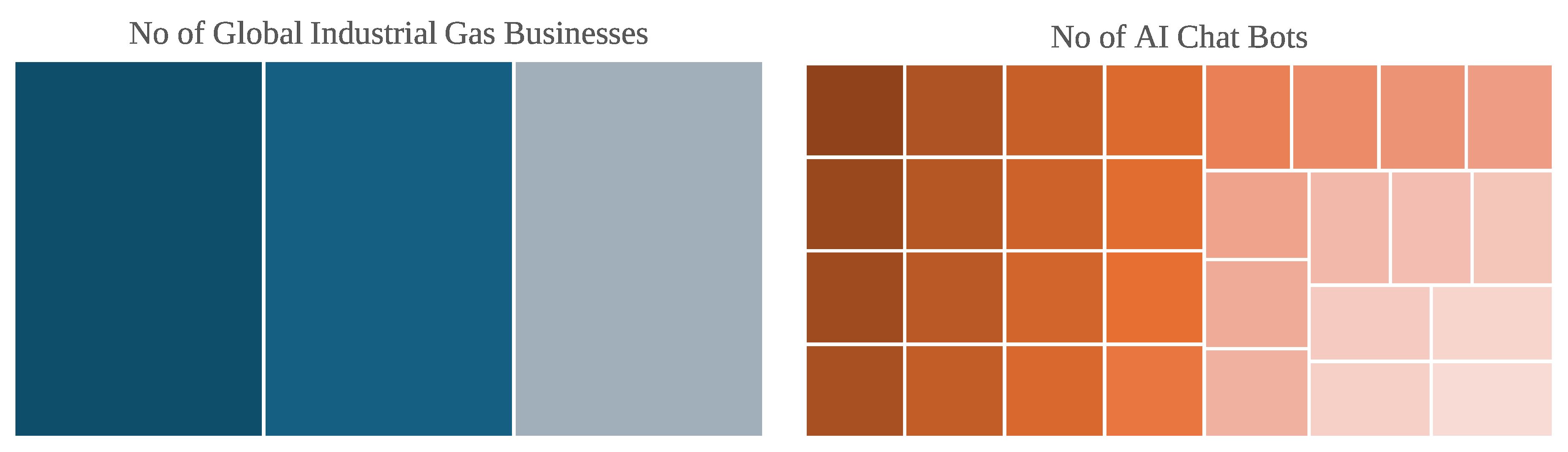

This point is handily illustrated by a comparison between the venerable, yet still critical, industrial gas industry and the emerging field of AI chat bots. In the former, we own Linde, one of three globally relevant firms providing essential gases for industries including semiconductors and healthcare. Linde has grown operating earnings at over 25% pa since 2017 supported by this concentrated structure. While revenues for AI chat bots as a group may grow attractively, there are more mouths to feed and little chance of identifying the winners ahead of time.

1 AI Archictecture

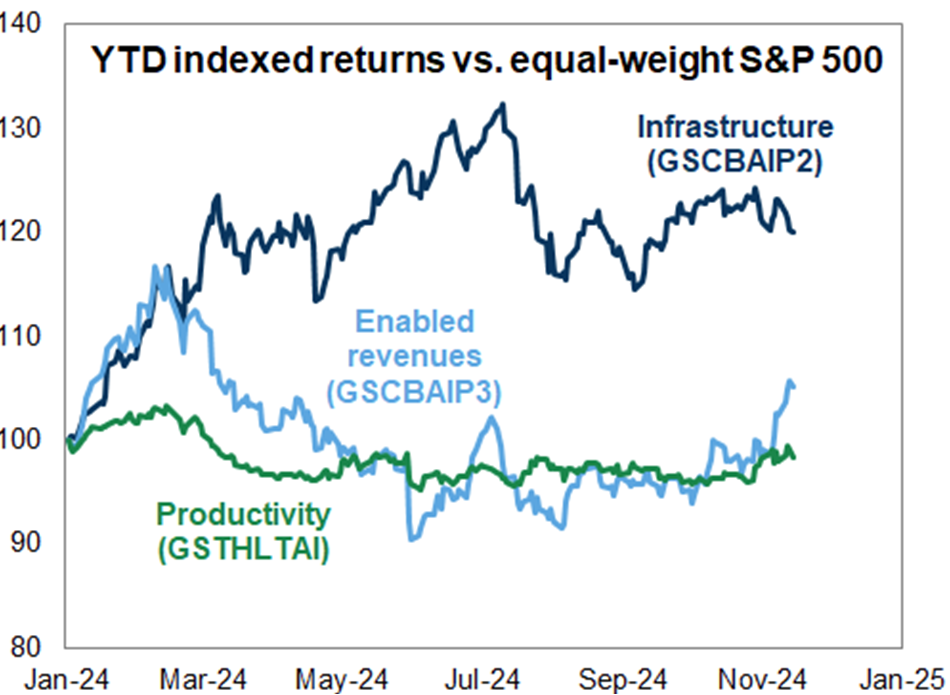

In the early stages of a new Tech cycle, it is often the providers of infrastructure (chip makers, equipment providers, utilities) who experience the strongest performance. Those who facilitate “build it and they will come”. Firms demand infrastructure to allow the development of investible end use cases. This has been the case with AI. The chart to the left shows the performance in 2024 of infrastructure versus other themes proximate to our stage 2, AI as an Accelerator.

Source: GS

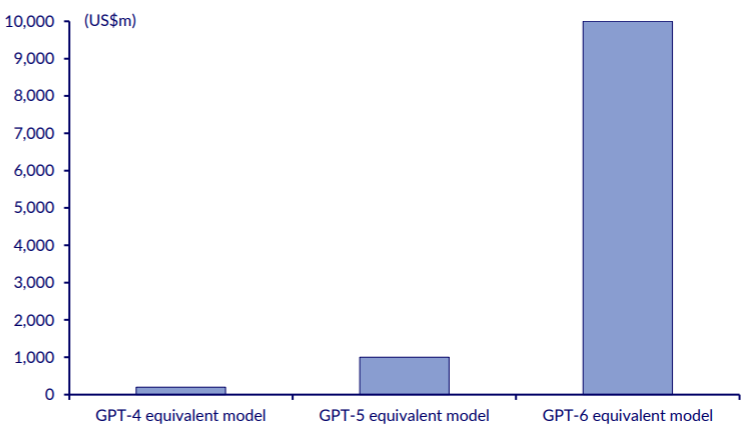

The demand for compute infrastructure has been powered by the observation that larger models produce better outcomes. This brute force doctrine has resulted in greater and greater compute spend at each generation.

More recently this ‘law’ has come into question amid observations of a plateauing of performance in new models. DeepMind recently proposed a modified law, known as Chinchilla, which suggests an equal emphasis on scaling data set size alongside model size can achieve optimal performance. This paves the way for smaller, lower cost models, which may be more accessible.

Cost of Training LLMs

Source: CLSA

This remains an area of debate. The implications for spending on semiconductors are not necessarily negative, however. Reduced tailwinds at the training stage are forcing companies to innovate at inference (the stage of practical use). OpenAI’s most recent release, o1, introduced a reasoning stage to the model’s process. This is potentially a breakthrough, particularly for AI agents (discussed later) as it enables machines to adapt and solve problems across diverse contexts. For semiconductors, it means the computational resources needed for inference will increase significantly. Already, 40% of Nvidia’s AI GPU shipments are for inference.

