By FAY REN

Techtronic Industries (TTI), the Hong Kong listed cordless power tool maker, was the target of a short report on the 24th of February, one week before the company was due to release its full year earnings.

With the high-profile precedence of Hindenburg/Adani case still fresh, investor nerves were particularly sensitive. The short seller, Jehoshaphat Research, is not a widely recognised name, nevertheless the impact on TTI’s share price was substantial, dropping 18% on the day, thereby yielding all of January’s gains. The shares have partially recovered since, ending the quarter down 2.6% in local currency terms, detracting 15 bps from the portfolio in Q1. Techtronic is also held in the companion Global Leaders portfolio.

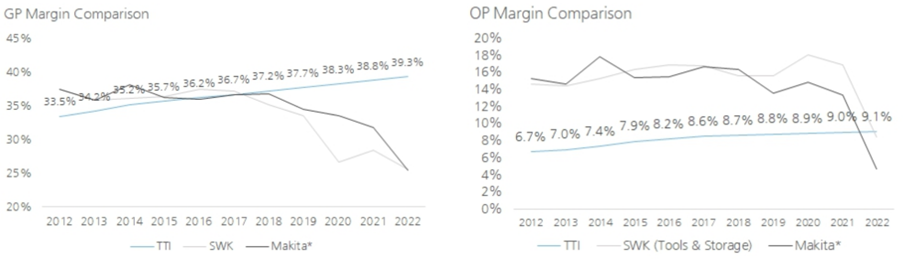

Jehoshaphat pointed out several accounting concerns that in their opinion signalled deteriorating financial and business quality. The main subject they took issue with was the divergence in gross margin in contrast to peers SWK and Makita. TTI boasts 14 years of uninterrupted gross margin expansion, while peers have been sliding. The short seller also suggested that TTI’s operating profits were achieved through a myriad of accounting tricks including excessive R&D capitalisation, inventory overproduction, and snowballing various expenses.

While we acknowledge that some of the points raised do give reason for caution, in our opinion management decisions lie within the tolerance of accounting rules interpretation. We do not believe TTI has actively engaged in accounting fraud and have subsequently connected with TTI for clarifications on top of their official rebuttal. We do not attempt to regurgitate the content of the rebuttal but use this as an opportunity to revisit the thesis for this business.

The timing of the short seller campaign was chosen carefully, one day after Home Depot, TTI’s major distributor in the US, released its earnings. It is no secret the external environment for the power tools industry has been deteriorating and this was duly reflected in Home Depot’s numbers. Notably, TTI’s largest competitors Stanley Black & Decker (SWK) and Makita have also pointed to a softening market. Nevertheless, these were fertile conditions to deliver a short seller report into.

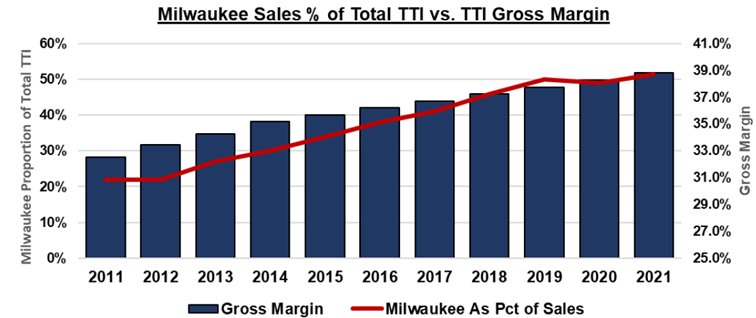

TTI’s business model is centred on fast-paced innovation. Part of our initial investment thesis in 2019 was the sustainability of the impressive market share gains over peers. Since 2006, TTI moved from #6/7 position to #2 globally today. This elevation was driven by a significant expansion in product portfolio breadth as well as a first mover advantage in the nascent cordless power tool space. As a physical goods manufacturer, volume driven economies of scale and the increasing contribution of high-end flagship brand Milwaukee as a proportion of Group sales and profits from <20% to 60% were the main drivers of gross margin expansion.

