By JAMES CHENEVIX-TRENCH & ED BONSOR

As part of our series on innovation, James Chenevix-Trench and Edward Bonsor have embarked on an examination of the potential for blockchain technology and suggest how it might reshape financial transactions and create new avenues for investment. A glossary of key terms and concepts can be found at the end of their article.

Whilst this article does not support or dissuade investment in Bitcoin, Bitcoin is a good starting point for investigation, as it was the first cryptocurrency that used blockchain to leverage the power of a permissionless decentralised database. In the article, we explain how this characteristic makes blockchain so important and lies at the heart of the emergent use cases of blockchain that we see in decentralised finance (DeFi) and Non Fungible Tokens (NFTs).

It is an interesting exercise testing the subject of Bitcoin on friends and family. The first observation is that engagement tends to be clearly divided along generational lines. For most, the subject seems either too complex or opaque to bother with. For a growing minority, there is a budding enthusiasm, most likely because they have bought a cryptocurrency and are making money from it. A smaller group still are galvanised by the potential of the underlying blockchain technology.

Until recently, investor attention towards Bitcoin has tended to ebb and flow depending on the fluctuations in its price. Most millennials can recount stories of friends of friends who were early miners of the Bitcoin using nothing more than spare laptops. Almost all these people have stories of Bitcoins that have been lost, spent or left on old hard drives. Even back then, it was possible to appreciate the high-level concepts and qualities of Bitcoin. In short, it was appreciated as a digital, transferable, peer-to-peer currency native to the internet. The movement itself is grounded in counterculture and idealism; a means to escape the vested interests controlling capitalism. Even having an awareness of this, the true potential for blockchain has only become clearer much more recently. The use case for the technology extends far beyond ‘digital gold’ use cases like Bitcoin. These blockchain ‘rails’ have the potential to act as programmable platform technologies (Layer 1 protocols) that can host smart contracts for decentralised finance (DeFi) applications, NFTs (Non-Fungible Tokens) and the Metaverse. As of today, the pre-eminent smart contract blockchain is Ethereum, but there are many others vying for their place in this brave new world (e.g. Solana, Cardano).

Theta Blockchain Conference

We recently attended the Theta Blockchain conference (subtitled A Journey to the Internet of Value) in Amsterdam where we met pioneers and thought leaders in the space. Speakers included Tyler Spalding, CEO of Flexa a crypto payments network taking on VISA and MasterCard, Eric Wall, CIO of Scandinavian crypto fund Arcane investments, Lasse Clausen founding partner of 1KX, Robert Leschner CEO of Compound, and Andrew Steinwold, founder of the world’s first Non Fungible Token (NFT) fund, Sfermion.

Our visit to Amsterdam confirmed much of what we have started to understand about this space. It is both foundational and transformative, it is happening at speed and the rails of a new financial system are being laid down under our noses. We believe that early engagement will be immensely valuable. Investment opportunities are likely to arise, even if they remain predominantly in the venture space for now. If it does ultimately entail a radical reordering of how financial transactions are completed then, as investors, it makes great sense to watch these innovators and study the utility of the products that they devise.

Initially, there were no use cases for Ethereum’s programmable qualities. As of today, we see a plethora of DeFi apps emerging even if these are still quite primitive when compared to traditional finance. User growth and transaction volume have increased substantially with significant potential. For example, Opensea the pre-eminent marketplace for NFTs reported US$1.6bn of transactions in September 2021 up from US$700k in September 2020. The platform still has just 200,000 users. Many questions of course remain, regulation, energy usage, and storage to name the most prominent, but in this article, we put those aside to focus on what this technology could mean and what it might enable in the future.

Why do we think blockchain can be so important?

- Future generations will have different attitudes around what constitutes value to them, and by extension will ascribe it to new classes of digital assets. Although it might be hard to understand the motivation that leads a young person to invest into digital land in the Metaverse or into NFT-based characters, this motivation exists, and their spending power is growing.

- Blockchain has the power to disintermediate all industries involved in trust functions – roles such as bankers, lawyers and accountants; these constitute as much one third of the global economy.

- Although there are only a handful of ways to gain access to blockchain technology in public markets, exponential development is underway in private venture capital backed projects and some of these may go public in the future. With change in the offing, and it is important to be contemplating the future.

