By MICHAEL FLITTON

By MICHAEL FLITTON

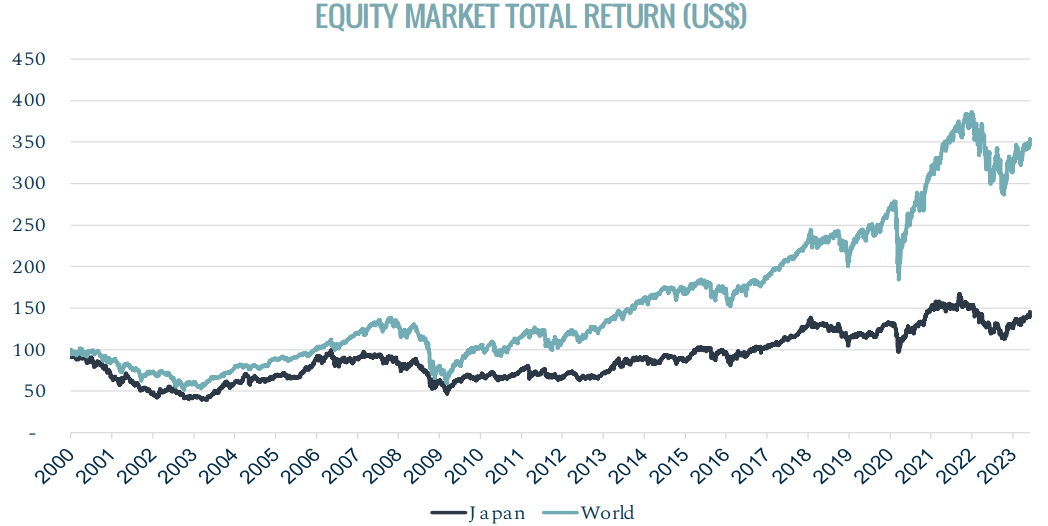

Despite a rich history of innovation, entrepreneurial culture, and supportive government policies, Japanese stocks have underperformed global equities over the past twenty years.

Source: Bloomberg

A contributing factor has been the conflicting priorities of global investors and Japanese companies. Leadership teams in Japan have tended to prioritise operational excellence. No bad thing. The result has been world leading business franchises.

However, corporate governance has been demoted as a result. Offence in one area has been offset by defence in another. Cross-holdings and bloated balance sheets have risen like buttresses around the Japanese corporate castle.

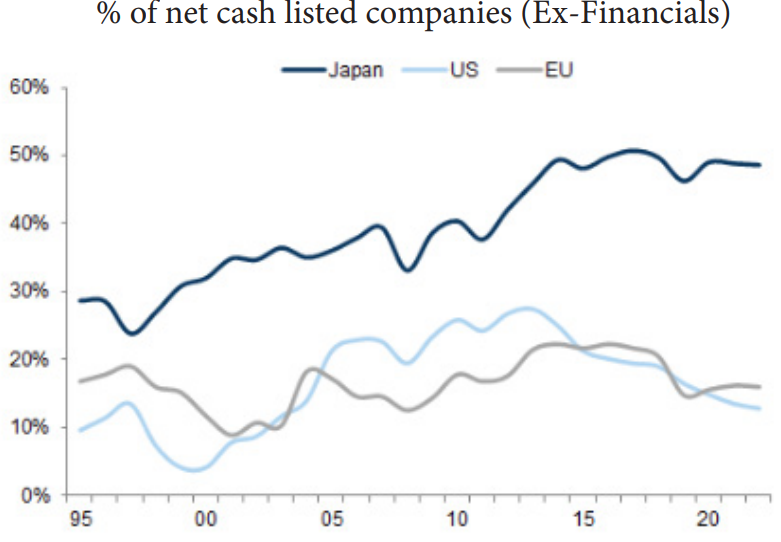

According to Goldman Sachs, almost 50% of listed companies (ex-Financials) are net cash. This compares to 10-15% in US/EU. Some cash is good, but all things in moderation. A lot can be bad for your health. Half of those Japanese companies have cash over 20% of equity.

Source: GS

Source: GS

This cash weighs heavily on return on capital and the valuation of Japanese businesses. Half of listed companies (ex-financials) trade below book value or theoretical liquidation value. This compares to just 20% in Europe and less than 5% in the US.

