By JAMES SPENCE

& MICHAEL FLITTON

In November of last year, we observed that, in the movie The Magnificent Seven, not all survived. A replay of that presentation can be found here. After a long period of outperformance, the monikered heroes of the stock market are fraying at the edges. The Magnificent Seven has been winnowed down to four.

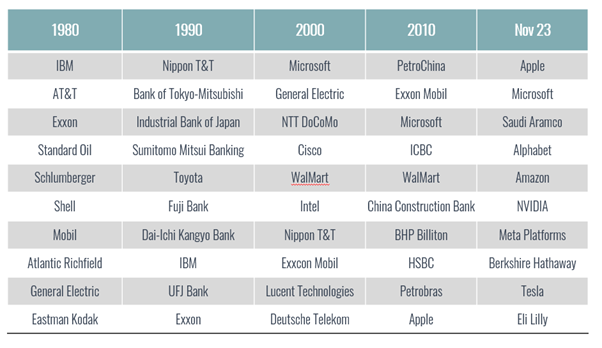

Amidst the emotions of the equity market, perspective is invariably helpful. It may feel like the dominance of US equity markets, and the ‘Mag 7’ in particular, is a feature of the investing landscape to be accepted. However, that persistence is an illusion. History shows us that market leadership tends to be transitory. Investors should assume that those at top of the pile today will face usurpers to the crown.

The Top 10 Largest Companies Globally by Market Capitalisation

Source: Companiesmarketcap.com

Source: Companiesmarketcap.com

The Mag 7 businesses are not homogenous. They have in common only that they are US businesses, and that technology plays a significant role in fuelling investor perception of future growth potential. Emerging challenges are likely to be particular to each company. Previously, we identified threats from antitrust regulation and external competition as particular pressure points. If there is one thread that connects them all it is that performance and outsized investor positioning has bred vulnerability to unforeseen challenges.

Since November the Mag 7 have continued to power US indices. Beneath the hood, however, some members of the Seven are being picked off as specific risks emerge to threaten established growth expectations.

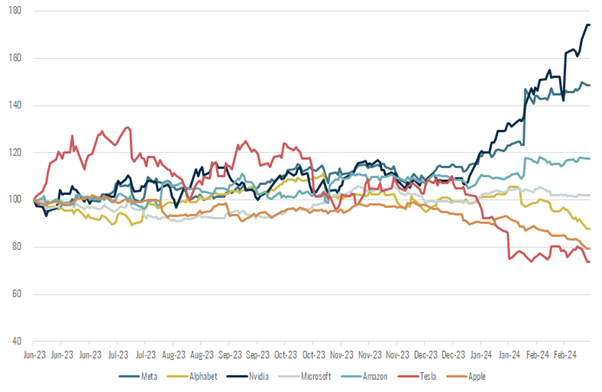

The chart below shows the relative return of each of the Mag 7 relative to the broader S&P. A bifurcation is evident. Tesla, Apple, and Alphabet (Google) are at risk of being dropped out the back of the peloton. Each has faced individual challenges. Tesla has suffered from the threat of competition from China. Alphabet has blundered in the AI race headfirst into the US culture wars. Apple has become the target of antitrust legislators in Europe, while also losing market share in China.

Mag 7 Total Return Relative to S&P500 (Rebased to 100)

Source: Bloomberg

Source: Bloomberg

A narrow market has become narrower as more lifting is done by fewer stocks. This is de facto unhealthy. However, the resolution does not have to be bloody. Breadth may return to markets as growth availability expands. The US economy has negotiated the headwind of higher interest rates better than most expected. We note that cyclical measures of growth may be picking up. If such an upswing were to become evident, smaller firms would likely attract more investor interest.

Absent a broadening we may get a reckoning. The Fab Four may not be able to fill Atlas’ shoes. We do not need to know the nature of the event(s) to see that markets are fragile. We argued in November that investors should look outside the US, particularly those businesses able to negotiate difficult periods to deliver consistently high returns. The Global Leaders strategy invests in a portfolio of quality companies with exposure to a broad range of structural growth trends.