Blockchain: New Foundations for the Financial System

“What is needed is an electronic payment system based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other without the need for a trusted third party” Satoshi Nakamoto, Bitcoin white paper

When the elusive founder of Bitcoin published these words in his or her now famous ‘white paper’ they described exactly what had been missing from the internet since its inception: e-cash – that is money that could be transferred seamlessly across the internet in a peer-to-peer system without need for a trusted third party.

Bitcoin was not the first blockchain, but it was the first that made this proposition a tangible reality through a brilliant structure that solved the double spend problem (tokens being used for more than one purchase). With more than a decade having passed since those words were published, blockchain technology has evolved far beyond Bitcoin. Analogous to the founding years of the world wide web, we are witnessing a progression from a small group of hobbyists and developers mining tokens on laptops to the mainstream adoption of crypto currency exchanges, to DeFi apps and NFTs. As US$28tn is tied up in so-called ‘trust functions’ in society, this could potentially entail a very substantial reordering of related economics and companies engaged in these trust functions. These roles are the basis of trusted intermediaries, as defined by society’s existing social and economic constructs. Actors within society are levied significant fees for utilising these entities. Blockchain technology threatens to reorder and largely eliminate these roles as it disintermediates the need for trusted third parties.

It is important to note that a blockchain need not be decentralised. Any organisation can run a blockchain simply as a secure way of storing data, and there are many companies today that provide these centralised blockchain services. One example is Trade Lens, a blockchain system for keeping track of shipping or the newly minted Central Bank Digital Currencies (CBDCs).

While these initiatives are notable, they under-describe blockchain’s most revolutionary capability as a decentralised permissionless network; to allow ‘trust’ in a ‘trust-less’ system. To enable individuals to enter into a contractual agreement with complete strangers with no intermediation from a trusted third party. Think about the cost, or tax charged by trusted intermediaries in every area in finance. In theory, these costs could be eliminated in all but the most complex situations.

Building the railroads for a new frontier in finance

Useful analogies to the position of blockchain today would be the internet of the mid 1990s or US railways in the early 19th Century. We are at a point where the infrastructure, the rails or IP protocol is being laid down and we are starting to see nascent applications being created on top of that infrastructure. In the language of blockchain these pieces of infrastructure are the ‘Layer 1 protocols’: Ethereum and other Ethereum like chains such as Cardano and Solana.

Bitcoin has already earned its place in financial history, bringing blockchain technology into the mainstream. Indeed, returns for early investors in Bitcoin have trounced other asset classes by a factor of ten over the last decade. Having said this, we think it is probable that Bitcoin will lose some of its dominance of the ecosystem in the next few years.

Bitcoin currently represents the majority of tradeable value in the entire space and is being increasingly spoken of as the pre-eminent form of digital gold. That is, it is limited in supply, can be used as a bearer asset, and can be stored in a cold storage wallet (a ‘vault’ equivalent).

However, this is as far as it goes. While Bitcoin contained the genesis of the revolution in its technical brilliance, it will be the new programmable money that carries the revolution forward. These programmable blockchains are the Layer 1 protocols, the rails of a new financial system. They make a departure from Bitcoin in that they can store small programs on their chains, or so-called smart contracts, which can settle payments or any other contractual arrangement without the need for a trusted third party. DeFi apps are being built on top of these Layer 1 protocols with 80% currently hosted on the Ethereum blockchain. It is this ability to run smart contracts on a blockchain which is so transformational.

The internet 3.0 will be built on smart contracts and NFTs

The internet as envisaged by Tim Berners-Lee was an open-source commons where the entire world could share information and no one truly owned anything. It all began as an interconnected computer system where scientists could share experiments. This was the internet 1.0. If this sounds naive and a little utopian it is because we are viewing it through the lens of the internet 2.0 – today’s internet landscape where the behemoths of Facebook, Google and Amazon dominate the web, organising our data and profiting from it. The internet has become centralised and opaque. Decentralised Finance (DeFi) based on blockchain technology allows for something entirely different. The first signs of the power of this technology to rewrite the rules of the internet are already being felt.

