By JAMES SPENCE

By JAMES SPENCE

Seven changes to the portfolio were made in the last quarter of 2021 and we profile these below.

Two holdings are leaving the portfolio and five are being added.

Cerno Global Leaders strategy is an entirely bottom-up investment strategy so these changes do not spring from any underlying macro views. The changes reflect work undertaken throughout the year. We can, though, surmise some inflection in views on a sectorial level as the two companies that are leaving are broadly engaged in health care provision and some of those joining are linked in some respects by either the acceleration of digitisation and the demand for precision tooling in the world economy. It should be noted, though, that many of the products of Thermo Fisher Scientific (an addition) are used in medical settings.

Once the re-alignment of the portfolio is complete, the portfolio’s holdings move from 24 to 27 companies, resulting in a little less concentration.

James Spence, Fergus Shaw, Fay Ren, Michael Flitton, Ion Sioras

Companies leaving the portfolio

Johnson & Johnson

Johnson & Johnson (J&J) has been held within the Global Leaders strategy for seven years. Over that time, it has generated a total return of 98% in USD against 96% for the comparator world index.

J&J has been an unusual position in the portfolio. An exception that proves the rule. It is a diversified conglomerate with a large pharmaceutical division. Both are characteristics we tend to eschew within the strategy. However, J&J is an unusual business with remarkable attributes based on its laser focus on market position.

The argument against conglomerates revolves around replicability and inefficiency. In our view, investors would struggle to replicate J&J through investment in comparable pure-play peers across Pharma, Med Tech and Consumer. Many aspects of the business are unique. For example, Pharma is diverse across many pathologies and is the largest player globally, measured by the number of blockbuster treatments (those that generate US$1bn+ revenue annually). Across the three business lines 75% of the products and services are number 1 or 2 in their respective markets. One would be downgrading by looking to replicate via competitors.

Where many conglomerates are inefficient, J&J has bucked the trend through its decentralised management structure. 200 unit heads are charged with delivering top 1 or 2 category positions for their product suite. Failure ultimately leads to the disposal of the business. This unsentimental portfolio management approach engenders alignment with shareholders and ensures efficient capital allocation. The outcome is a diverse business with relatively low earnings volatility, generating significant excess returns on capital.

The recently communicated decision to demerge the business into two prompted a reappraisal of the investment case. For, upon demerger, the choices would be to own two linked businesses – which makes little sense in a concentrated portfolio format or to select one of the two: a pure pharma business or a slower growth consumer product business. Pharma businesses, even those as well run as J&J, are a collection of hit-or-miss projects with limited predictive power attached to them. A track record of past successes are clearly helpful but no guarantee.

What we surmise in communications from the top-management around the announcement, especially outgoing CEO Alex Gorsky and incoming CEO Joaquin Duato is some impairment in the growth rate of the consumer product business due to the rise of B2C channels, expedited by online sales platforms. Consequently, management appears to see less ability in their portfolio approach to extract value from ongoing joint ownership given diverging growth prospects between the consumer and medical/pharma segments. This re-appraisal appears to be quite recent and possibly spurred by an acceleration of an underlying trend during the onset of Covid-19.

Also, there have been of mounting concerns about product litigation. Over the last few years, the company has faced a number of controversies, most significantly around alleged carcinogenic implications of talcum powder, although the connection is both rebuffed by the company and not supported by administrators at the US FDA. Nonetheless litigation rumbles on and payments are being made. While the scientific basis of the various cases appears equivocal, the company’s handling of the situation has been far from optimal. The recent decision to ringfence talcum liabilities in a Texas entity, which then declared bankruptcy, the so-called “Texas Two-Step”, risks appearing cynical in the court of public opinion.

Fresenius Medical Care

Fresenius Medical Care has been held in the Global Leaders portfolio since 2017. The company provides kidney dialysis care through a global network of clinics and the supply of equipment, principally dialysis machines and the consumables that accompany this critical care service.

Fresenius is the dominant international operator and, within the US, views with DaVita. Given it is both an equipment vendor and care provider, Fresenius has established its position as the leading integrated company supporting patients with renal disease.