2 AI as an Accelerator

AI implementation follows on from the infrastructure or enabler phase. We split AI implementation into two, AI accelerators and AI disruptors (white space). The accelerators are companies building in AI functionality into established products, services, and operations to enhance quality and reduce cost. Companies in this cohort may exhibit the traits we look for in quality companies, including durable growth, innovative culture, high quality management teams, and attractive industry structure. It is this category of company where we have observed increasing opportunity, reflected in additions to portfolios over the past year.

3 AI White Space

AI disruptors, in contrast to Accelerators, are companies leveraging artificial intelligence as their core offering. Driving innovation through advanced technologies, these companies aim to redefine existing business models, industry structure, or create entirely new value propositions. The characteristics of these companies are similar to those business models that appear at the advent of any new technology, such as blockchain or the metaverse. For this reason, we do not see attractive investment opportunities in this area at this time but would expect this to change in the coming years.

Cerno participation in AI

We have had a healthy exposure to AI’s emergence by virtue of holdings in companies where management teams have moved rapidly to embrace the opportunity. Before ChatGPT’s emergence in November 2022, we had a strong roster of AI participants in our Global Leaders strategy representing almost 30% of the portfolio.

This outcome was not a function of any skill of technology foresight. Rather, it emerges by design of our approach to equity investment at Cerno. We seek out management teams with the culture and the decision-making skill set to pursue avenues for growth, which may not yet be obvious to outsiders. This is particularly crucial for growth vectors like AI, which evolve rapidly from ‘potential’ to ‘NOW’. Unlike picking the inflection points in tech industry growth, focusing on this company characteristic is a repeatable skill set that applies as much to emerging vectors of demand in other fields as to tech. Two examples illustrate this.

- TSMC was predominantly a smartphone business when we initially invested. 50% of sales were related to handsets with high performance computing too small to even split out for reporting. Six years later HPC represents half the group’s revenue.

- We were attracted to Microsoft due to the momentum in the cloud business and the company’s position as the owner of the attention funnel for business via its Office product suite. This latter factor conferred a valuable optionality for pushing penetration of any new products that might emerge. It was the foresight of CEO Satya Nadella and his team that saw that opportunity to leverage this foundation into a leading position in applied AI.

Cerno portfolio holdings

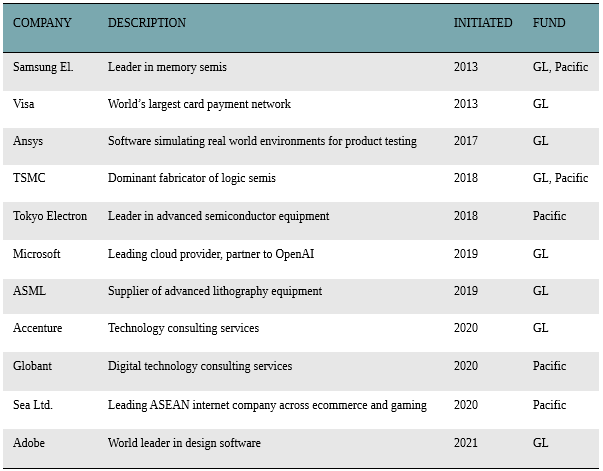

Our portfolio exposure has historically been heavily weighted to the infrastructure layer, primarily via technological leaders in the semiconductor value chain. These longstanding investments are based on the premise that societal and technological trends requiring higher levels of computational output will necessitate progressively advanced semiconductors.

Cerno AI-related holdings across portfolios

However, we are increasingly finding implementation opportunities in Phase 2, AI as an Accelerator. In established industries, we are now seeing the emergence of companies with deep competitive moats applying AI in novel ways to layer in greater growth opportunities to their existing business models or open up profitable adjacencies. These businesses offer the characteristics we look for in long term holdings allowing us to significantly expand the range and diversity of AI exposure in our equity portfolios.

Cerno Portfolios: AI Implementors

Opportunities in AI implementors sit within the ‘AI as an Accelerator’ phase (phase 2). This piece of the portfolio has been built out over the last year as opportunities have emerged to profitably deploy capital.

For the sake of simplicity, we categorise these examples into three fields: Productivity, Creativity, and Safeguarding. We have laid out various use cases across our invested businesses below.

Productivity: better decision making

RELX creates tools to allow its customers to make better decisions, driving improved revenue, operating efficiencies and reduced business risk. They are first to market with a tool to leverage generative AI in the legal profession, one of their core businesses.

Lexis+ AI uses generative AI to build upon the existing analytics solutions through both increasing the value of existing products and enabling entirely new use cases. For example, the Lexis+ AI tool is being used to contextualise ongoing trial events and can relate these insights to upcoming trial preparation. The tool can also provide a rapid summary of opposition motions and briefs, identify inconsistencies in arguments and report on the impact of novel litigation data on individual cases.

These tools aim to reduce the administrative burden on employees allowing capacity to be directed to higher impact client work. A survey of professional preview customers for Lexis+AI shows: 89% estimate a saving of 6h/week on summarising case law and 74% estimate a saving of 7h/w on legal research. For context, lawyers spend close to 40% of their time on legal research[iii]. The return on investment for law firms is clear supporting a rapid proliferation of RELX’s products, in our view.

Experian is a global data analytics and consumer credit reporting company that provides information and insights to businesses and consumers. It specialises in credit scoring, identity theft protection, and marketing services, helping organizations make informed decisions and consumers manage their credit health.

Experian has introduced AI functionality across its Ascend technology platform, with features such as the Experian Assistant, Intelligence Services and Analytic Sandbox reducing client time spent on data building by up to 75%[iv], and decision-model development from months to days,[v]. Today, Experian’s ascend platform is leveraged by 1,500+ clients globally, processing 14 million credit reports daily and billions of credit and fraud transactions per year[vi]. The deployment of AI allows Experian to unify data analytics, credit decisioning and fraud management software in a singular interface, simplifying model deployment and enabling businesses to rapidly scale new and existing revenue lines, whilst prioritising both operational and capital efficiency.

S&P Global is a prominent provider of financial market intelligence and analytics, delivering essential data and insights across sectors such as credit ratings, market research, and risk assessment.

The nature of this business is ideally suited for leveraging AI and machine learning to uncover innovative methods for dissecting data and distilling information. This enables clients to derive greater value from SPGI’s offerings through enhanced data analysis, improved speed and accuracy, pattern identification, and process automation. For example, S&P has introduced new Gen AI features into market intelligence services across its Financial, Commodity and Mobility platforms. The Cap IQ Pro Generative AI functionality allowing users to rapidly build predictive models, automate workflow and automatically identify data patterns.