Examples of successful DeFi apps include Compound, a crypto lending platform where a yield can be earned on digital assets or Nexus Mutual, a new concept of mutual fund that is entirely decentralised. The Nexus Mutual DAO (Decentralised Autonomous Organisation) holds members’ funds in a risk sharing pool and uses those funds to pay out claims. Nexus Mutual uses its community to assess and accept coverage proposals, and to fund the pools that ensure that coverage – all with added rewards built in through the platforms’ NXM token. All this is underpinned by smart contracts executing on the blockchain with no intermediary sitting between respective counterparties.

Flexa is another example of a DeFi application that is directly challenging the financial system. In the payments arena, Visa and Mastercard have operated a powerful duopoly for many years at high profit. Flexa believe that their blockchain technology will provide a real challenge. Most recently they played a pivotal role in the integration of the bitcoin payment network in El Salvador (the first country to adopt Bitcoin as legal tender).

We are already seeing examples of where blockchain use cases are intersecting with real world traditional finance. For example, earlier this year the European Investment Bank issued a EUR100mn two year bond using the Ethereum blockchain network. Likewise, in June Compound announced the launch of Compound Treasury, a product designed to be accessible for traditional banks. Clients need simply transfer USD to their Compound Treasury account to gain access to the rates.

Non Fungible Tokens (NFTs)

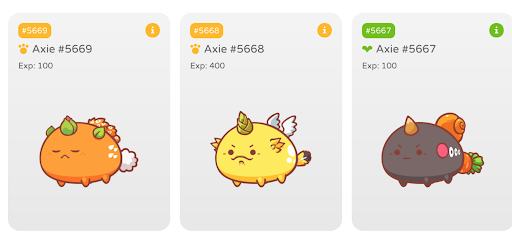

Axie Infinity is a game come social network mixed with a financial services platform based on the Ethereum blockchain. In the game players own Axies (cute Pokémon-like creatures) that can be bred to create new Axies, trained up to gain new abilities or do battle with other Axies in competitive tournaments. Players can earn income in the form of the games’ native token which also acts like a share class ensuring that players own a stake in the Axie Infinity universe.

The economic activity on the platform is made possible by smart contracts, but it is NFTs that are the last piece of the puzzle that give us a vision of the internet 3.0. Each Axie is represented by a unique NFT – a file that sits on a blockchain, the NFT cannot be copied or reproduced, this gives a digital certificate of originality and ownership. Much has been made of NFTs since they appeared in the popular imagination with the sale of Beeple’s ‘The First 5000 Days’ for US$78mn, but the implications of NFTs are nothing less significant than the realisation of private property rights for the internet. If one needed an example of the power of this reality just think about how transformational private property rights have been for the development and success of capitalism.

The economic activity on the platform is made possible by smart contracts, but it is NFTs that are the last piece of the puzzle that give us a vision of the internet 3.0. Each Axie is represented by a unique NFT – a file that sits on a blockchain, the NFT cannot be copied or reproduced, this gives a digital certificate of originality and ownership. Much has been made of NFTs since they appeared in the popular imagination with the sale of Beeple’s ‘The First 5000 Days’ for US$78mn, but the implications of NFTs are nothing less significant than the realisation of private property rights for the internet. If one needed an example of the power of this reality just think about how transformational private property rights have been for the development and success of capitalism.

The Axie platform has seen phenomenal growth in users and activity this year. According to Coin Desk the game accounted for over US$500mn in NFT token sales in September 2021, with all time sales totalling US$2.2bn. Apart from NFTs, Axie’s native token is now valued at US$9bn. At the beginning of October 2021 Axie confirmed that it raised US$152mn led by Andreessen Horowitz. Additional investors include Paradigm, Accel, and Samsung.

During the third quarter of 2021 alone, Axie generated over US$760mn from in-game revenue. To put this in context, Axie Infinity currently has a mere 1m users. A gaming platform such as Roblox has 202mn users so the potential for existing franchises to retrofit NFTs into game play is enormous.

User growth is focused on the developing world, and particularly in Southeast Asia, where young players are earning significant incomes away from challenging labour markets. There are organised groups of gamers such as Yield Guild, which has funding from Animoca and Andreessen Horowitz, together these players can achieve higher yields and help the platform to proliferate. Axie Infinity is the culmination of many of the latest trends in blockchain but is just the beginning of what can be made possible by this technology.

The metaverse – what will we ascribe value to in the future?