Prior to the Covid-19 coronavirus pandemic, Fresenius has been focused on growth internationally by offering its services in developing markets which are experiencing increased cases of identified kidney disease accompanied by increasing ability to fund care systems. In addition, Fresenius was evolving its service to cater for home dialysis in developed markets which was increasingly sought by both patients and governments. The company’s growth strategy incorporated some degree of acquisition which resulted in taking on additional debt, however, the steady revenue streams associated with dialysis care provision alongside a focus on efficiency provided a clear pathway for debt reduction.

While Fresenius has performed well for its patients through the pandemic with no interruption to care provision, the company’s financial position has deteriorated. Patients have, in aggregate, suffered a higher mortality rate because of coronavirus. This excess mortality rate has continued to rise as a result of the Delta variant and might be expected to remain elevated as subsequent variants emerge.

The company must now manage its financial position carefully. This inevitably means management’s near-term focus is on cost control while revenue growth is likely to remain anaemic. Headcount is already in decline and further reductions have been communicated. The company has recently announced its 2025 strategy roadmap with a reduction in the cost base of €500mn annually taking centre stage. The balance sheet will become a point of contention as the net debt to equity ratio has reached a level which will make financing growth challenging.

Fresenius operates in a sector where ethical considerations are high profile. The company has a been successful in demonstrating good governance processes and procedures and shown a willingness to invest to counter threats – for example dialysis results in the need for effective water management processes and the move to home dialysis increases the challenge presented by water use. The current squeeze on revenues and emphasis on cost control increases the risk of less-than-optimal actions being undertaken in this area.

The growth outlook for Fresenius is currently muted given the state of the sector and the necessary focus of management on cost control. We are therefore exiting the position.

New additions to the portfolio

Adobe

Adobe is the third largest software company globally. Its name is synonymous with its most successful flagship product, Adobe Photoshop, originally introduced in 1989. It’s other flagship toolkit Adobe Acrobat, the PDF reader-editor first released in 1993, also remains the ubiquitous standard for electronic document distribution used by millions every day.

The company was founded by two computer scientists John Warnock and Charles Gescheke in December 1982, in Warnock’s garage (traditionally productive places in Silicon Valley). The pair co-developed Postscript, a programming page description language for laser printers that revolutionised the media publishing industry throughout the 1980s by enabling accurate translation of text and images from computer to print. It was Adobe’s first commercial product (Apple’s LaserWriter was its first adopter) and the predecessor to the PDF, in the same vein that it enables an electronic document to be transmitted and printed exactly as seen on the screen.

Almost four decades later, Adobe has become the established leader in creative and document productivity software, with no direct competitor of comparable scale on the market. The company has expanded its portfolio to offer over 50 products, housed under three core suites: Creative Cloud, Document Cloud, and Experience Cloud.

Creative Cloud, its biggest division (75% group sales) hosts Photoshop, Lightroom, Premiere Pro, and a collection of specialized applications for audio, graphics, and video content design and editing used by digital marketers and content creators. Document Cloud offers PDF reader-editor, digital e-signature, and other document productivity tools. And Experience Cloud, which includes a set of analytics, customer journey orchestration, content and workflow management products targeted at the B2B digital marketing industry.

Despite the successes of its earlier products, Adobe has continued to reinvent itself. Experience Cloud is a relatively new business that Adobe has been quietly building out since 2009 via a series of acquisitions. Now a US$3.5bn business, it represents a quarter of group revenues, and growing at over 20% per annum. It aims to capitalise on a new engine of growth with the explosion in digital marketing and e-commerce over the past decade, which the company believes could be a US$100bn addressable market (which would be more than twice the market Creative Cloud). Whilst not a first mover, it is establishing itself as a leader in digital experience management, with major brands becoming customers.

Source: Adobe

Source: Adobe

The company was an early mover in the software industry to complete its transition into the cloud and adopt the software as a service (‘SaaS’) subscription model. This had allowed them to virtually eliminate piracy, enable regular product updates over the cloud, and allow remote collaborative work on multiple devices. Financially, it allowed generation of steady recurring revenues (from lumpy sales prior), and the modular structure in all three suites also made it easier to cross-sell different products for multiple use cases, directly on its platform.