Productivity: lowering customer acquisition costs

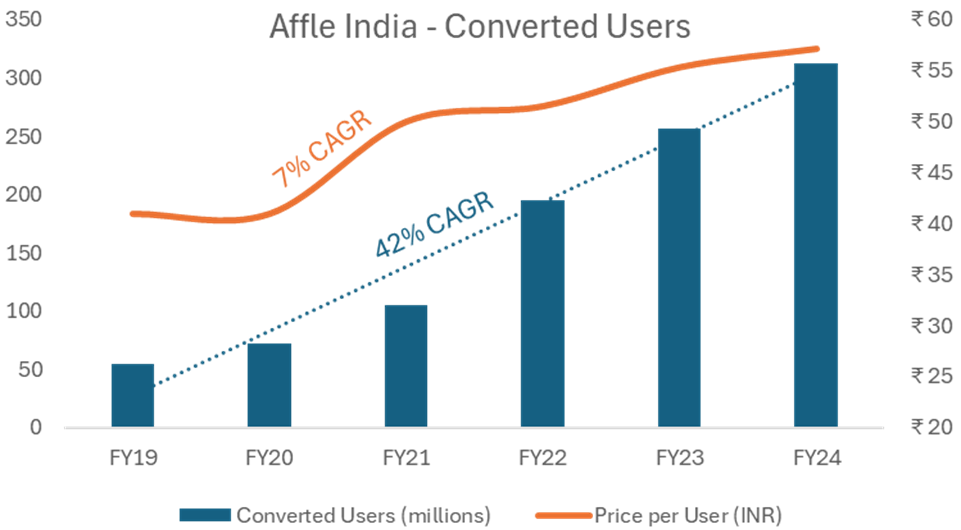

Affle (India) is a technology company that specializes in mobile advertising and marketing solutions, delivering targeted and performance-driven campaigns. Its platform leverages data analytics and artificial intelligence to enhance user engagement and drive customer acquisition for businesses.

The company uses AI and ML to construct and track a library of consumer profiles. Artificial intelligence is also deployed in the purchase of advertising inventory, with algorithms used to determine the conditions most likely to result in real consumer engagement. Finally, a series of generative AI models are used to ensure the vernacular compatibility of the advertisements with the consumer[vii]. This is critical in emerging markets, with India alone recognising 270 ‘mother tongues’ with over 10,000 speakers.

Source: Affle (India), Cerno Capital

The efficacy of these technologies allows Affle to operate a novel business model, only generating revenues when tangible financial outcomes are achieved for its customers. This contrasts with the traditional advertising model, operated by companies like Google, where customers pay for ‘impressions’ regardless of whether they achieve any revenue. The value proposition for potential advertising clients is compelling allowing a guaranteed return on investment for their outlay. Results are tangible: Affle recently disclosed the results[viii] from advertising contracts with Bajaj FinServ[ix] and Serasa Experian[x]. During the engagements, Bajaj FinServ benefited from a >90% conversion ratio throughout the year and onboarded over 2 million new app users. Serasa Experian on the other hand registered a 119% increase in conversions and a 147% growth in existing users versus the prior year.

Productivity: organisation efficiency

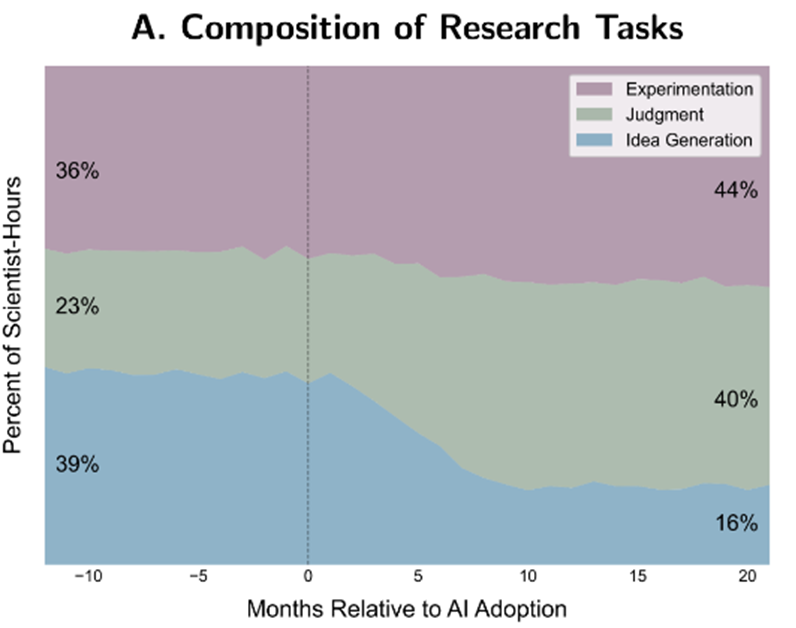

Generative AI tools are also being utilised to enhance operational efficiencies by reducing the resource burden within businesses. A recent study conducted by MIT’s Aiden Toner-Rodgers[xi] quantified these capabilities by examining the integration of Artificial Intelligence technologies into the R&D lab of a large U.S. firm. Within a year, the implementation of Artificial Intelligence had decreased the time researchers spent on idea generation by 59%, with 77% of that time reallocated to idea evaluation and the remainder to product experimentation. This led to positive outcomes in R&D productivity, including a 44% increase in material discovery, a 39% increase in patent filings, and a 17% rise in downstream product innovation.

Source: Aidan Toner-Rodgers, Massachusetts Institute of Technology

The opportunity for operational efficiencies is significant and companies within our portfolios have built out effective offerings for their enterprise customers as well as employing them within their own operations.

Microsoft has continued to build upon its position as a core efficiency partner for digital enterprises through their Co-Pilot systems. The most mature of these systems sits within the company’s GitHub subsidiary, the world’s largest open-source code repository. GitHub Co-pilot acts as a coding assistant that significantly accelerates development cycles by embedding AI directly into developer workflows. It is critical for developers; “life as a developer without GitHub is like life in a Chinese city without WeChat”[xii]. This integration results in an average improvement of 55% in task completion, a 50% reduction in time-to-merge, and quality enhancements across key dimensions[xiii].[xiv].

Productivity: improving the efficacy of healthcare

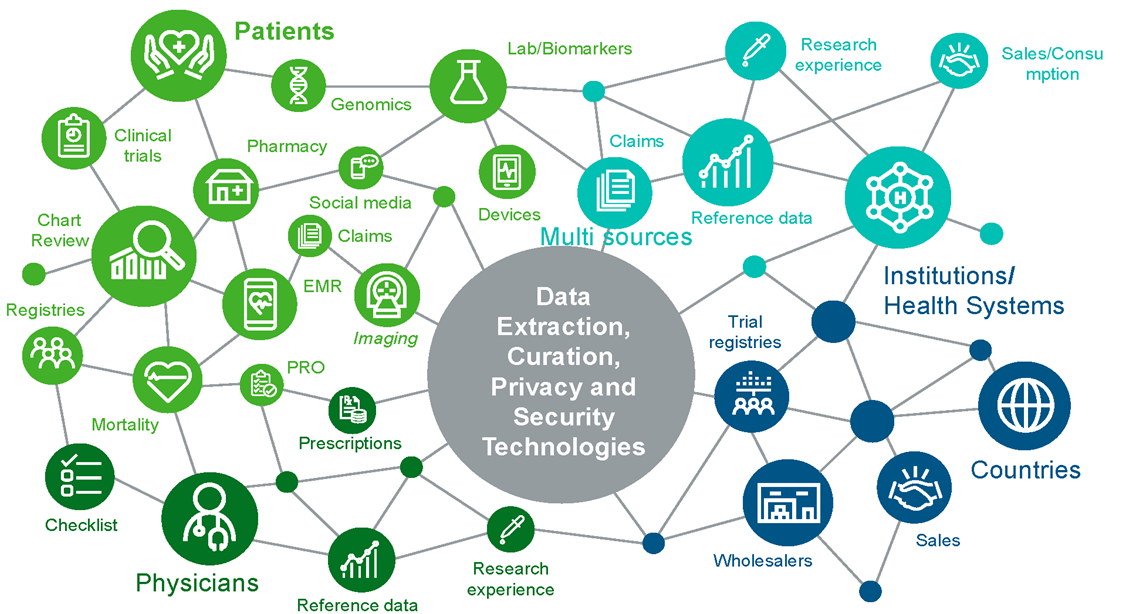

IQVIA is a global leader in advanced analytics, technology solutions, and contract research services for the healthcare industry. It combines data from various sources with innovative technologies to provide insights that help pharmaceutical, and biotech companies improve their drug development and commercial strategies.

