By OSCAR MACKERETH

By OSCAR MACKERETH

India, a founding member of Morgan Stanley’s 2013 ‘Fragile Five’[1], has experienced a transformative decade.

Driven by programmes of corporate governance reform, improving political and currency stability, rising private expenditure, lower debt, and favourable demographics, India presents one of the most compelling global growth stories.

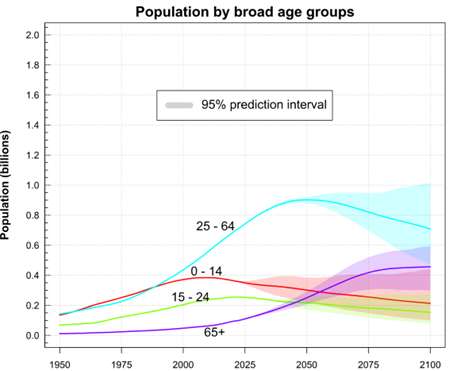

According to UN estimates[2], in April of 2023, India overtook China as the world’s most populous country. This represents the first time since the 1950s, when the UN first began taking global population records, that China has not sat atop the global podium. Since 1950, the Indian population has grown by over a billion, with forecasts suggesting a 1.7 billion peak by 2064. Simultaneously, total fertility rate decline has moved towards replacement levels, thus reducing the dependency ratio[3]. The country will have a largely youthful population over the next two decades, laying the foundation for a sustained ‘demographic dividend’[4].

Figure 1: UN Forecasts of Indian Demography[5]

Figure 1: UN Forecasts of Indian Demography[5]

India’s ability to leverage this advantage will depend on continued investment into the technological literacy of the country’s incumbent and new workers, who will likely increasingly rely on digital connectivity to interact with global commerce.

By most measures, India is making significant progression towards becoming digitally advanced. Driven by public governmental programs such as the ‘Digital India Initiative’[6], in 2022, non-active Indian internet users were a minority for the first time. Smartphones are the primary means of internet access driven by steady declines in the cost of hardware.

Last year, 52% of total users engaged in e-commerce, 45% in digital payments and 88% engaged in OTT services[7],[8] . Thus, in absolute terms, India lags only China in most vectors of digital adoption.

We invested in two listed Indian businesses in the second quarter: Affle and Tanla.

Both are deeply integrated in India’s digital evolution. They provide high value utility functions to their end markets via innovative processes and proprietary technologies.

Affle (AFFLE.NS/AFFLE.BO) is a leading programmatic digital advertising business. It is differentiated by the vernacular diversity of its offering enabled by AI capabilities.

Affle operates through a consumer platform which seeks to acquire and re-engage customers for enterprise clients. The group specialises in under-served, high-growth markets: non-metropolis and rural emerging-market communities. Its primary markets include India, Southeast Asia, Africa, and Latin America. Secondary markets include developed markets such as North America, Europe, Japan, Korea, and Australia.

Alphabet and Meta have historically controlled the lion’s share of global digital marketing revenue. However, recently their dominance has regressed with the emergence of nascent advertising technologies and a shift away from traditional online communities, such as Facebook. Thus, their market share has declined from near 60% in 2016 to an estimated ~45% in 2023[9]. Affle considers the residual 55% to be its total addressable market (TAM). Due to the markets’ fragmented nature, it is difficult to present reliable share data. Affle estimates that market share falls in the low single digit percentiles. However, because of low penetration, this places Affle within the top three competitors in their target markets.

The communities targeted by Affle have historically been underserved due to the low levels of their internet penetration and commercial interactions size. The technical barriers of advertising in areas with intense vernacular diversity are also significant. Affle has mitigated these issues through its proprietary Machine Learning (ML) and Artificial Intelligence (AI) driven algorithms, which utilises its unique data inventory to automatically present consumers with multi-media advertisements which are specific in both content and linguistic preference. This level of localisation is difficult for multinationals, like Google, to replicate.

The programmatic nature of this service allows it to minimise costs and maximise campaign efficacy. Therefore, as a demonstration of faith in its proprietary systems, Affle utilises a ‘cost-per-converted user’ structure whereby fees paid by the enterprise customer is proportional to the success of the contracted campaign. This allows Affle to guarantee a pre-determined ROI to its customers, whilst evidencing the efficacy of their systems via a strong earnings profile.

Finally, Affle has evidenced the efficacy of its technology in diverse geographical markets through its successful international expansion program. Affle attributes the adaptability of its systems to its target consumers not having been digitally native for long enough to develop unique browsing behaviours. Thus, the operations of the business appear to be capable of scaling with both local and global digital penetration trends.