Adobe is one of a very few software businesses that embodies the triple attribute of growth, profitability and scale. It has grown revenues at +14% per annum and EPS at +23% over the past decade, with industry leading gross margin at 89% and operating margin at 45%, and sits on a net cash balance sheet.

The company sells globally and touches many industries. Its Creative suite is used by over 90% creative professionals worldwide and downloaded over 449 million times, its Behance online community has over 24 million members (to showcase work and find inspiration), and over 300 billion PDFs were opened in Adobe products over the past year. The market is also not limited to creative workers, Cerno Capital produces its quarterly factsheets within Adobe InDesign, for example.

With the digital ‘creator economy’ becoming ever more prominent, the amount of digital content is ballooning and will continue to expand particularly with accelerated investment in the metaverse and digital tokens, raising ever more need for Adobe’s tools can help to create and curate this content.

Techtronic Industries

Techtronic Industries (TTI) is the second largest global manufacturer of power tools and floor care tools. Its products are sold through 12 recognisable brands including Milwaukee and Ryobi in power tools, and Hoover and Vax in the floor care space.

The company has heritage in Asia, having been founded in Hong Kong in 1985 by Horst Julius Pudwill and Roy Chi Ping Chung. TTI’s history mirrors the technical development of much north Asian industry: migration up the value chain from outsourcer for Western incumbents to competitor. TTI began life lining up suppliers for Western brands, subsequently taking on the manufacturing side as an OEM, to eventually becoming owners of brands themselves (OBM).

The professional power tool market is dominated by American, German, and Japanese players. TTI was the first power tool company to set up a manufacturing base in China, competing with high-end makers who historically shunned ‘Made in China’ tools, opting for US or Japan made products for quality reasons. Their first big break came from Japan’s Ryobi brand in 1988, who commissioned TTI to make their tools and subsequently took a 20% stake in the company as a vote of confidence.

Another definitive deal that propelled TTI to global status was the acquisition of the Milwaukee & AEG brands from Sweden’s Atlas Copco (a Global Leader company) in 2005. Milwaukee now represents over 70% of TTI’s revenues and growing at over 20% per annum, much higher than the single digit industry average. The hiring of their current CEO Joseph Galli Jr. in 2006 was another significant decision. Mr. Galli built a reputation at rival Stanley Black & Decker for taking their DeWalt tool brand to global No. 1 player in the 1990s.

Innovation has also been a major growth driver: TTI generates 30-40% of its sales from new products every year and has expanded their tool portfolio from 100+ products to 450+ over the last 6 years. They were the first to introduce wireless tools, which has now become the industry standard, and with earlier experience as an OEM, TTI has the technical capability to research and develop core components in house, having extensive knowledge in brushless motors and battery techniques, compared to peers who tend to use third party componentry.

Globally, power tools is a US$60bn market, where 18 megabrands control over 90% share and the top 4 brands 50%. Since 2013 TTI has gained market share from the other global players, such as Bosch and Makita, rising to global No. 2 player after Stanley Black & Decker from No. 5.

The company demonstrated superior supply chain management during the Covid-19 lockdowns to put products on the shelves, growing 12.8% in the first 6 months 2020, further gaining market share as its competitors struggled. Its multi-brand approach is working well, the Ryobi line that targets the DIY market became a major beneficiary during the pandemic while professional trade slowed down.

TTI has a grown sales at +13% CAGR and net profit at +26% CAGR over the past decade, and is expected to continue growing at double digits over the medium term. It is expected to see positive re-opening demand, gearing into better economic activity such as construction and the prospective higher future infrastructure spending in the US, as well as geographic expansion into strategic growth markets.

Thermo Fisher Scientific

Thermo Fisher Scientific (TMO) is the largest, most diversified participant in the Tools sector. The company provides analytical instruments, consumables, and services to customers in the biopharma, academic, applies, industrial and diagnostic markets. Over time consumables and service revenue have come to dominate sales such that recurring revenues are now 70-80% of sales. This creates a durable, consistent revenue stream with significant pricing power. TMO has a global presence but is naturally tilted towards the US market (53% sales) given the dominance of US companies in global healthcare supply chains.

