By MICHAEL FLITTON

By MICHAEL FLITTON

Nabtesco was introduced to the portfolio during the second quarter of 2022.

It is a Japanese manufacturer of mechanical components relating to motion control with leadership positions across a wide portfolio of niche products. It is a business which benefits from rising capital expenditure and inflation. The economic New Order post-pandemic is likely to feature both of these factors at structurally higher levels than the during the deflationary cycle established with the emergence of globalisation in the early 90s, in our view.

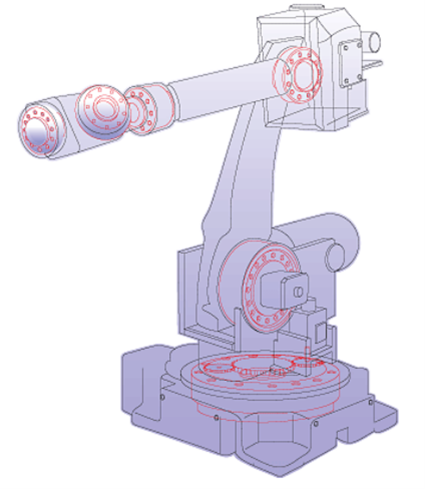

The business was formed from the 2003 merger of two companies: Nabco (est.1925) and Teijin Seiki (est.1944). The resulting combination offers a broad range of products and services linked by its expertise in motion control. The core franchise is the manufacture of speed reducers for industrial robots which generates half the group’s operating profit. The portfolio stretches from hydraulic units for construction machinery to automatic doors, commercial vehicle brake components, and marine engine control systems, among others.

Source: Nabtesco

Source: Nabtesco

Across these business lines the group has established leading positions. This is particularly apparent in the core reducer division where Nabtesco holds a dominant global share of around 80% within their addressable market of medium/large gears. The company supplies all the global big four robot makers (Yaskawa, Fanuc, ABB, Kuka) as well as the rising Chinese players (Estun, Siasun, GSK). The wide moat of this business is a product of the group’s technology leadership developed over decades of cumulative R&D and know-how. This institutional knowledge, or invisible IP, is hard to replicate. Other intangible advantages lie in the deep relationship with customers. Reliability, quality, and safety all combine to make entry hard for emerging players. Finally, switching costs are high given the critical nature of gears in the functioning of industrial robots. These speed reducers enable precise movements with a high degree of torque through transforming the high speed from a motor into a low speed. They must be durable for the 7-10 year life of the robot. They dictate the quality of the robot and this importance is shown by the value they represent at one third of the total cost of a robot arm.

Source: Nabtesco

Source: Nabtesco

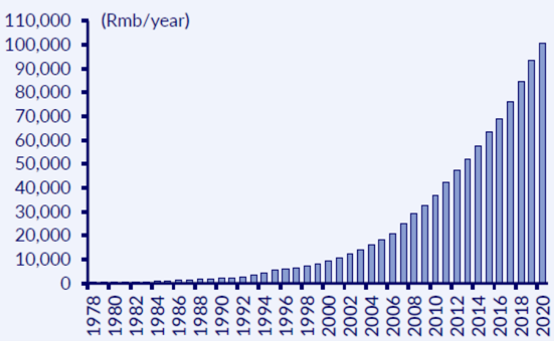

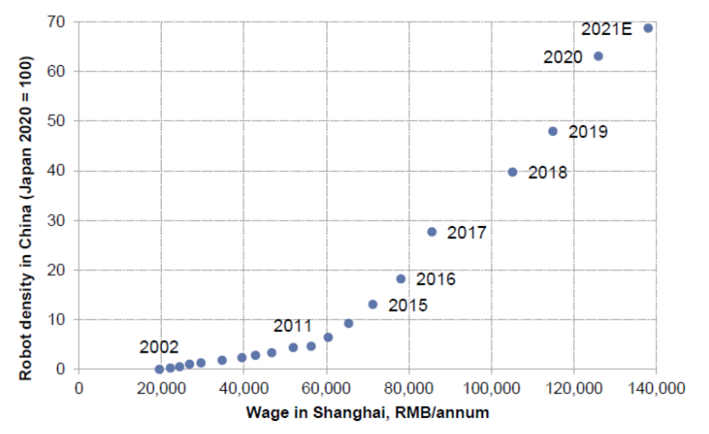

Demand for Nabtesco’s product is linked to capital investment. Most notably the company is geared into investment in automation. The choice between man and machine comes down to cost. Taking into account productivity benefits and the initial capital outlay, the key question for Nabtesco’s customers is whether the payback period from investment is attractive against the equivalent labour cost? It is in this context we can understand the emergence of China as the largest market for industrial robots. Robot density in China has expanded at 32% pa since 2010 against 10% pa for the global average. The chart on the right points to why. Average urban wages in China have compounded at around 12% pa in the past twenty years steadily eroding the competitiveness of human capital.

Source: CLSA

Source: CLSA

As wages have risen efficiency gains have also reduced the cost of robots pushing the substitution point lower and driving robot density in China. Automation is recognised as the primary means by which China can escape its demographic headwind. However, wage pressure, labour availability, and geopolitics are all trends now being felt globally. The International Federation of Robotics expects demand for robots to run at 8% pa with China continuing to outgrow at 15% pa.

Source: GS

Source: GS

Nabtesco is a high quality, deep moat, business supporting productivity gains at a time of rising inflationary pressures. It is a non-zero sum business. The efficiency gains it makes are passed on to customers to drive market penetration through lower end prices. Margins have been steady, if unspectacular, as a result. As we move from a disinflationary to an inflationary environment it may be there is more room for the company to internalise some of these gains as wages do more of the heavy lifting to drive substitution. After a decline of 50% from the highs valuation is now extremely attractive, despite ongoing uncertainty.

This piece is taken from TM Cerno Pacific Investment Report – Q2 2022, which can be downloaded here.