By ION SIORAS

By ION SIORAS

The step change in computing power achieved over the past 18 months has allowed for the commercialisation of a new class of neural networks.

The capabilities of these larger neural networks have been most effectively showcased in the deployment of large language models (LLMs) such as ChatGPT or similar.

ChatGPT and other LLMs allow for a neural network to parse human speech and develop “natural” responses that replicate contextual understanding and can appear as “intelligence”.

These demonstrations have created justifiable excitement about how such neural networks may evolve and what other capabilities they may display. An increased cadence of advancement in their capabilities could rapidly herald new growth vectors in a multitude of industries.

Microsoft – Chatting with ChatGPT

The most prescient of the Global Leader companies in the current AI/LLM boom seems to be Microsoft. Through its initial investment into OpenAI in 2019 and subsequent additions of capital into that firm, Microsoft has laid claim to the intellectual property of what appears to be the most cutting edge LLM available today. The productivity gains of interacting with ChatGPT have already been experienced by large parts of the general population through the open access that OpenAI provides to the software. Indeed, experiments are ongoing in companies around the world on how to integrate ChatGPT into workflows and how to optimise or eliminate low complexity but time consuming tasks.

Microsoft is taking this concept much further, by deploying the algorithms behind ChatGPT into its vast suite of software including Microsoft Teams, Github Copilot in the form of assistive coding and the optimisation of the Bing search algorithm, which has yielded market share gains versus the incumbent, Google. This renaissance of capability likely cements Microsoft’s already formidable market position in its Office product line and expands its competitive position in less penetrated markets. The combination seems so successful that we would not be surprised to see anti-trust involvement in the future if OpenAI’s technological lead remains substantial.

Thermo Fisher Scientific – Merging silicon with biology

Thermo Fisher Scientific (TMO) has been an applier of AI methods before the latest excitement over LLMs. Software underpinning TMO hardware such as mass spectroscopy machines and electron microscopes utilises automation in every step from calibration to data collection to analysis. This automation creates large productivity and throughout enhancements for end users deploying TMO products in their research.

In 2021 TMO collaborated with MSAID to provide AI assistance for the identification of peptides within its Proteome Discover software. Proteomics, or the study of proteins, is a notoriously intractable research area due to the complexity and variability of protein formation. It was in-fact one of the first areas of biotechnology research to admit massively parallel computing methods, through the distributed Folding@Home program of the 2000s.

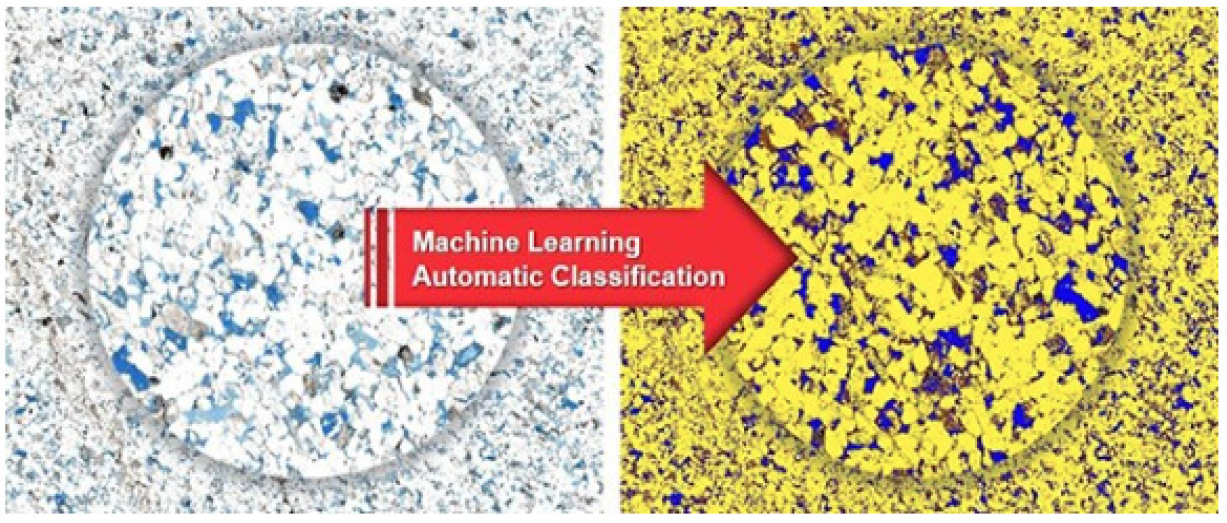

Thermo Fisher also utilises machine learning algorithms in its Amira-Avizo software to assist in image recognition in large data sets.

Thermo Fisher also utilises machine learning algorithms in its Amira-Avizo software to assist in image recognition in large data sets.

The software platform allows for “deep learning” training on an existing image set to then be able to identify and select new images from incremental data runs. These examples, in our view, demonstrate a total familiarity and integration of AI methodologies in the TMO product set.

Philips

In its transition to a pure play medical devices company, Philips is also deploying AI technologies across its product suite. The latest models of Philips CT scanners feature machine learning to assist in both the calibration and image analysis of CT scans. Machine learning assisted CT scan analysis has yielded increases in both the speed and accuracy of diagnosis.

In comparable medical fields such as AMD identification from eye scans, as pioneered by Deep Mind, deep learning algorithms are now considered on par or exceeding trained human analysis.

