By ION SIORAS

By ION SIORAS

& OSCAR MACKERETH

& OSCAR MACKERETH

The Cerno Global Leaders strategy is wholeheartedly a bottom-up process focused on identifying attractive companies and business models.

We seek to identify “mega-trends” that persist through economic cycles and provide secular growth prospects.

The messiness of reality often collides with the sterile elegance of the investment model in the form of exogenous shocks. Events such as wars, pandemics and technological breakthroughs send ripples through the global economy which can and do alter the urgency or relative priority of a mega-trends evolution.

COVID-19 and its effects on digitisation is a recent and effective example. What was previously a steady but inexorable transition in work environments was super-charged to allow for the continuation of societal and economic activity in a mostly remote fashion. Below we will examine which mega trends that the Global Leaders portfolio is exposed to could be accelerated by the war in Ukraine and broader global inflation.

In response to an offensive war being prosecuted by one of the largest energy exporters on the planet, the international community’s primary non-military tool has been the sanctioning of Russian oil and gas exports. The most obvious direct beneficiary of these disruptions, the fossil fuel energy complex, is a sector that is precluded from the Global Leaders investment mandate. Likewise the global defence sector is also a proscribed sector.

We thus turn to the few secondary beneficiaries of high energy prices in the first instance. One nexus we identify is the potential for prices at the pump to alter the competing economics between internal combustion (ICE) and electric vehicles (EV). With the cost for the average full tank of petrol exceeding £100 (roughly 17p per mile) the equivalent cost per mile in an EV is estimated at less than a 3rd (5.5p) at current retail UK electricity prices. We do not think it is fanciful to consider that the Ukraine war may do for electric vehicles what COVID did for the digitised office.

Figure 1: Source

Figure 1: Source

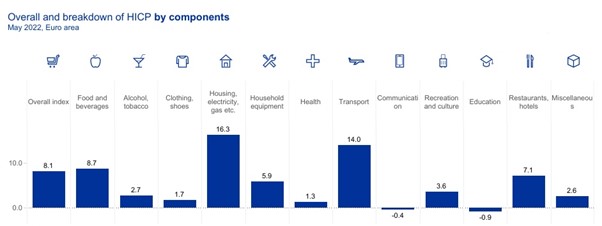

The largest restriction in fossil fuel supplies since the 1973 oil crisis is happening concurrently with a melee of supply chain constrictions around the world. Chinese COVID policies have hampered activity in several of the world’s major industrial heartlands. A number of global industries are still dealing with disruption on the lee of the pandemic more associated with the unlock rather than the lockdowns. In aggregate, these problems have led to the largest inflationary impulse in over 40 years.

The corollary of inflation, once it is persistent for a lengthy enough period of time, is agents’ reaction functions. Over the past 18 months, inflation has caused an erosion in excess of 10% of real earning power in developed economies. There is already a swathe of anecdotal evidence that consumers are responding in their wage negotiations. Taking just a cross section of the UK since March, refuse collectors in Manchester have received a 22% pay increase, Gatwick airport workers a 21% increase two weeks ago and cleaners and porters at a Croydon hospital a 24% raise in pay.

Energy prices and EVs

With respect to how we regard opportunities in the auto industry, our approach is not to try to pick a particular vehicle manufacturer which might dominate the transition from combustion to electric. As with all industries we review, we rather seek where we can find commonality across the electric vehicle space and then identify which companies are embedded incumbents in the supply chain.

The EV section of the global auto manufacturing industry is currently facing a “hundred flowers blossoming” moment of electric only start-ups. In addition to this, multiple well-funded technology oriented conglomerates have unveiled plans to enter the electric vehicle space in the medium term. Baidu, Xiaomi and Sony are expected to launch branded vehicles in 2023, 2024 and 2025 respectively and it is expected that these companies will bring a smartphone-esque operational strategy to the manufacturing of vehicles, of which a key element is outsourcing practices.

Through our picks and shovels approach, we can own the organisations which will facilitate these practices. Some examples include Ansys which provides Vehicle Electrification Simulation and Design software to optimise the control and efficiency of power management systems. Keysight Technologies, a specialist in electronic test and measurement of systems across the electromagnetic (EM) spectrum, has a growing business in the test and validation of EV battery and charging systems.

