By JAMES SPENCE

& MICHAEL FLITTON

In a recent presentation, James Spence and Michael Flitton outlined just how concentrated returns from seven companies have been, the so called Magnificent 7, and how this has distorted equity allocations. At this time, there is more opportunity in the rest of the world than in the recent past, an idea that the firm’s two equity funds are well positioned to exploit.

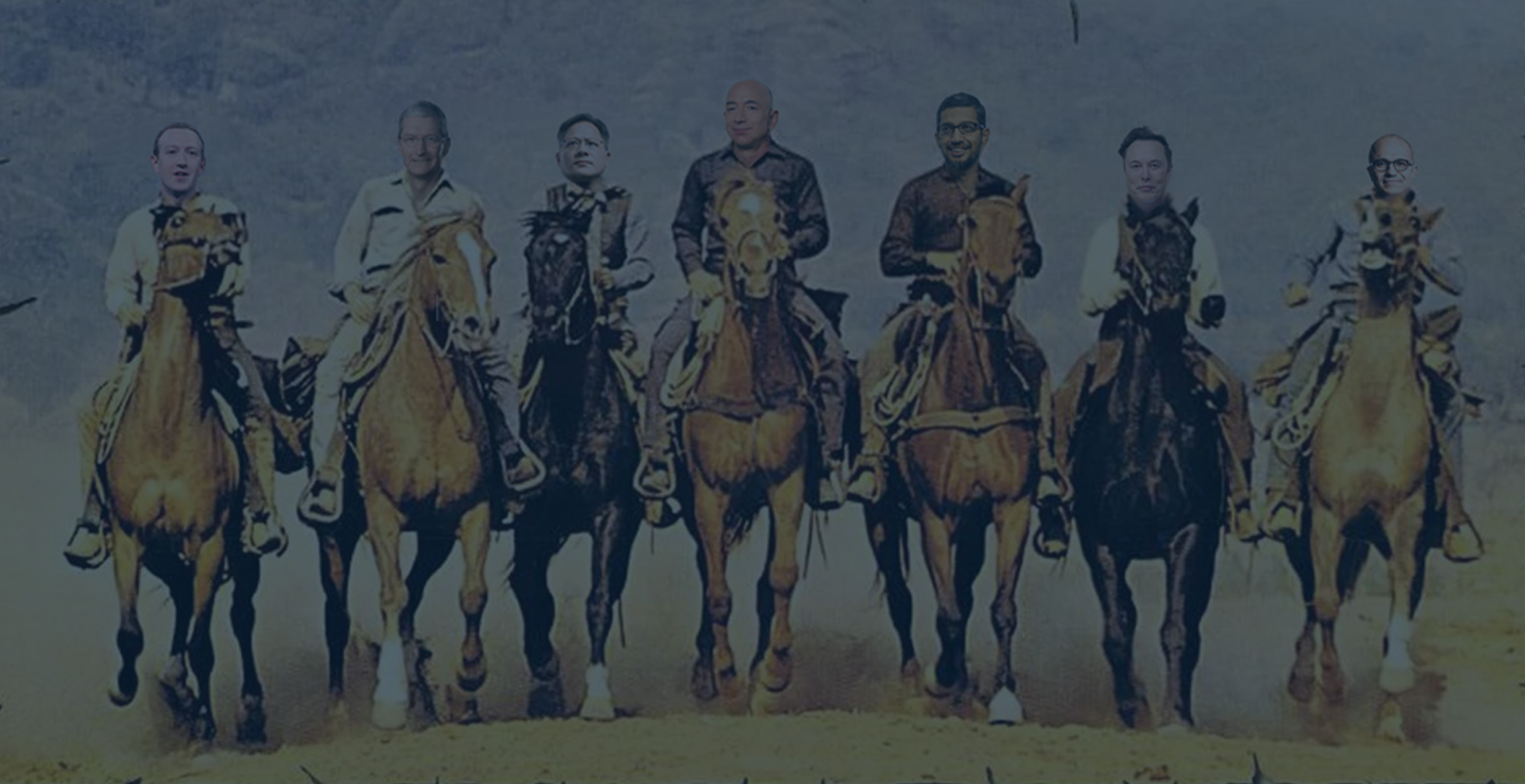

The title derives from the 1960 film. The seven companies in question are Meta Platforms, Apple, Nvidia, Amazon, Alphabet, Tesla and Microsoft. It is not known how good the CEO’s depicted are on an actual horse.