Aptiv – Your (AI) driver will be arriving shortly

Aptiv is one of the most natural bedfellows for the application of AI technologies. Aptiv can be described as providing the “brains and nervous system” for the multitude of sensors underpinning the latest vehicles, in both ICE and EV varieties. Aptiv has historically built connectivity and processing packages for auto-manufacturers but since 2020 has cofounded its own autonomous vehicle company, Motional, in association with Hyundai.

Aggregating the various assistive technologies it provides for modern vehicles, Aptiv has built what it names its “Gen 6 ADAS platform”. This platform provides the autonomous driving technology for a Hyundai Ioniq 5 vehicle shell to achieve self-driving.

Aptiv’s pursuit and success in this area is directly linked to the availability of new machine learning capabilities which the company has leveraged to interpret and process incoming sensor data at the speeds required for successful self-driving. The success of this program is illustrated by the Lyft/Motional self-driving taxi service available in Las Vegas since 2022.

Conclusions

Whilst it would be true to state that we have not invested in a company solely on its potential in the commercialisation of AI, at the same time, it is no surprise to find that many of the portfolio companies are well placed to benefit.

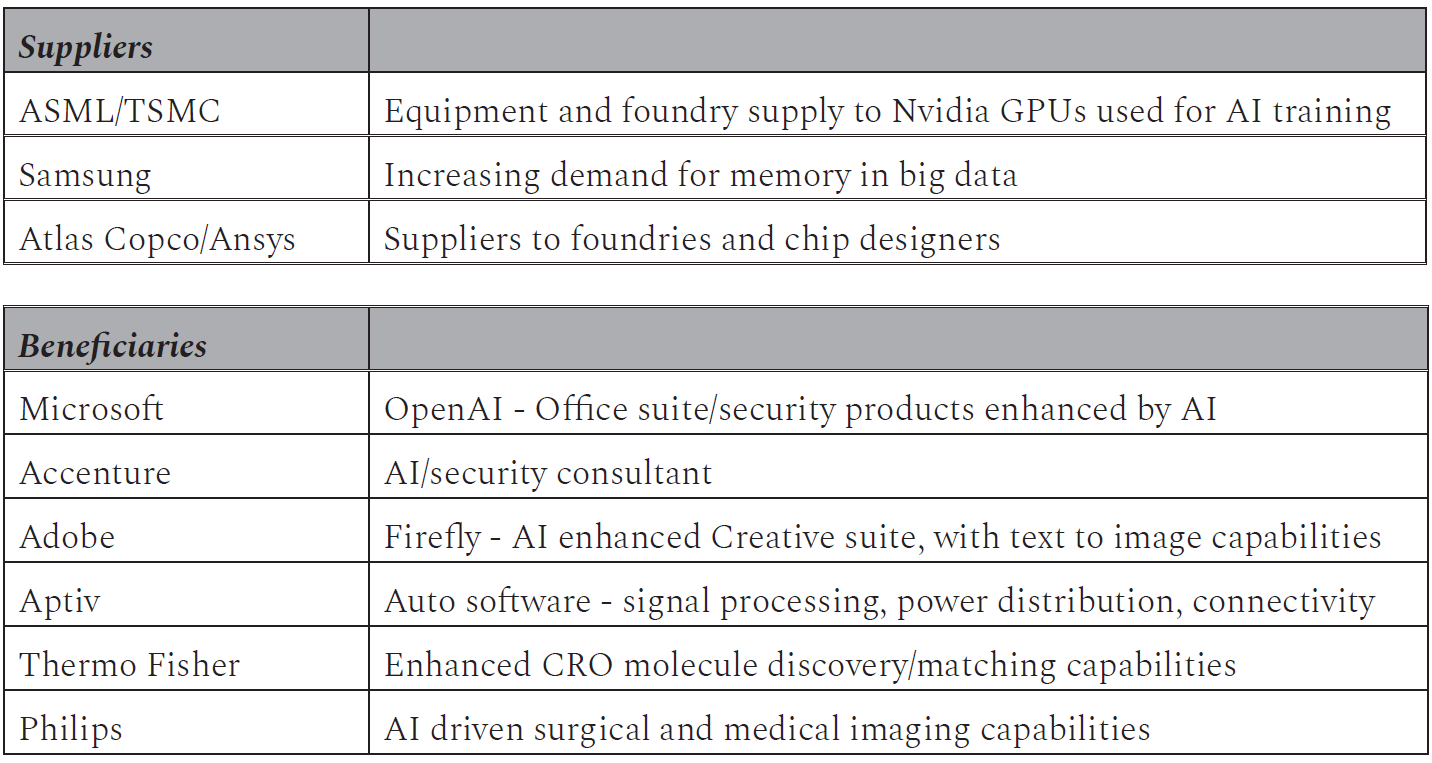

As can be seen from the captioned below slide from recent Investor Updates, we have identified 11 companies in the portfolio that are, to some, extent, geared into this generation of AI tools. Some are suppliers, some are beneficiaries. The rationale for each of these eleven is captioned in this table: The rationale for each of these eleven is captioned in this table:

The rationale for each of these eleven is captioned in this table:

This Journal is taken from the TM Cerno Global Leaders Investment Report Q2 2023 which can be read in full here.