By MICHAEL FLITTON

By MICHAEL FLITTON

DeepSeek, a China-based emerging player in AI, released its novel reasoning model ‘R1’ on the 20th of January.

The results are nothing short of stellar, matching OpenAI’s o1 performance across benchmarks but at a fraction of the cost. The initial reaction to the prospect that AI can be delivered with less high-end chips and the notion that the US may no longer lead in the apex technology of our times, saw the Nasdaq down 5%. Nvidia dropped 20% with the semiconductor benchmark down 11%. All have since recovered the losses somewhat.

Across portfolios, we have long held significant exposure to leading semiconductor businesses. These firms operate in consolidated industry structures characterised by relentlessly rising barriers to entry, in the form of both capital and IP. The first order implication of R1 is negative for these businesses. DeepSeek’s innovations in model construction suggest that AI can be built more efficiently than expected using fewer advanced semiconductors.

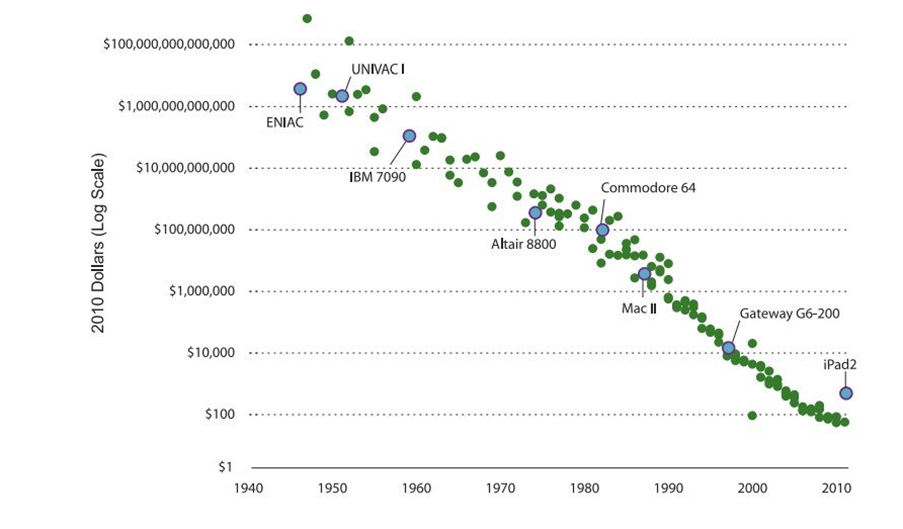

In our view, however, the second order implications are more powerful and decidedly positive for the industry. Technology deflation is integral to the proliferation of semiconductors. As Moore’s Law has been pursued by the industry, the cost of computing power has collapsed. But as costs dropped, applications emerged to fuel greater demand and allow costs to drop in a virtuous cycle. The (slightly dated) chart below shows the cost of computing power delivered in the iPad 2 over time. This is why semiconductors can be put in your fridge to remind you to buy milk when they previously could only be afforded by the US military. Indeed, we have seen this deflation-penetration story play out twice in the last twenty years: via the now ubiquitous cloud and the ARM built architecture which enabled the emergence of smartphones.

Source: Brookings Institute

Source: Brookings Institute

Every generation of advanced semiconductor made by TSMC offers a 15-20% improvement in efficiency or performance. You can do more for the same cost or you can do the same with less. Every year companies make a choice to utilise the efficiency aspect to provide cheaper products or they pursue better products via performance. In our view, DeepSeek is part of this trend. Its approach may be used to make cheaper models or pursue much better models. Either outcome is likely to be positive for the chip industry over the long term.

R1 also confirms our long-held view that “the model is not the moat”. When ChatGPT emerged, we were sceptical of the ability for any business to differentiate based on a technology likely to diffuse rapidly and with the only barriers to entry apparently the cost of chips from one nodal supplier (Nvidia). When layers of the Tech stack get commoditised, the margin moves elsewhere. Like squeezing a balloon profits move to other layers, in this case the software or application layer built on top.

The advent of R1 validates the direction we have been moving portfolios in over the past year. As we wrote in our recent journal, The Emergence of Implementation, the investable landscape in AI is evolving into phase two, implementation. This phase is characterised by established firms utilising AI to accelerate existing revenue streams or build adjacent businesses. DeepSeek’s model innovations allow these firms to leverage cheaper/better models. The value of their proprietary, deep pools of data and domain knowledge is becoming ever more critical for the value of AI as the models become more commoditised.

DeepSeek’s R1 model potentially pulls forward the adoption curve for AI. We have moved from a world of AI scepticism to a world of AI now. We believe we are likely to see a much faster unlock of demand leading to rising penetration of AI in our daily lives. This is beneficial to advanced semiconductors and the businesses building revenue streams at the application layer.

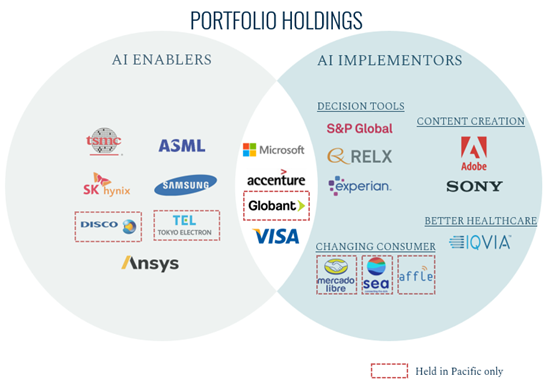

The below diagram sets out our AI exposed businesses across the Global Leaders and Pacific portfolios. 50% of Global Leaders holdings are, to greater and lesser degree, marshalling AI, with the majority of this cohort of implementor companies built out over the past 12 months.

Our conclusions are as follows:

Our conclusions are as follows:

1) The advent of DeepSeek’s model is a positive development for AI proliferation, this will act as an accelerator to many of our companies’ business models.

2) Our scepticism about investing in companies on the basis of their AI models is bearing out.

3) Whilst the notion that lower grade or last generation microchips can be more than adequately deployed appears threatening to the progress of leading-edge micro-chip manufacturers, we see market expansion as a consequence of DeepSeek’s innovation.

4) The sweet spot, in our view, is in investing in implementors, not model developers, and that has been our focus.