The company is unusual in the depth of its data sets and the size of the opportunity to leverage that data into improved revenue streams. For clinical trial engagements, the tools not only enhance drug development capabilities, but drive operational efficiencies across patient recruitment, the stratification of trial participants, and dose optimisation. For instance, in a recent engagement, IQVIA utilised AI/ML platform capabilities to identify patient cohorts with untreated and undiagnosed respiratory diseases. By profiling individuals based on sub-national concentration, demographics, and other clinical drivers, patients were identified with 86% precision. Additionally, 30% of the existing target population was reclassified resulting in a 20% reduction in uncontrolled disease status[xv].

These tools also serve as standalone products, with the NHS partnering with IQVIA recently to screen for individuals at risk of Atrial Fibrillation related strokes. Here, at risk individuals were predicted using the NHS’s EMR records, such as age, gender and clinical risk factors. During the implementation phase of this partnership, annual strokes were reduced by ~22% across targeted regions, leading to annual savings of ~£2 million[xvi].

Source: IQVIA

In its recent results, Microsoft discussed a recent innovation in healthcare support, DAX Co-pilot. DAX is an AI enabled solution to enhance the efficiency of clinicians. It is the winner of a US government challenge to help reduce clinician burnout. The co-pilot securely captures patient conversations ambiently and extracts key information to create clinical documentation automatically. The whole workflow operates under strict security and privacy guiderails. DAX is now documenting 1.3m physician-patient encounters each month at 500+ healthcare organisations.

Productivity: building new businesses adjacencies

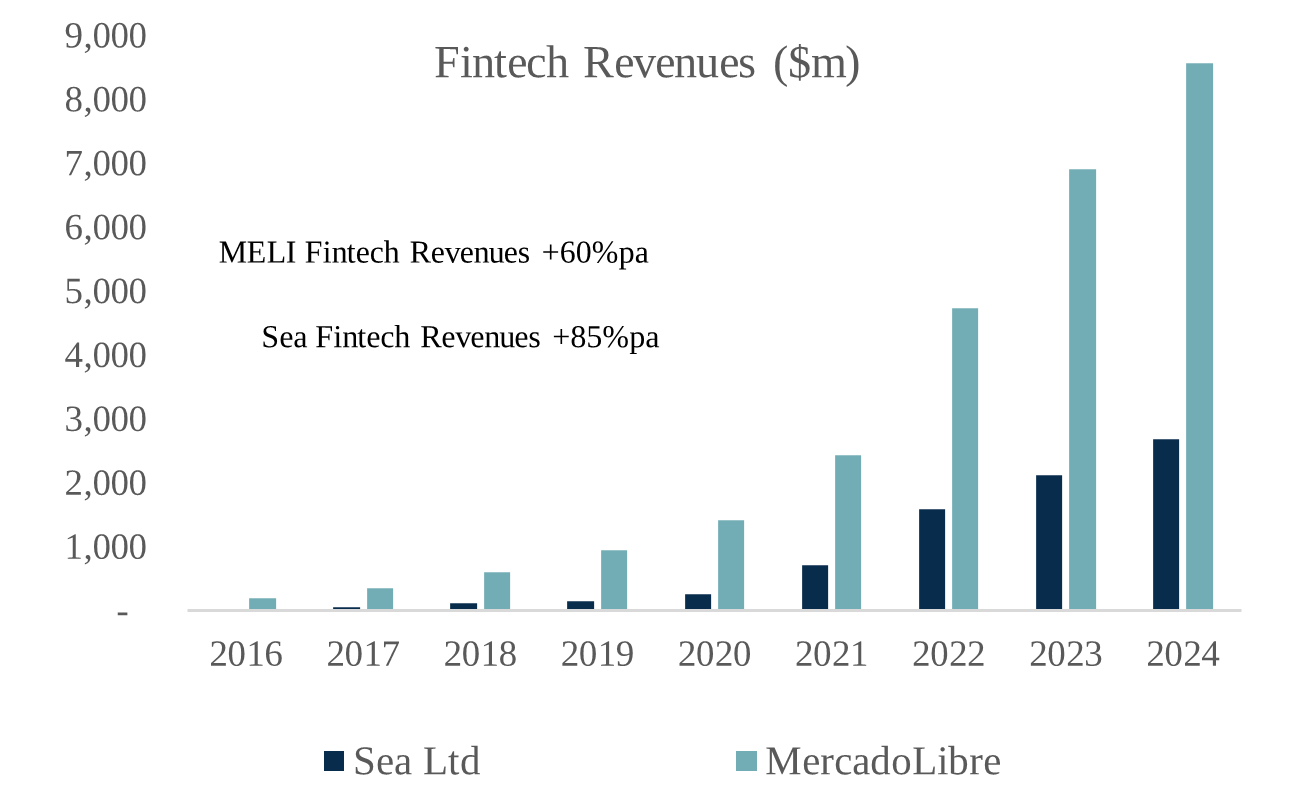

Sea and MercadoLibre are owned within the Pacific portfolio. Respectively they are the largest ecommerce companies in ASEAN and Latin America. Considering the attractive demographics in both regions the addressable market for both firms is large and expanding. Since 2018 Sea has compounded revenues at 65% pa and MercadoLibre at 56% pa. The two companies are very different, but one area of commonality is adaptive, opportunistic management teams. These leadership groups have independently used the deep customer data from their expanding ecommerce businesses to establish complimentary financial revenue streams. Today financial services are a $2.7bn business for Sea and $8.6bn for MercadoLibre.

These are effectively disruptive EM digital banks. They have grown from nothing 8 years ago on the strength of analytics on their marketplace data, which allows better risk targeting and knowledge of the customer.

Creativity

In the contemporary landscape of creative industries, artificial intelligence is also emerging as a transformative technology, with the potential to augment and accelerate creative processes for both organisational entities and individual practitioners.

We argue that the role of Large Language Models and other AI formations must be understood through the lens of their relationship with data. As these models respond to prompts through the analysis of human-generated datasets, their outputs represent an algorithmic extension of historical works on which the model has been trained. Therefore, creativity, even when technologically mediated, remains intrinsically anchored in human intellectual property and cognitive innovation.

Creativity: Customer Experiences

Within the Cerno Portfolios, companies are leveraging AI to elevate creative services and enhance consumer experiences.

Globant has employed AI technology to drive novel fan experiences at the LA Clippers’ Intuit Dome, where fans are able to engage in promotional activities directly from their seats. Similarly, Globant has partnered with Disney to implement AI-driven solutions to personalised consumer experiences in their parks. These include the development of the ‘MagicBand’ – a wearable connected device that stores information and enhances guest interactions through delivering personalised experiences, centred around customer details such as birthdays, names, place of birth and attraction preferences.