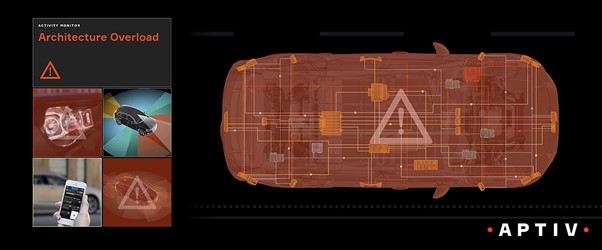

Electronic content represents roughly 50% of the bill of materials for an EV, in comparison to the >10% of traditional ICE vehicles. Component suppliers that are facilitators of this advanced electrification will become ever more important in the auto supply chain versus legacy manufacturers of ICE products (transmissions, turbochargers, exhausts etc). Aptiv’s Autonomous Mobility business segment is the sole global provider of integrated automotive “brain and nervous systems”. Aptiv systems provide the interconnect infrastructure to receive and circulate the information being captured by sensor arrays across the entire modern vehicle. More importantly standardised Aptiv operating systems allow for base-level processing of this data before it reaches the marquee specific driver facing software packages. Aptiv can white-label such whole systems to enable new entrants to focus on software-defined vehicles, supported by electrified and intelligently connected architectures.

Figure 2, Source: Aptiv

Figure 2, Source: Aptiv

By 2024, the daily data consumption of a vehicle with ADAS capacities is expected to be equal to the data generated by roughly 5,750 smartphones per day, resulting in the semiconductor content costs per vehicle tripling from 2015 to 2030. As a result autos are expected to meaningfully contribute to incremental semiconductor demand, with analysts expecting >10% contributions after 2026, whilst the global auto semiconductor market could increase over 300% by 2030. Global Leaders holds positions across the entire semiconductor value chain.

The automation drive

In a persistently inflationary world, one of the tailwinds for corporate margins in the past decade, the cost of human labour, will likely become a headwind. Pay negotiations in the industrial sector are following patterns observed in white collar workplaces or the service industry. Germany’s most powerful industrial union, IG Metall, is demanding a pay increase of 7 – 8% in upcoming negotiations after accepting a 2.3% rise as recently as 2021.

In an effort to protect already pressured margins, we would expect companies to accelerate capital expenditure on automation plans. What previously may have been a marginal business case given the high start-up cost of automating an industrial process will become incrementally more attractive if labour costs are inflating 5–10% per year rather than the 0–3% of the previous economic cycle.

Rockwell Automation is a world leader in end-to-end factory automation solutions. Rockwell has already been a beneficiary of the increased digitalisation COVID demanded of even the humble factory. We think the company is now uniquely positioned to help corporates achieve efficiency gains through varying levels of automation.

Given the cost-base and low margin of error for automating high throughput and complex processes, the design, planning and control of an automated factory is equally if not more important than the hardware implementation. Product lines such as Rockwell’s FactoryTalk and Studio 5000 software suites are examples of the crucial tools needed to achieve this. Rockwell has spent the past few years focused on creating an integrated offering between software and hardware that we believe gives them a competitive edge.

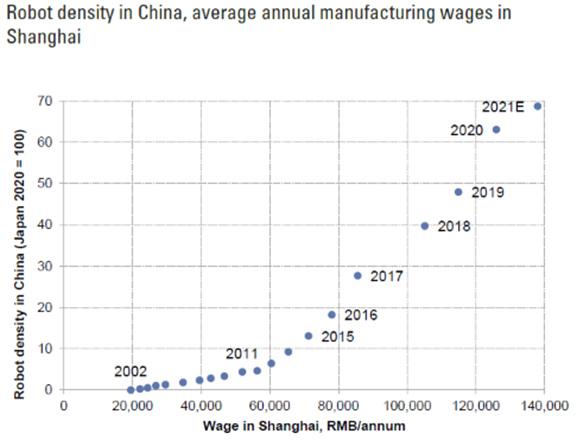

When we speak of automation we often speak of the all-capable industrial robot. Similarly to our thinking on electric vehicles we have sought suppliers that benefit from the aggregate growth of robotisation rather than having exposure to an individual manufacturer. Nidec’s Motion Control offering, which sits within the largest business line of the group (ACIM, ~37% of sales) supplies drive motors and their attendant controllers to a number of major robotics manufacturers. There is empirical evidence that increasing labour costs will engender an exponential demand for industrial robots going forward, and we expect Nidec to be integral in responding to this demand.

Source: Source: NBS, Wind, Shanghai Bureau of Statistics, GS