By ION SIORAS

By ION SIORAS

The end of the 1st quarter, reporting season for major listed corporates in 2024 has completed. Although equity markets (led by the US) have tracked a positive first half to the year, we find it informative to observe underlying earnings trends and dynamics.

Much is made by the short to medium turn movements of individual stock prices and stock market aggregates but we believe that stock prices follow underlying earnings in the long term.

With respect to the breakdown of earnings growth by region, Japan has led the way. The US remains positive and Europe has been negative. Earnings growth was +17% YoY in Japan, +5% YoY in the US and -8% in Europe for the first quarter.

Some of the strength in Japanese corporate earnings is likely due to the weak yen, which has fallen 14% against the dollar in the intervening period. The effects of the yen can also be observed in the sectoral breakdown of Japanese earnings. As a net energy importer, Japanese utilities posted a -51% fall in earnings growth YoY. In contrast, financials showed a +75% increase over the same period in anticipation of the Bank of Japan’s policy normalisation cycle. The IT and healthcare sectors recorded negative YoY EPS growth of -1% and -31% respectively.

Some cheer can be extracted in the second derivative (rate of change) of earnings growth for Europe. After peaking in the previous quarter, at 17%, the spread between S&P 500 EPS growth and Eurostoxx 600 EPS growth came in at 12% in Q1 2024. There is an argument to be made that as the global industrial cycle inflects, this spread may continue to narrow.

A headwind to this reversal is the continuing weakness in global “cyclicals” earnings versus “defensives”. Particular attention must be paid to the auto sector, a major eco-system for the European economy, which faces monumental challenges in the face of extreme price competition from Chinese imports as the automotive industry transitions to full electrification.

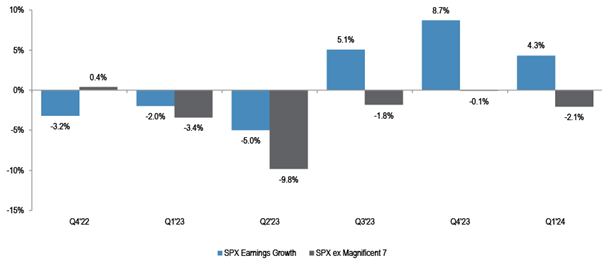

Within the US, the effect of the “Magnificent 7” may be even more pronounced in earnings terms than it is in price terms. Excluding these 7 companies, the remaining 493 constituents of the S&P are on track for the 5th consecutive quarter of negative YoY earnings growth.

It is sobering to consider that 70% of the S&P by market capitalisation (for the “Mag 7” make up the remaining 30%) has not managed to grow earnings in 15 months (see below chart). This throws into relief the positive sentiment around US equities and the substantial boost they have received from pandemic support and financing and domestic growth initiatives such as the Inflation Reduction Act. It also begs the question as to how US earnings might develop if the economy begins to weaken, as may indeed happen between now and the end of the year.

Source : JP Morgan

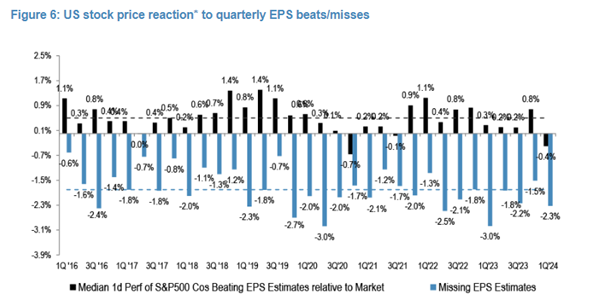

A more arcane observation was the market reaction to corporate results relative to expectations. This is commonly described as a “beat” versus a “miss” in industry parlance. Given the strong performance of equities since Q4 of 2023, expectations could be described as toppy.

This optimism was indeed borne out by the reaction to results in the first quarter. The median 1 day return of a “beat” for a company in the S&P 500 was -0.4%, and the median 1 day return for a “miss” was -2.3%.

Source : JP Morgan

7 of the 28 Global Leaders companies reflected an element of this dynamic, recording negative share price reactions of greater than -10% in the two months encompassing the Q1 reporting season.

As we enter the last month of the second quarter and look forward to the Q2 reporting season, we think two points raised in this piece are likely to increase in importance.

First, the narrowness or broadening of earnings growth within the S&P 500 as an indicator of aggregate corporate health. Secondly, if a further handoff in momentum occurs between the US versus the rest of the world. Continued quarters of this dynamic may presage a reversal of US versus Rest of World equity performance. Our investment guidance at this time is to shade recent winners and diversify in two ways: acquire more non-US stocks, reduce growth weightings in favour of value. Both these allocation expressions are present in Cerno multi-asset portfolios.