James & Mike suggested that, on grounds of high valuations and increasing regulations, the group are less invincible and more vulnerable that they appear. The normal cycle of US outperforming and then the Rest of the World outperforming has been interrupted and a strong US dollar has exaggerated this. They conclude that returns from these seven may underwhelm going forward and that not all of them are likely to retain leadership. Were the dollar to weaken against other currencies, asset allocation shifts will more favour the rest of the world: Emerging Markets, Japan and the UK being likely beneficiaries.

Mike outlined the long-term mega-trends that the Cerno Global Leaders and Cerno Pacific portfolios invest around: electric vehicle systems, security, digitalised corporations, automation, more efficient health care and changing nutrition.

The key attributes of these companies are quality, self-funding, adaption and structural growth. James observes that we have entered the point in the economic cycle where Quality companies tend to outperform by the greatest degree.

Questions asked by attendees ranged widely, the questions, and our answers to them, are recorded below.

Q: In terms of the US election, Biden potentially getting a second term. How do you think the markets will react to the thought of Trump getting back in?

JS: Not well. There are a couple of things to point out here. When Trump was elected in 2016, we sat down as a group to discuss, and my main point of advice was no matter what you think about Trump, let’s not assume it will be negative for markets. And it did not prove to be. However, if there is a second time, it will likely be different. We need to remember that when Trump entered the White House in early 2017 he was very nervous, perhaps nervous of making a fool of himself, so his appointed officials in many key agencies were experienced people. In a second Trump Presidency, he will likely skip this phase and seek to dismantle, disable or scale down various agencies. Revenge seems to be the main operating principle.

Q: You talk positively about Japan but you don’t own many Japanese companies in Global Leaders?

JS: The bulk of our Japanese holdings are held within the Cerno Pacific portfolio and account for 30% of that portfolio’s assets. When I speak about country allocations, I am wearing another hat. Leaders is a very bottom-up selection process that pays little attention to countries. But, if I were principally a country allocator, I would invest heavily in Japan in a multi-asset context. Our main point about Japan is that the early part of the corporate reform drive has favoured a certain group of companies. I think the rally will broaden considerably from here, especially if the yen stops going down against the dollar. As a firm, we spend a lot of time thinking about Asia and monitoring investor positioning, Japan is not yet a consensus overweight by any means. So there’s a long way to go.

Q: You mention you have a Quality bias. Can you talk to the sectors and holdings you have that meet both the high ROE and lowest volatility of ROE so we can have a sense of where you are finding those assets?

MF: I don’t have a breakdown on an individual basis as we do not screen specifically for those variables. Our approach is to construct a portfolio that works as an aggregate, as a whole. By blending the pieces of the puzzle work better together than on their own. That said, there is not a huge outlier spread of some companies that do better than others. That probably speaks to the focus on industry structure, where, by virtue of understanding the dynamics and evolution and the basic utility of the companies we invest in that the kind of one-way volatility that all investors should fear, is taken away.

It should therefore follow that they have stable returns. Everything in there should be pre-funnelled in that sense. If we did that same comparison for younger business in emergent sectors, they might be higher growth they haven’t proven out through the cycle that they can generate sustainable returns.

Q: So, it is a product of process rather than that you’re creating a screening process for that specific metric?