The company emerged from the 2006 merger between Thermo Electron (est. 1956) and Fisher Scientific (est. 1902). This was a complimentary merger in the classic sense. Thermo was a leader in lab equipment instrumentation and software, while Fisher was strong in reagents and consumables.

Through its products and services TMO is a central enabler of healthcare innovation. Its business spans the full breadth of the sector with participation throughout the value chain in each vertical. It is this uniquely expansive offering which has allowed the company to steadily grow market share over time.

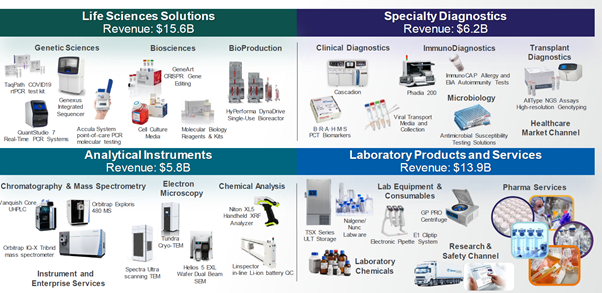

Source: Thermo Fisher Scientific

Source: Thermo Fisher Scientific

Just over one third of sales comes from Life Sciences Solutions. This division provides an extensive portfolio of reagents, instruments, and consumables used in biomedical research and the production of new drugs. Their capability extends from cell and gene therapy to CRISPR systems, PCR technology, gene sequencing machines, and end-to-end support for biologics production. Lab Products and Services, also just over one third of sales, is the core support service for labs. Anything needed for drug discovery and development, be that centrifuges, solvents or simply pipettes. The two smaller divisions both represent around 15% of revenues. Specialty Diagnostics offers a broad range of testing capabilities as the front-line service for clinicians. Finally, TMO’s Analytical Instruments division includes the full range of technologies, from mass spectrometry to liquid chromatography, as well as an expanded capability in CRO (clinical research organisation) services after the acquisition of PPD.

TMO is number 1 or 2 across most of its product offering. This quality, along with its unrivalled breadth, places it in a strong position as customers increasingly desire a one-stop shop in the supply chain. In this pursuit of breadth TMO has proven itself a highly successful acquiror and integrator of businesses. 50-75% of capital is earmarked for M&A, either in adjacent markets or where a bolt on asset would aid in the customer value proposition. US$39bn has been deployed on 68 transactions since 2012. Despite this high spending ROIC has advanced to 15% from 10% 5 years ago. The company has benefitted from lower interest costs, but improved asset efficiency and higher margins have been significant drivers. Despite its success, the market remains fragmented, and we see TMO’s role as a consolidator continuing to drive value.

Aside from M&A, TMO is exposed to significant organic growth opportunities. In the near term the group’s 50% market share in PCR testing and complex evolution of the Covid pandemic creates an ongoing tailwind. Beyond the near term the group’s total addressable market is expanding at 3-5% pa. Biopharma is the fastest growing area and TMO’s single largest exposure.

Tool companies like TMO benefit from rising complexity and the need for quality and accuracy. Emerging therapeutic platforms, catalysed by the declining cost to genome sequence, including cell and gene therapy, biologics, and mRNA hold the potential for a step change in growth. Inherent within the business model is a self-sustaining growth flywheel. As long as innovation and superior service continue to drive replacement cycles, which in turn drives the installed base, there is a durable revenue compounding effect from recurring revenues. This is evidenced in the 2 percentage point gap in revenue growth for the tool sector vs the S&P, which leads to an 8pp advantage in FCF growth.

In our ESG assessment we were impressed by the company’s efforts on diversity and inclusion. This includes a recently launched neurodiversity recruitment programme. TMO has been voted the best place to work for LGBTQ equality, best company for women, and one of the best places to work for dads. It is our observation that diversity is an indicator of a strong culture and core driver of future innovation.

Keysight Technologies

The testing division of Hewlett Packard was spun off in 1999 in what then was the largest IPO in Silicon Valley history. It created an US$8bn firm, Agilent, that encompassed testing and instrumentation across semiconductors, electronics, medicine and biochemistry.