Image: Forbes

When looking at the exponential adoption and development of blockchain based currencies, DeFi and NFTs, we think that it is important to be open when considering what future generations will ascribe value to. The truth is that the importance of the online world will only grow, the average American now spends about 7 hours a day on screens. The online identity of the future will only achieve more significance.

Imagine a young person in Delhi in 2050, the city is overcrowded and polluted, opportunities for good jobs and quality of life are scarce, but all these inequalities feel far less important when that person enters the metaverse. He or she walks from confined accommodation to an airconditioned booth with a stable WiFi connection and in a few moments, they are connected to the web via a constellation of satellites that bypass non-existent fibre infrastructure. The individual is then transported to a world where they can leverage their own intellect and agency against any person from America or Europe on a level playing field. The person can compete fairly and own digital assets that are displayed for all to see (denominated in a cryptocurrency). It is no accident that games like Axie Infinity are taking off in the developing world where the use cases seem obvious to people who suffer regular cycles of inflation, economic mismanagement, and corruption.

The ‘metaverse’ is a word we will hear a lot more about. As yet, it is a poorly defined vision (notably recently described by Mark Zuckerberg), but it represents a belief in the power of the online world to shape human culture and experience. It is a vision today best represented by gaming worlds like Axie Infinity, the mania for digital assets in communities like Decentraland and the rapid growth in the market for NFTs. It is a belief that in the future the things people own online will be as important to them as those that they own in the physical world.

When people who are not involved in these spaces hear about others paying eye-watering prices for digital assets there is a temptation to dismiss all this as meaningless illustration of a mad bubble. While it is true that the current mania for NFTs far outstrips any use cases, we should not underestimate the power of blockchain technology to change and possibly transform the economics of how transactions are conducted and recorded and in so doing transform the ‘real world’ for all of us.

James Chenevix-Trench & Edward Bonsor

Glossary & Key Concepts

Blockchain – A piece of technology that consists of a database that records information in a way that makes it difficult or impossible to change, hack, or cheat the system. A blockchain is a digital ledger of transactions that is duplicated and distributed across an entire network of computer systems. The data is stored in blocks, each block contains a unique identity and the unique identity of the previous block in an unbroken authentic chain that cannot be forged or changed. The most famous blockchains are those underpinning crypto currencies like Bitcoin and Ethereum. It is important to understand that while integral to the incentivisation and adoption of Bitcoin and Ethereum – a blockchain can exist independently of a cryptocurrency.

Bitcoin – The first cryptocurrency, Bitcoin is a digital token underpinned by blockchain technology. When transactions are recorded in the Bitcoin blockchain, they are agreed upon by a method of cryptographic consensus that does not require any central authority. This is Bitcoin’s key innovation, and it is called ‘proof of work’. When a certain number of transactions are recorded, a new block is created, and an algorithmically determined number of new tokens are ‘minted’. Value from these new tokens accrues to those using the greatest computer power to assist the validating effort in the form of digital tokens or crypto currency. There are other methods of achieving consensus than proof of work that may come to replace it just as there are newer cryptocurrencies with their own chains that are in many ways superior to Bitcoin, but it is important to know that all are at least inspired by the original innovation of Bitcoin and try to replicate its ability to validate transactions with no need for a trusted third party.

Ethereum – Ethereum is more than just a cryptocurrency. Founded in 2015 it is the second most valuable digital token after Bitcoin. Ethereum, like Bitcoin, has its own blockchain, however it is possible for developers to host computer programs on this blockchain, something that Bitcoin cannot do. Ethereum therefore forms the basis for crypto business that are disrupting traditional finance, decentralised finance (DeFi).

Smart Contracts – Simple computer programs that are hosted on blockchains like Ethereum, they can store information and settle payments with no trusted third party.

Decentralised Finance (DeFi) – The burgeoning area of finance that uses blockchain technology to replace traditional financial services while cutting out the need for intermediaries and centralised structures.

Non-Fungible Tokens (NFTS) – Unique files that sit on a blockchain and cannot be replicated, they in effect give a digital certificate of ownership and authenticity to any asset. They are hosted on chains like Ethereum.

Metaverse – A loose concept that imagines a time when the digital world will take on as much significance as the ‘real world’. In this digital universe people will own assets and accrue value and status just as they do in the physical world. Blockchain has a vital role in underpinning this concept as it will allow future generations to ascribe value to digital assets.