JS: Yes, exactly. It is important investing in companies with a Quality approach not to try and denature the cycle. Individual sectors have individual cycles. Take semiconductors, for example. They tend to have their own cycles that need to be understood. We are not painting a picture of perfection in respect of cycles, they need to be taken on board. The most important thing is that once a full cycle turns, leading businesses are in at least a strong or, if not, stronger than the previous cycle. This is what we generally expect and if that was not the outcome then we would be looking critically at the position in question.

Ion Sioras: Adding to Mike’s point about ROE volatility, I have seen work on earnings volatility and a lot of the European names in the Global Leaders portfolio show up within the top 10 most stable in terms of earnings volatility.

Q: Do you think we misrepresent the Tech sector? Apple is a luxury brand. Is there a danger when we bundle Tech together and say that is has massively outperformed, it is more distorted against the rest of the market in history we have missed the point a bit a little bit?

JS: Yes, it is a simplification isn’t it? You could argue that some companies are pure Technology companies, but others labelled Tech are not. This reminds me of the TMT grouping in the 1990s (Technology-Media-Telecommunications). That was also a simplification. The car market has technological aspects to it, as it always has done. But if Tesla is just a smartphone on wheels then Tesla should be worried.

Q: Are not some things resolved? Amazon has eaten the lunch of retailers.

JS: I take the opposite view. The remarkable thing is that Amazon has not prevailed. Physical retail clearly has a part in our lives. Not long ago, people predicted the demise of the bookshop, but they continue even though there has been a winnowing process. Same with vinyl which has come back.

Q: The Cerno Pacific Fund continues to invest in China? How have you found that recently and what is the near-term outlook?

MF: It has been painful. We have been following closely the politics and policies. Russell Napier, who sits on our Investment Advisory Committee, wrote a book titled Anatomy of the Bear which studied historical bear markets. In that book he describes late bear cycles where things start improving but no one cares. I think this does characterise China at the moment. Things are finally moving and there is a recognition that they do need to do something. But, at the same time, they are well aware that they cannot just use more debt, so supply-side policies need to do more lifting and a series of smaller reforms which are beginning to bump things up a bit. Cleary, for the last two years it has been very painful because domestic policies have been a bit of a headwind. That headwind has become a tailwind but few people are recognising this. It is interesting to consider that the economic cycle in China compared to the rest of the world is very different. It very likely that we are heading to a decelerating world in the West certainty but in China they are going in the opposite direction.

Looking bottom-up, China creates great companies. That should not be forgotten.

Q: You have provided reasons not to invest too heavily in Magnificent 7 at this point but you have Microsoft as a Global Leaders holding in your portfolio. How does that company sit with your philosophy and is there opportunity for the other 6 at some point?

JS: Microsoft has been in the portfolio a few years. Why does that company line up better for us? They are an enterprise company, in effect selling to other businesses. We gravitate towards nodal companies that are supplying a lot of different businesses and building and delivering key infrastructure. Microsoft fits that bill. It is right across the waterfront of lots of things we think have a lot of growth yet to come.

Some of the other companies within the 7 are a bit closer to consumer trends and the fickleness of those. The reasons for not owning the other 6, are quite individual to the companies in question. Alphabet, for example, is a very opaque business and deliberately so. Can we invest in a business that won’t tell us what they plan to do, where they plan to invest? I don’t think so.

Tesla has been a remarkable ride, if I can say that, but the competition that it now faces is substantial.

I have read the trove of emails that were leaked from Facebook, and, to my mind, they show real moral turpitude inside that company in respect of how they seek to hook users. I think Meta (owner of Facebook) is in a dangerous position and they might get pincered: regulators on one side, consumers on the other. So, there are reasons that we don’t have the others but Microsoft is likely to remain unless something changes. And we have of course enjoyed the back and forth with respect to Sam Altman and Open AI. It is a bit like a soap opera, and we can all conclude different things about that episode, which is clearly not finished.

Q: Is Microsoft a way into AI?

JS: It might well be although we treat that section as a positive option. Where we have concluded, more materially, is that AI is very heavy on microchips. The ramp in investment is a caused by a need to grab computing power. There is also huge demand on memory chips, so there is a very clear read through on Samsung.