The constituents of this spinoff are today worth a combined US$81bn split across two companies, Agilent and Keysight Technologies.

Agilent retained and expanded upon Hewlett Packard’s medical instruments and chemical analysis business whilst Keysight, formed in a subsequent round of demerging, inherited the electronic testing and instrumentation lines.

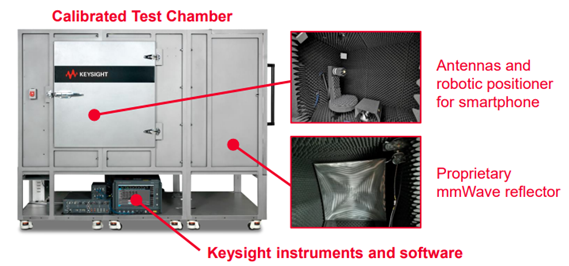

Keysight’s raison d’etre is its deep expertise across the electromagnetic spectrum. The firm offers turnkey solutions for the testing and validation of predominantly wireless systems and networks through the production and provision of relevant hardware and software for the task.

Historically the key customer base for such products has been the telecoms and communications sector and forms the bulk of Keysight’s revenues. Keysight is a supplier for all of the major telecoms equipment companies in the test and validation of their products and commands the largest amalgamated market share at 26 – 30% globally.

Source: Keysight Technologies

Source: Keysight Technologies

A focus on telecoms however belies the broad applicability of electromagnetic spectrum (EM) solutions. Keysight’s offerings in wireless communications extend to the design and testing of WiFi, Bluetooth and other NFC products and networks. Within radio frequencies Keysight is also an active provider of solutions for the testing, design and validation of radar systems, with both civilian and military applications.

The physics and solutions of the EM spectrum extend to visible and near visible light, where Keysight’s products such as high precision oscilloscopes and spectrum analysers are used in the design and testing of lidar systems and fibre optic networks.

Today Keysight is split into three main business lines. The Communications Solutions Group (CSG) makes up roughly 50% of revenues with the Electronic and Industrial Group (EISG) and Aerospace, Government and Defence Group equally contributing a remaining 25% each.

The company operates in 100 countries around the world with revenues split 40/40/20 across the Americas, Asia and Europe. The largest operator in its space, Keysight’s competitors are typically smaller, more specialised outfits (such as Japanese company Anritsu) or subsidiaries of wider industrial conglomerates (such as the US business of Teledyne LeCroy).

Keysight is arguably supremely levered into the deployment of 5G (and beyond) networks which form the core response to the increasing bandwidth requirements. In the same vein the wider wireless solutions are supportive of any IoT (internet of things) application coming to market today.

Across the rest of the EM spectrum Keysight is exposed to ADAS and autonomous driving, wireless charging, data centre and network capital expenditure and electric vehicle battery and charging systems, to name a few.

The firm’s position as a design and testing specialist that is customer agnostic also makes it an archetypal “picks and shovels” approach to accessing these themes.

The management team of Keysight have demonstrated good business sense in their growth of the company since becoming independent in 2014.

Within its fields of expertise, the company has focused on vertical integration to take full advantage of its superior market share and strong relationships. In telecoms for example Keysight has leveraged its experience to provide modelling and design capabilities for the simulation of networks and components at a pre-production stage.

The company is also a partner for all of the top 10 telecoms operators and has assisted them in the test and validation of 3, 4 and 5G networks over the past two decades. This offering has become increasingly valuable at each incremental wireless network generation in alleviating accelerating development and deployment costs.

As a corollary of achieving this vertical integration, the firm has also incrementally rebalanced its business mix from a reliance on lower margin hardware manufacture to the software required to provide such specialised solutions.

From near zero in 2014, 30% of total revenues today come from software and 20% are recurring revenues. The ultimate expression of this ambition has been Pathwave, Keysights integrated software suite that captures the entire workflow of system development from prototyping and simulation to manufacture and testing.

Both of the above, and the expansion of market share in growth areas, have been achieved through a regular but disciplined acquisition record. Highlights include (in order of size)

– The acquisition of Ixia, a leader in wired and wireless network testing and visualisation for US$1.6bn

– The purchase of Anite plc, a British company supplying testing and analytics software to the global wireless market for £388mn

– Acquiring Eggplant from the Carlyle Group for US$330mn. Eggplant is a software testing design and automation company specialising in enterprise customers.