Source: Disney

We have also witnessed an increased focus on content ownership. Sony has been proactively acquiring the rights to music groups, purchasing not only their recorded music interest, but also their ‘name and likeness’. In 2024, Sony purchased rights to the Pink Floyd and Queen catalogues for US$400 million and $1.27 billion respectively, with the Queen transaction being the largest artist catalogue acquisition in music history. The success of AI facilitated experiences such as Abba Voyage, which according to company accounts generated over £100 million of turnover in 2023[xvii] has drawn widespread attention for potential replication, with rumours of Sony discussing a new hologram based show based around Elvis Presley[xviii]. Sony’s strategic focus on creativity, and the enjoyment that flows from it, positions it well to exploit its vast catalogue of IP across music, games, and TV/movies.

Creativity: Consumer platforms

AI is not only being deployed to elevate the experience of consumers within creative spaces, but also to enhance the creativity of the consumer through both hardware and software augmentations.

Sony has integrated a suite of AI features across their professional and consumer camera offerings. Innovations such as the AI-powered autofocus system and scene recognition features offer automated subject tracking and photo compositions across a range of scenarios. Furthermore, AI-driven image processing algorithms enhance image quality by reducing noise and improving sharpness, ensuring high-resolution images with preserved detail. These advancements collectively enhance technical processes and expand the creative capabilities of customers across varying skill levels.

Adobe is the preeminent software provider for design professionals, offering a comprehensive suite of industry standard tools including Photoshop, Illustrator, and InDesign. Since the 2016 release of Sensei AI, Adobe has embarked on a comprehensive strategy to integrate artificial intelligence into its portfolio, with the aim of enhancing and accelerating the creative capabilities of its clientele. At the heart of this initiative are Adobe Sensei GenAI and Adobe Firefly, both of which are designed to boost productivity by enabling the rapid generation of diverse content variations, thereby meeting the escalating demands for creative output in the digital sphere. The efficacy of this approach is evidenced by the remarkable uptake of these tools; for instance, Adobe’s Firefly has facilitated the creation of over 3 billion images in a mere few months.

Safeguarding

Finally, whilst the advent of AI has led the rapid development of creative capabilities, as generative AI media becomes increasingly sophisticated in mimicking human creativity, fears have mounted regarding the unauthorised use of copyrighted material in training datasets and the potential for AI to replicate and devalue original works.

Here too, AI has begun demonstrating its utility as a tool for intellectual property protection. The European Union Intellectual Property Office’s study on the impact of AI on copyright and designs34 highlighted this in 2022, suggesting novel use cases such as “an automated cyber patrol, looking for content that might contain copyright and design infringement to a greater extent and more quickly than could otherwise be undertaken”. This presents a unique opportunity for the creative industry to harness its power not only to foster innovation but also to safeguard the very works it helps to create.

Safeguarding: protecting creative IP

As stewards of creative content, Sony and Adobe have deployed significant resources to the safeguarding of intellectual property. Ethical technology frameworks form the lens through which product pipelines are constructed and prioritized. Adobe’s Ethical framework promotes ‘accountability, responsibility and transparency[xix]’, leading to a suite of ‘safe for commercial use’ products. This designation authenticates that products trained on public domain content, mitigating the risks of copyright infringement. As such, Adobe has introduced an IP indemnification clause for Firefly[xx], covering legal costs and damages from third-party IP claims related to AI-generated output.

Sony’s AI Ethics flagship project[xxi] is driven by the groups ‘initiatives for responsible AI’[xxii], prioritising the provision of trusted service, privacy protection and supporting creative lifestyles. This project has also driven technical developments, with SilentCipher[xxiii] and Diagnosis[xxiv] models integrating audio and visual watermarks which are imperceptible to humans, but detectable to diffusion models. Similarly, in 2019 Adobe founded the Content Authenticity Initiative[xxv], now a near 4,000-member strong foundation, promoting media transparency and open-source content credential tools to label digital work with accreditation metadata. Through these policies and products, Adobe and Sony have brought to market products which automate the detection of unauthorized use of intellectual property, whilst protecting the quality of creative outputs, promoting transparency and authenticity in the creative process.

Safeguarding: cyber security

Given the data-intensive nature of the problem and the necessity for rapidly scalable solutions, security is a critical consideration for AI. We have not found pure-play cybersecurity firms to be prospective for investment. Valuations are exorbitant, stock compensation is excessive, and competitive moats appear overly dependent on technology leadership in an aggressively competitive marketplace. Nevertheless, we have identified numerous opportunities for exposure through companies leveraging their existing data assets to offer supplementary cybersecurity services.

By virtue of its commanding position as both a software and services vendor, Microsoft has built out a formidable security business, by function of both societal expectation and customer demand. With leadership in four Gartner Magic Quadrant reports, nine Forrester Wave categories, two Engenuity ATT&CK evaluations and three IDC reports[xxvi], it maintains broader leadership than any other vendor, serving over 1.2m security customers globally.

