By JAMES SPENCE

The US has been a spectacular investment location for equity investment throughout the 20th century and this predominance has extended into the 21st.

Today, American equities are a mighty 62% weight in the World All Country Index, and 70% of developed markets. The consequences of this material rise in weight over the past 25 years directly feeds into funds that track indices and also naturally creates a drift upwards in active manager weights, even amongst managers who do not slavishly follow indices, so called index agnostic managers.

If an active manager placed 50%, say, of their assets in the US and 50% spread between the other 22 developed markets in the world, they would be running a 20% underweight US position. Few have been tempted to do so despite the evident skew in such an imaginary portfolio.

Clearly, a very large part of the upswing of the past 25 years came with the commercialisation of the world wide web as it was once called. It seems almost quaint, an anomaly, that the web was invented by an Englishman working in Switzerland. America is the doyen of start-ups, roll-outs, seeking and achieving scale. In the fall out of the dot-com bust that follows the upswing of the 1990s many businesses failed (remember Pets.com, Webvan, Boo, eToys.com, Alta Vista). Others survived and prospered: Amazon, Cisco, eBay.

Whilst is it commonplace to proxy the US indices’ leading companies as “Big Tech”, not all of them have the internet at the core of their businesses. Whilst Meta and Alphabet sit on the nexus, Tesla and Apple make and sell physical products.

The rest of the world has had considerably less to offer in terms of world beating, internet-centric businesses. China has come closest. The run up in the Chinese indices between 2018 to 2020 had smart phone, gaming, shopping and social media companies at the heart of it as well as the ubiquitous Tencent. Investors, at that time, found technology models in China that were, in some ways better developed and more advanced than those in the west. For good reason Elon Musk is looking to morph X (formerly Twitter) into a WeChat type business. WeChat is owned by Tencent.

We all know what happened next. Crushing pressure from both ends. China changed tack on its policy settings and its previous tolerance of large, private sector run technology businesses and their main shareholders evaporated under the diktat of Xi Jingping which swung towards social responsibility. It became obvious that the world had changed when Jack Ma compared China’s state-owned banks to pawn brokers. A short time afterwards he was disappeared and, following a period of re-education, took to the quiet arts of Japan. Today, Jack Ma is the world’s wealthiest retired English teacher.

Meanwhile, Brussels and Washington decided that China was a joined up, high tech conspiracy. Washington asked Ottawa to nab Meng Wanzhou, group CFO and the daughter of the founder of Huawei, that company having been identified as the entity that would suck Western information into Beijing’s servers. Valuations in China have been crushed as foreign portfolio investment left, so much so that a China allocation now looks like a counter-consensus, high-risk, value play.

The problem with American equities is that as they have arrived at this gargantuan world weight, they now look overly expensive against the rest of the world on all measures. This comes at a time when the underpinnings of US finances look vulnerable (see our previous Journal: The problem with America …part 1) and the body politic is gerontocratic. The neutral overweight is beginning to look risky. Whilst it is hard to determine we might not be at the point of maximum risk at maximum allocation, investment is a probabilistic exercise and a reversal of the trends that have been in place for so long have great consequences for global allocations and funds flow.

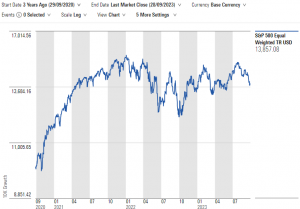

In fact, the turn may have begun. An equal weighted version of the S&P500 made its top in July, as can be seen from this chart.

When markets get narrow, they get dangerous.

Its is often the case that when a stock market begins the run out of steam, the lower registers deteriorate before the upper register submits. In the case of the US, the lower register is proxied here by the equal weighted index of the S&P and the upper register in the mega cap stocks Apple, Alphabet, Amazon, Tesla & Microsoft. The consequences of the US stock market surrendering leadership of global equities, if that does take place, makes the decision of a full US weight more problematic but would also produce better opportunities for global allocators who feel comfortable passporting allocations around other regions.