Herein lies the opportunity. With appropriate motivation companies can return cash, slim down, and close the valuation gap. The authorities in Japan have long tried a softly-softly approach to reform. However, in January, The Tokyo Stock Exchange (TSE) went full bore, proposing naming and shaming companies persistently trading below book. In Japan, shame is a highly powerful motivation. Since then, 13 companies have announced buybacks over 10% of outstanding shares (CLSA).

This renewed reform agenda has helped catalyse outperformance of Japanese equities, the NIKKEI index is up 24% in 2023.

We have looked to prosecute this theme in Cerno multi asset portfolio via a specialist manager, Zennor which is focused on corporate reform.

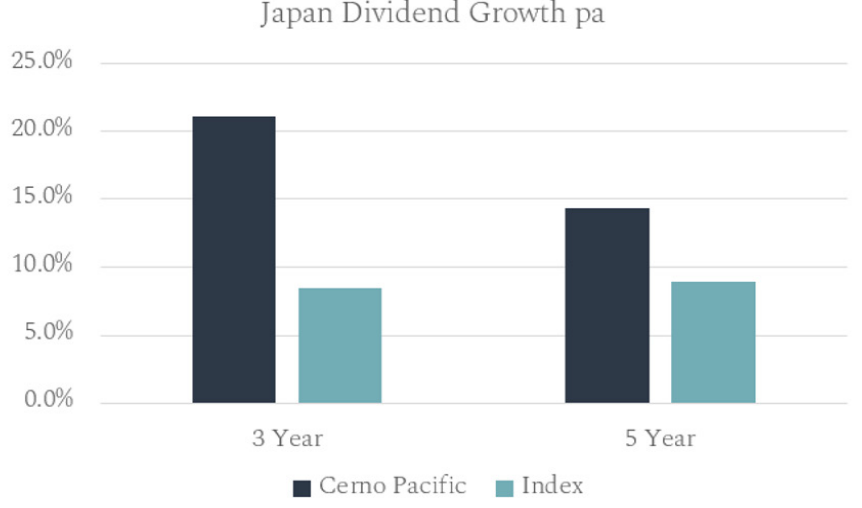

In Pacific, our focus on quality and management alignment means we do not own the types of companies being targeted by the TSE. Nevertheless, all corporates can see the way the wind is blowing. We would not be surprised to see reform proposals burgeon across the listed sphere.

Our search for resilience in the companies we own leads to significant potential for increased cash returns; the average net debt to equity ratio for our Japanese holdings is -32% (one third net cash).

Cross holdings reform is also gathering pace. This is not a governance feature we like to see in the companies we own, despite the strategic logic from a company perspective. It is particularly encouraging, therefore, to see action taken when the strategic logic wanes.

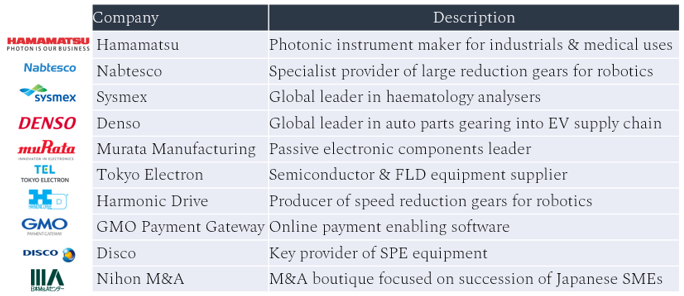

Denso, an enabler of the green transition in autos, has tended to use strategic shareholdings to foster research collaboration or support better relationships with clients. In JuneDenso announced that it had sold all US$116mn of its holdings in Suzuki Motor as well as 70% of its stock in Honda Motor (Nikkei). The new filing shows Denso holds stakes in 20 or so listed companies, half as much as 2019. The company has been duly rewarded by inves

Japan is the largest country weight in the Cerno Pacific portfolio at 33%. The companies invested already exhibit superior governance than the market at large. We would expect to continue to benefit from this characteristic as patient shareholders over the long term.

Source: Bloomberg

The Japanese holdings in Pacific are set out below:

This Journal is taken from the TM Cerno Pacific Investment Report Q2 2023.