Tanla Platforms (TANLA.NS) is a cloud computing business, offering businesses communication platform services (CPaaS). Tanla facilitates communication and engagement services via automated messages services in a medium agnostic format.

Its primary market is India, where it maintains a 20% share of mid-market enterprise revenue and a 50% share in large enterprises, resulting in a 45% revenue market share of the Indian SMS TAM. The Indian CPAAS market has an estimated TAM of INR 53.3 billion (US$650mn)[10] and is predicted to grow at a CAGR of 24.8% until 2028.

The growth of the CPaaS market is driven by increased online transactions and interactions. Tanla accesses this market via an ‘application-to-person’ messaging and platform business. Aided by a disciplined acquisition programme, Tanla has developed the technical capabilities to offer end-to-end CPaaS solutions via an asset light business model, now delivering over 169 billion automated messages per year and processing over 800 billion interactions annually[11]. Tanla’s competitive edge in this market is denoted by the technical barriers to entry it has established through a first mover advantage.

Moreover, Tanla also maintains a smaller, but higher growth platform segment. This can be largely split into the Trubloq stack and the Wisely Platform.

Trubloq is a blockchain-enabled commercial communication stack, designed to provide a secure platform for commercial communications. Trubloq uses blockchain technology to create an immutable ledger of promoters and the message headers and templates they use. These are used to verify the authenticity of messages sent, record delivery to the intended customers and prevent SMS based fraud. Today, roughly 65% of India’s A2P SMS traffic is processed through the Trubloq system, resulting in a net reduction of 60% of customer complaints of SMS based fraud[12]. This likely makes Trubloq the largest case study of commercial blockchain utilisation in existence today.

Finally, Tanla’s latest endeavour, the Wisely platform, is a digital marketplace for enterprises and suppliers. It provides a global edge-to-edge network, delivering private, secure and trusted customer communication capabilities. It’s two main components are the Wisely Network and Wisely Marketplace.

The Wisely Network is a managed end-to-end encrypted network, encrypted via proprietary cryptographic algorithms which provide critical data security services within global A2P communication services.

The Wisely Marketplace is a digital marketplace where enterprises can both host their own communication services and connect with new enterprise customers. This allows enterprises to obtain essential CPaaS services in a consolidated location, saving time and money and allowing inter-provider collaboration in key projects.

Wisely provides coverage in over 190 countries, allowing customer global reach and scalability. Moreover, it has provided Tanla with a means of exporting the technical capabilities developed in its native market to an international audience. Trubloq has deployed as the security foundation for Wisely, ensuring that all commercial communications are secure and encrypted, as well as tracking the delivery of messages to their intended recipients.

These organisations have developed unique technical capabilities via a focus on innovation, which allow them to operate within markets which have higher barriers to entry, lower competition, and higher growth dynamics. Both have outgrown India’s digital expansion trend due to their investing in sustainable competitive advantages and capture of defensible market share. Moreover, these companies offer strong balance sheets, free cash flow profiles and management teams, which has allowed them to capitalise on lucrative inorganic growth opportunities both locally and internationally.

—

[1] A group of countries that relied heavily on foreign investment for growth due to domestic instability, originally made up of Brazil, India, South Africa and Turkey, https://www.businessinsider.com/morgan-stanley-fragile-5-emerging-markets-2013-9?r=US&IR=T

[2] undesa_pd_2023_policy-brief-153.pdf

[3] The rate of the population of young (0-14 years) and old (60+ years), to the population in working ages (15-59 years).

[4] Demographic dividend refers to the economic growth that occurs when a country’s working-age population is larger than the population that is dependent on it.

[5] 20/06/2023, UN Department of Economics and Social Affairs, Population Division, https://population.un.org/wpp/Graphs/DemographicProfiles/Line/356

[6] https://digitalindia.gov.in/

[7] ‘Over The Top’ media services – digitally native platforms, offering traditional telecom services (voice, messaging, video calls) in an online only format (e.g. WhatsApp).

[8] IAMAI & Kantar, 2023: ‘Internet in India 2022’, https://www.iamai.in/knowledge-centre

[9] https://www.bloomberg.com/news/articles/2023-01-10/meta-meta-and-google-googl-advertising-dominance-slips#xj4y7vzkg

[10] https://www.mordorintelligence.com/industry-reports/india-communication-platform-as-a-service-market

[11] https://www.tanla.com/media/images/Annual/Annual-Report-26-2022_revised.pdf

[12] https://trai.gov.in/sites/default/files/PR_No.75of2022.pdf