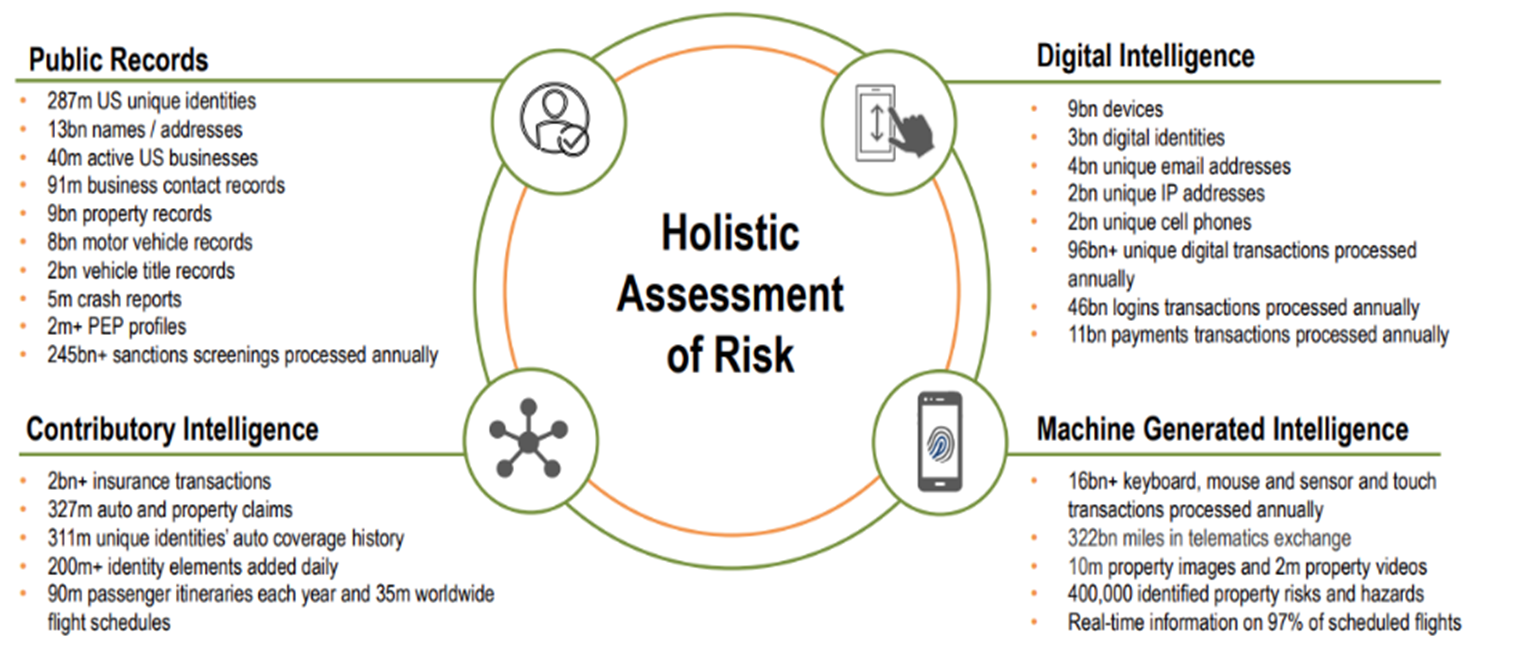

Originally a provider of scientific, business and trade publications, RELX’s data-ownership predates its re-alignment to analytical services. However, thanks to a foundation in data services, RELX’s ‘Risk & Business Analytics’ division is a leading position in fraud detection and prevention services. It is the number 1 in US physical identity and number 1 in global digital identity, transacting with 92% of the Fortune 100; 84% of the Fortune 500; nine of the world’s top ten banks and 21 of the world’s top 25 insurers[xxvii].

Source: Relx

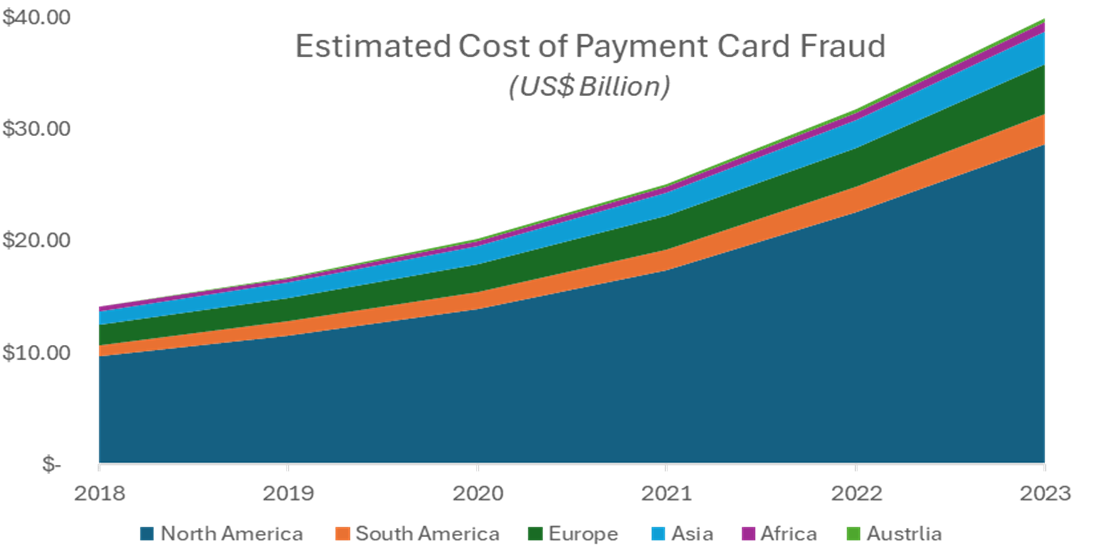

Visa is the custodian of the largest global payments data set. As a result, it is exposed to sophisticated card-based enumeration attacks, facing roughly 500 million cyber-attacks per month. In response, VISA has spent billions on cybersecurity and fraud prevention measures, with 1 in 30 employees now focused solely on cyber security. The insights of these data assets and accompanying skills sets are being leveraged as value-added services. Products such as Visa Account Attack Intelligence[xxviii] have been trained on 15+ billion historical transactions to better identify suspicious transactions.

Source: Nielson, Cerno Capital

What comes next: AI White Space

This is the final stage of the AI investment opportunity. Here novel use case and new revenue streams emerge not hitherto possible under existing technology architecture. This phase is likely to see permanent alterations to behaviour patterns of consumers and business. The most observable progress on this front is the agentic world.

AI agents are programs, which are capable of autonomously performing tasks on behalf of a user. The agents can interact with external systems to pursue their goal (unlike the sterile sandbox of pre-trained models). Their ability to store past interactions in memory also allows self-improvement and a more personalised experience.

This seemingly small evolution in programming architecture has the potential to be a game changer. AI can evolve from a productivity tool to intelligent, scalable labour. While some jobs could be effectively replaced, for most tasks AI agents would act to amplify human labour. The potential for western societies, where populations are facing severe demographic headwinds is significant. Productivity, after years of stagnation, may be about to contribute meaningfully to growth.

While this space is too nascent to support investment in pure AI agent businesses, we can see use cases emerging in companies we own. Microsoft, RELX, Affle, and Globant are all actively deploying agents within their current workflows. These are businesses able to bridge the Accelerator and White Space phases, incubating longer term growth vectors.

Conclusion

The opportunity set for investment in AI is expanding. From a prior focus on infrastructure, we now observe AI implementation improving the products and services of established firms. For these companies, the result is an acceleration in the quality and cadence of growth. The potential beneficiaries of AI implementation are broad. The general knowledge of these models, afforded to them by the diverse nature of the data on which they are trained, results in a tool which is valuable in a range of different contexts. This is evidenced both in academic literature, and in real world scenarios as found in the Global Leaders and Pacific portfolios.

This opportunity is not without risks. Challenges in regulation, ethics, operational execution, and technology roadmap are likely to emerge. These risks inform our prosecution of AI implementation via leading businesses with established, resilient revenue streams.

As the technology stands today, it remains to be seen if there are any companies that cannot benefit from AI implementation. Perhaps every business is a potential ‘AI company’.

—

APPENDIX

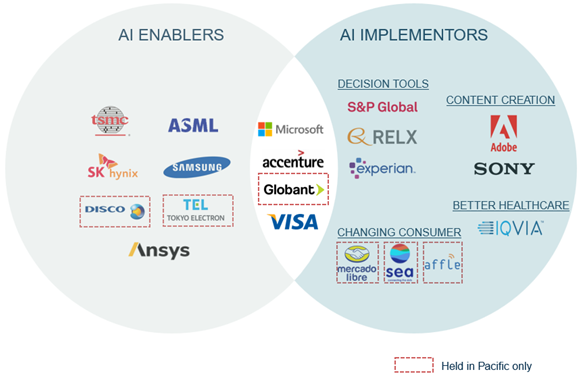

Enablers vs Implementors

In our view, AI exposure can be categorised into two broad groups: AI enablers and AI implementors.

AI Enablers are companies that provide the foundational technologies, infrastructure and tools necessary for the development and deployment of AI systems. This category includes semiconductor manufacturers, hardware and software providers, cloud computing platforms, data management companies and AI research innovators. These entities form a specialised group, creating the technological foundation of the broader AI ecosystem.

AI implementors, conversely, are organisations integrating AI technologies into their existing operations, products or services to enhance efficiency, create new value propositions or gain competitive advantages. This diverse and extensive group spans most industries, representing the wide-ranging applications of AI in various business contexts, from healthcare and finance to retail and manufacturing. They are unified by their leveraging of tools, technologies and infrastructure provided by AI Enablers to transform their business models, improve decision-making processes and deliver innovative solutions to their customers. Due to the breadth of this category, at Cerno Capital, we further divide this group into AI accelerators and AI disruptors.