Source: TTI

The power tools market historically has a slower replacement cycle compared to, say, consumer electronics. In contrast to peers, TTI’s go to market resembles the high frequency approach of consumer companies, reinvesting heavily back into the business to drive new product releases that routinely making up 30-40% of total sales. Given pricing tends to increase with each new generation this approach provides a natural, mechanical tailwind to aggregate pricing.

However, operating profits have actually lagged behind peers, primarily due to TTI’s heightened spending on R&D and SG&A to drive the group’s high frequency product strategy.

Source: UBS

The short seller was correct to point out TTI’s much higher R&D capitalisation ratio versus peers, typically between 45-60% of total, where it expenses research costs and capitalises development costs. However, this is fully in accordance with international accounting rules. US listed peers using GAAP accounting must expense all R&D costs. This is a well-known international distortion and is reflected across countless companies and sectors. Adjusting for this capitalisation distortion, TTI’s R&D expense as a percentage of sales is still almost double its peers at 3.7% against an average of 1.9%. This differential reflects TTIs focus on internal innovation and low contribution of inorganic M&A led growth, compared to peers, in our view.

It is notable that, even in 2022 as TTI conducted a mass layoff of 13% workforce (mostly on the manufacturing side, it also added close to 1,000 in new headcount in R&D engineers. Overall, staff costs ended higher as R&D personnel are more expensive to hire.

We have written in the past about TTI’s superior proprietary design and configuration capabilities in the three core components used across the cordless power tool family: i) battery, ii) small brushless motors, and iii) electronics/software, while peers have been more reliant on third party providers. In some ways the construction of power tools analogues that of an EV, on a much smaller scale. These components are key to performance contribution although often overlooked as commodities. In this regard TTI has a clear recognition of the opportunity. Its aftermarket battery business has grown to >US$1bn sales (c.10% group) in FY22 on the back of its exclusive focus on cordless penetration and larger installed base, which has also been highly accretive to gross margins.

TTI spends on average 10ppts more than peers on sales and marketing, which forms an important aspect of their go to market strategy. This sales-focused philosophy is driven by long-time CEO Joseph Galli Jr., whose early days were spent as a floor salesman.

Longstanding customer relationships with major distributors such as Home Depot (going back to 2001) play a symbiotic role in the R&D cycle. Direct feedback from the salesfloor and customer-led product requests ensures a close understanding of changing demands in the market and higher rate of success of new product launches. TTI remains one of the few tool companies that does not sell directly through generic platforms like Amazon, which can increase sales volume but does not breed brand loyalty in the long-run given bigger focus on the professional tradesman market where the Milwaukee brand targets.

Since the 2018 tariff war, TTI has been active in diversifying its production base outside China. The subsequent pandemic and Russian-Ukraine war placed further strains on the supply chain to speed up this transition. It executed well in early 2020 to shore up inventory in the onset of the pandemic which allowed it to keep deliver and take market share while its peers initially struggled. The current growth landscape is mixed. In 2H22, revenue growth was -7%, ending the year on a flat footing. The consumer segment was notably challenged, given the pull-through demand from the pandemic and inventory destocking taking place across the industry. The Pro market was more resilient, Milwaukee pulled through +17% growth in H2, below its long-term 20%+ track record but still impressive given a generally wounded battlefield. TTI guided mid-single digit growth for FY23, including mid-teens growth for Milwaukee, where the pro market is more exposed to non-residential trends including infrastructure spending. The recent ConExpo (largest industrial machinery trade show in Las Vegas) participants indicated continued momentum in mega infrastructure projects.

Valuation is trading at the bottom of its long-term range at 15x forward 12 month price to earnings, which we believe is attractive given further structural growth in cordless penetration, industrial reshoring capex, and infrastructure spending.

This Journal is taken from the TM Cerno Pacific Investment Report Q1 2023, which can be read here.