Q: Do you see the geopolitical tensions between the US and China continuing and that being a significant weighting on Nvidia future potential earnings in such an important region?

JS: Yes and yes. In their results, Nvidia referred to lower forecasts for sales to China but that that is balanced by higher demand from the rest of the world. So, what do we really think is happening? It could be that China is buying its chips elsewhere, not direct. Everybody wants Nvidia’s GPUs but that raises the incentive for other companies to compete. Nvidia’s strategy for that is to build more software around their chips because you don’t just received microchips you received modules that operate, which they have done very well. But other people will try and do that as well. This is a battle royale right now.

Q: Beyond the hardware of AI, I think part of the problem in 2000 was everyone brought the hardware underpinning the internet, that was the wrong trade then. With the Nvidia and the hardware element of AI, who do you think are the winners beyond that AI. Which industries will be transformed? Could it be healthcare?

A: Yes, I believe so in a big way. That is a high conviction for us. There is a decent amount of healthcare in Leaders and Pacific. Our overriding thought is that everyone has a vested interest in more efficiency in healthcare as it has only become more expensive. So, whether it is healthcare or medical equipment, or contract research or AI.

Oscar Mackereth: I also note that whilst particular industries would like to be beneficiaries of AI on a company basis the key beneficiaries will be businesses that have new data sets on which they can train their own algorithms, because that functionality has already be rolled out by AI.

JS: It is somewhat disturbing that Elon Musk is emerging as the moral conscience of AI.

Q: Could you speak about valuations in the portfolios? You spoke about the Magnificent 7 valuations and Asia that has had a bit of a harder time.

MF: Yes, valuations have come down quite a lot in Asia. The Pacific portfolio has experienced about 20% de rating which is double the market. But in that time the companies have delivered decent earnings growth of 13% per annum over the last 3 or 4 years, which is 10 points more than the market. So what I think is what you have seen, is the hype of 2020 has faded and what you’ve got is earnings and the froth has disappeared.

We’re looking broadly at early 20x Price to Earnings (PE) ratios and broadly getting 30% growth for that, so it is relatively attractive Price to Growth ratios in Asia. This has been the case for a while, so it is more the investor mindset that needs to change in terms of asset allocation to capitalise.

JS: The PE ratio on the Global Leaders portfolio is 21x. It had been as high as 30x which is very rich. 20x-23x is what I call the zone of reasonableness for these businesses. Let’s not forget we have just come out of a period where nobody knew what was happening to the discount rate. A year ago, gilt yields and Treasuries started blowing out and there have been sequential interest rate increases. We are now paused out and I personally believe we won’t see any more hikes.

When the market is unsure about where the discount rate is heading, when you are not sure what it is, valuations have to fall. We have just lived through that. Now I think there will be less volatility around the discount rate. The big remaining question is where bond yields will settle. Do they settle at positive in real terms or negative in real terms, or par? As an allocator or an investor it would be dangerous to assume that they return to negative in real terms, I think we should assume that they will be modestly positive in real terms. That should be a back-drop assumption for the next few years. At 21-22x times earnings, the zone of reasonableness, I am comfortable.

Q: Could you address what appears to be a consensus that inflation has been put back in the box and that we are going to have a soft landing?

JS: Well with soft landings, one must be very careful about wishful thinking, because most soft landings don’t land. They don’t transpire. It is a smaller probability than assumed. Everybody talks about a soft landing before the actual landing takes place. It is still possible. We are seeing some softening of order books, some consumer retrenchment. The picture is somewhat fragmented, hard to summarise.

On inflation, in a somewhat fractured world with aspects of de-globalisation certainly argues for a different landscape that the perfect picture of globalisation and urbanisation in China that prevailed from the late ‘80s to the early late 00s. That world is partly or largely gone. The bigger question for me is where bond yields hang. It would be a mistake to assume that they are going to be anything like as low as they have.