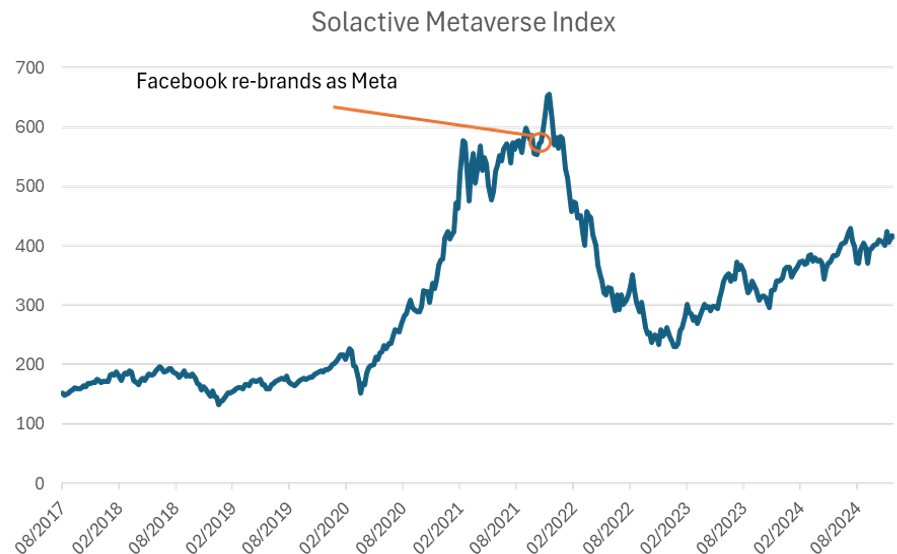

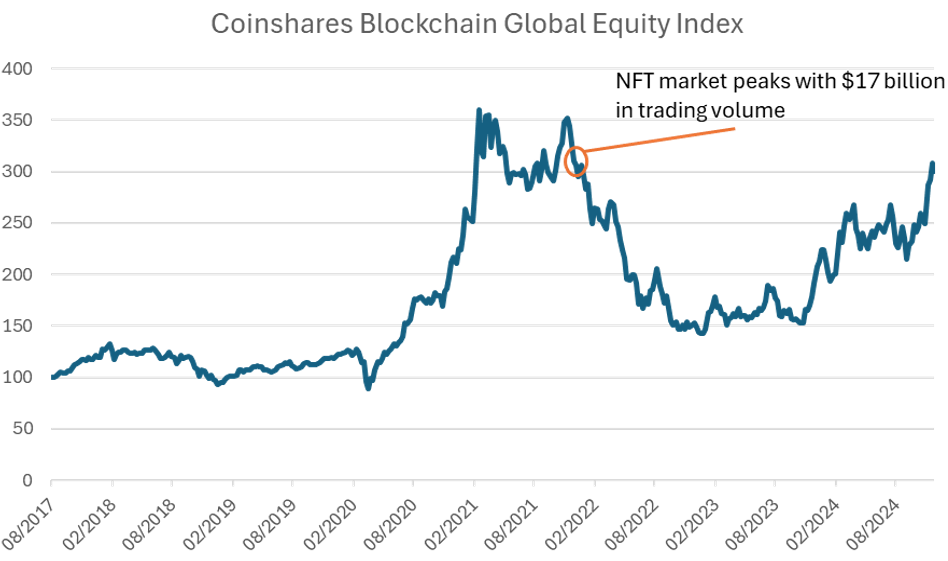

AI disruptors can be broadly defined as companies that utilise artificial intelligence as their primary offering, fostering innovation through advanced technologies aimed at redefining existing business models, industry structures, or creating entirely new value propositions. The attributes of these companies are generally analogous to those observed in business models emerging at the onset of any new technology, such as Blockchain or the Metaverse.

They exhibit technological evangelism and first-mover advantage, positioning themselves as pioneers in developing new methodologies and applications in AI, particularly in areas like deep learning, reinforcement learning and generative AI. These disruptors often seek asymmetric competitive advantages stemming from a singular, long-duration proprietary format of the novel technology. They revolve around groundbreaking technologies promising to revolutionise existing industries, creating unique barriers to entry that fundamentally differentiate them from potential competitors. Their commitment to innovation is reflected in substantial R&D investments, which they argue will help them introduce groundbreaking features and establish thought leadership in rapidly evolving markets. In AI, this manifests in a high cash burn, spent on training proprietary models, acquiring unique datasets, compiling unique algorithmic libraries and aggressively pursuing GPU capacity. These companies invest heavily in pursuit of unique intellectual property, aiming to provide a sustainable competitive moat and maintain long-term technological superiority.

Through this position, the appeal of disruptor companies often lies in the promise of the extraordinary growth potential of an early winner in a nascent market, offering the potential of new avenues of growth for both customers and companies alike. Moreover, through these value propositions, these companies generally position themselves as catalysts for fundamental change in established industries, promising radical capital migrations as industries are forced to change by new technological advent. This translates to sectors like natural language processing, computer vision and predictive analytics, where potential applications are vast and largely untapped. They propose solutions that could potentially upend traditional processes in fields such as healthcare diagnostics, financial services, manufacturing and customer service. By leveraging advanced AI capabilities, these disruptors aim to create entirely new paradigms of efficiency, personalisation and decision-making that challenge the very foundations of how industries have historically functioned.

On the other hand, AI accelerators are companies weaving AI functionality into established products, services, and procedures in order to augment their existing value proposition through enhance the quality of their services or efficiency of their operations. Generally, companies that best fit the AI Accelerator model will have characteristics reflected in typical quality-growth equities. These include: 1) Durable growth traits in the form of a large, growing and increasingly penetrated Total Addressable Market, 2) Best-in-class products and services which are proven in their provision of real utility to the customer base, 3) Industry structures allowing for the generation of real economic value above and beyond the cost of capital in a non-zero-sum manner, 4) High-quality management teams with the ability to balance offensive growth and defensive pragmatism through the sensible deployment of innovation, financial flexibility and judicious capital allocation to both defend and grow the company’s market share. At Cerno Capital, we are of the view that ‘AI Accelerators’ present a more reliable avenue for capital growth for our investors. The basis for this belief is two pronged.

Firstly, new technologies historically have been exposed heavy drawdowns as the markets experience what is colloquially referred to as a ‘hype cycle’.

Source: Bloomberg, Cerno Capital

Source: Bloomberg, Cerno Capital

Returning to the previous examples of Blockchain and the Metaverse. Facebook famously re-branded to Meta in late 2022, in acknowledgement of the broad-based excitement around spatial computing and speculation around the merging of digital and physical social interactions. Similarly, cryptocurrencies rallied through 2021, driving the associated NFT valuations to all-time highs in November 2022. At that time, CryptoPunk NFTs had a floor valuation of US$ 417,000 with an estimated total collection value of nearly US$ 6 billion. Today, the lowest priced Crypto Punk is valued at an estimated $112,000, with a total collection market value of $1.6 billion.

However, once market enthusiasm faded and participants begun looking for tangible value in the form of practical applications, consumer adoption and revenue generation, these markets experienced severe contractions. The Solactive Metaverse and Coinshares Blockchain indices both peaked in November 2021, followed by violent drawdowns which saw contractions of 62% and 57% respectively. Neither index has recovered to previous highs.