We think that Keysight represents a strong candidate for accessing the multiple high growth themes discussed while being dominant in the established Communications sector, which is expected to exhibit secular growth into the intermediate future.

The firm assists with integral points of a products lifecycle (design, validation, testing) while capturing a small part of the total value chain. With an average ROIC of 16% per year since the firm’s inception, Keysight has demonstrated a successful and attractive business model in the provision of these services.

Rockwell Automation

Rockwell is the largest, pure-play company in the realm of industrial automation. The company defines its core competence as developing processes to eliminated or reduce repetitive manual processes/tasks in an industrial environment or application through the substitution of labour with capital. As such it is tightly aligned with one of the strongest long-term themes in modern, global capitalism and a favoured theme of the Global Leaders strategy. Rockwell left the portfolio for a brief period in 2020-21 at the time at which we ran a very conservative balance sheet and screened out a small number of companies with relatively higher balance sheet leverage at the beginning of the COVID pandemic when the financial authorities’ responses were not known. Since then, we have reassured ourselves as to the financial strength of this enterprise.

The company’s antecedent enterprise was founded in 1901 by Lynde Bradley who invented the compression rheostat, which is used to control the speed of electric motors. He was joined by Stanton Allen and in 1909 they incorporated the Allen-Bradley company. The group entered a hyper growth phase in the 1920s as the radio became the dominant entertainment and information device. Prior to WW2, the company had considerable success with solenoid starters and fixed resistors and in that war, its components were deployed widely in supporting industries. In the middle part of the 20th Century, Allen-Bradley components were fundamental to the worlds first few generations of computers, the television set and NASA built rockets and capsules.

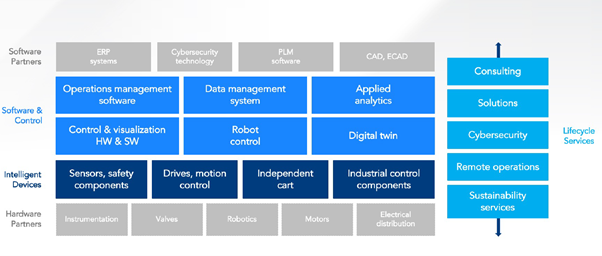

In 1995, Allen-Bradley merged with Rockwell International and the company renamed itself as Rockwell Automation in 2001. Fast-forwarding to today, the biggest single change to its offering is the build out of complimentary software (44% of sales) wrapped around its long-standing competences in componentry and hardware. Rockwell is cited as one of the best 50 places to work for innovators by Fast Company and one of the world’s most ethical companies by Ethisphere.

Source: Rockwell

Source: Rockwell

Its product offering can be understood as bridging 5 key areas of the operations of the modern, multi-national enterprise.

- Networks and security services

- Product and application lifecycle support

- Remote monitoring and cloud analytics

- Asset management and reliability services

- People and asset safety

Rockwell reports estimable returns on assets and invested capital of 15.1% and 28.3% respectively (data from Morningstar) backed by a strong margin structure. Net margin is estimated by UBS to be 15.8% in the year ended September 2021. Rockwell’s translation of sales into cash and transparency on this measure provides a degree of comfort with respect to its gearing ratio of 1.2:1 (debt/equity). In the event that no substantial acquisitions were to take place in the current financial year, this ratio should further moderate to 0.8:1. Free-cash flow conversion runs in excess of 100%.

Future growth opportunities are provided by the further extension into Software as a Service (SaaS), the electric vehicle ecosystem, cyber security and sustainability in all its guises. We see Rockwell as having a glide path toward US$10bn in annual sales in the next 5 years (current sales US$6.9bn).

Rockwell’s closest competitor is probably Siemens, although Siemens’ comparable activities are buried within a wider conglomerate structure. Rockwell is rated by Sustainalytics as being in the 9th percentile within its industry group (Electrical Equipment) on ESG measures. Rockwell targets net carbon neutrality by 2030.