This is not to disparage the potential utility of these technologies or to distance our investors from the companies which deploy them. However, in pursuit of maximising long-term quality returns for our investors, we believe that durable avenues of growth are best located in companies deploying novel technologies to augment their utility functions, rather than companies whose entire utility function is located in a novel technology.

What are LLMs and why are they useful?

At their core, Large Language Models (LLM’s) can be thought of as sophisticated tools for information retrieval and synthesis. They are based on transformer architectures[xxix], which use self-attention mechanisms to understand context in sequential data. These models are trained on vast repositories of text data, in which they identify patterns and relationships, granting them general knowledge across any topics contained within that data set. When given a prompt, generate responses by predicting the most probable next words, based on the contexts derived from their training. This process enables them to produce contextually relevant and coherent text for a diverse range of queries or tasks, often outperforming traditional AI models in tasks for which they have been trained specifically. This dynamic has several core consequences:

The current operating system may pose barrier to achieving Artificial General Intelligence. LLM’s do not comprehend questions in the manner a human would. Rather, they interpret and respond to prompts based on the parameters identified within the training data. Therefore, whilst these models can simulate conversation, their responses are based on patterns and information from the vast amounts of data they are trained on, and therefore unlikely to deliver responses that are unique or exhibit characteristics of original thought.

However, as suggested in earlier publications[xxx], LLM utility should scale in conjunction with the quantity and quality of their training data sets. Moreover, as training techniques advance, Large Language Models are becoming increasingly adept at processing and generating diverse data formats, expanding from written text to code, images, and videos. Similar to quantity, as the nature and content of training data improves, so does the ‘general knowledge’ of the models. This grants significant technological advantages to those organisations which produce, already hold or have the means to acquire proprietary data sets.

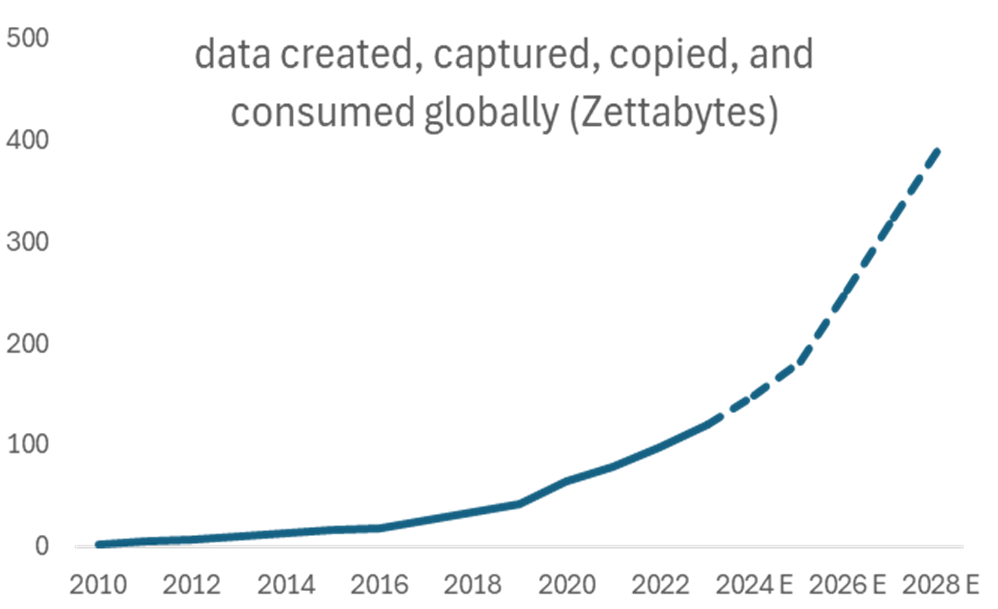

Therefore, while the data-centric nature of large language models limits their knowledge to the that on which they are trained, the extensive volume of data generated by modern society provides incredible utility to these tools. Today, these tools maintain access to vast repositories of knowledge across multiple contexts and formats and have already demonstrated their ability to create real economic value. By 2028, the amount data created, captured and consumed globally is forecast to increase by ~230%, providing a long-term growth runway for these models[xxxi].

Source: Statista, Cerno Capital

Footnotes:

[i] OpenAI, AI Awakening, AI and Adobe, AI in Global Leaders 1, AI in Global Leaders 2

[ii] The Coming Wave (2023)

[iii] JPM Research

[iv] https://www.experian.com/blogs/news/2024/10/28/experian-slashes-model-development-time-with-revolutionary-ai-toolset/

[v] https://www.experianplc.com/newsroom/press-releases/2024/enhanced-experian-ascend-technology-platform–transforms-softwar

9 https://www.experianplc.com/newsroom/press-releases/2024/enhanced-experian-ascend-technology-platform–transforms-softwar

[vii] 2018 India Census: Language

[viii] Affle India, Q2 & H1 FY25 Earnings Presentation

[ix] Leading Indian non-banking financial services company: One year contract

[x] Experian’s Brazilian subsidiary, providing B2B and B2C services: One quarter contract.

[xi] Aidan Toner-Rodgers: Artificial Intelligence, Scientific Discovery, and Product Innovation

[xii] https://technode.com/2019/04/16/github-gives-chinese-developers-censor-proof-forum/

[xiii] https://resources.github.com/learn/pathways/copilot/essentials/measuring-the-impact-of-github-copilot/

[xiv]https://github.blog/news-insights/research/research-quantifying-github-copilots-impact-on-code-quality/#fnref-74630-2 – Quality dimensions include Readable, Reusable, Concise, Maintainable, Resilient

[xv] https://jobs.iqvia.com/en/ai-machine-learning-careers#tab-panel-1-2

[xvi] https://jobs.iqvia.com/en/ai-machine-learning-careers#tab-panel-1-2

[xvii] https://find-and-update.company-information.service.gov.uk/company/12109762/filing-history

[xviii] https://www.telegraph.co.uk/business/2024/06/11/abba-voyage-creator-talks-elvis-hologram-show/

[xix] https://www.adobe.com/content/dam/cc/en/ai-ethics/pdfs/Adobe-AI-Ethics-Principles.pdf

[xx] https://www.adobe.com/cc-shared/assets/pdf/enterprise/firefly-legal-faqs-enterprise-customers-2024-06-11.pdf

[xxi] https://ai.sony/projects/ai-ethics/#:~:text=The%20AI%20Ethics%20flagship%20project,fairness%20benchmarks%2C%20and%20bias%20mitigation.

[xxii] https://www.sony.com/en/SonyInfo/sony_ai/responsible_ai.html

[xxiii] SilentCipher: Deep Audio Watermarking – Sony AI

[xxiv] DIAGNOSIS: Detecting Unauthorized Data Usages in Text-to-image Diffusion Models – Sony AI

[xxv] Content Authenticity Initiative

[xxvi] https://www.microsoft.com/en-gb/security/business/reports-analysis/industry-recognized-cybersecurity-leader

[xxvii] https://www.relx.com/our-business/market-segments/risk

[xxviii] https://investor.visa.com/news/news-details/2024/Visa-Announces-Generative-AI-Powered-Fraud-Solution-to-Combat-Account-Attacks/default.aspx

[xxix] A deep learning architecture, deploying a number of neural networks to process and interpret sequential data with contextual understanding.

[xxx] https://cernocapital.com/openai-next-generation-of-data

[xxxi] https://www.statista.com/statistics/871513/worldwide-data-created/