By OSCAR MACKERETH

Introduction

Few pharmaceutical advancements in recent memory have garnered as much attention as glucagon-like peptide-1 receptor agonists (GLP-1RA). These drugs, initially formulated for diabetes treatment, have emerged as powerful treatments for obesity and addictive tendencies, resulting in speculation on their potential for improving public health and the future of the healthcare and fitness markets. However, there are obvious concerns in several consumer sectors as to their potential to disrupt consumption patterns.

To date the following national medical authorities have approved their use for remedial treatment for obesity: European Medicines Agency, U.S. Food and Drug Administration, U.K. National Institute for Health and Care Excellence, Health Canada, Australian Therapeutic Goods Administration, Japanese Ministry of Health, Labour, and Welfare, as well as several others in Asia, Latin America and the Middle East.

The redeployment of the group of drugs has had significant consequences for the equity value of both pharmaceutical companies engaged in their manufacture and food companies that have been deemed to be negatively impacted by curtailed consumption of their products.

For example, in 2023 the market capitalisation of Novo Nordisk and Eli Lilly have risen by US$362bn in aggregate (Novo moved from being a US$308bn company at the beginning of the year to a US$453bn company by year’s end and Eli Lilly from US$365bn to US$583bn.

By contrast, US$63bn market capitalisation has been shaved off the following four companies: Inspire Medical Systems, Pepsi Co, Kellanova and Coca-Cola.

GLP-1RA

GLP-1RA are large-molecule biologics drugs which replicate the action of the natural hormone, GLP-1. GLP-1RAs bind to the GLP-1 receptors and stimulate insulin secretion, reduce glucagon secretion, slow gastric emptying, and decrease appetite. These processes counteract the underlying mechanisms of diabetes by preventing insulin resistance and glucose overproduction-based hyperglycaemia, preventing postprandial spikes in blood sugar levels.

The first GLP-1RA to be discovered and approved for clinical use was exendin-4[1], first identified in 1992 by Dr John Eng, a veterinarian researcher in New York, who isolated the hormone from the saliva of the venomous lizard – the Gila Monster. Exendin-4 was patented in 1995 and licensed to Amylin Pharmaceuticals in 1996, who partnered with Eli Lilly & Co to develop and market it as a diabetes treatment. Soon after, it was developed into a synthetic peptide called Exenatide, which received FDA approval as a diabetes medication in 2005 and is still in use today through the Byeetta[2] and Bydureon[3] formulations.

The Gila Monster

The Gila Monster

GLP-1RA drugs were first identified as having weight loss potential in 2010[4] in animal studies, which were reinforced in a 2012[5] meta-analysis. However, it wasn’t until Novo Nordisk’s clinical trial of Semaglutide, that the public attention was captured. The trial[6] sought to demonstrate the efficacy and safety of Semaglutide as a long-acting pharmaceutical aid to reduce body weight and improve metabolic outcomes in people with obesity. The 68-week randomised, double-blind, placebo-controlled trial[7] ran across 129 sites, in 16 countries. All 1961 participants were non-diabetic adults with a BMI of 30+ or 27+ with weight-related conditions, who had previously failed to lose weight via diet. Both groups were prescribed a 500-calorie deficit per day diet, 150 minutes per week of physical activity and either a Samglutide or placebo dose.

81.1% of all participants adhered to the treatment which resulted in an average reduction of 14.9% (15.3kg) of body weight, versus -2.4% (2.6kg) for the placebo group. The Semaglutide group also demonstrated greater improvement with respect to cardiometabolic risk factors and physical functioning, with 84.1% reverting to normoglycemia, relative to 47.8% of the placebo group. The study found that weight loss via Semaglutide was driven by a reduction in energy intake from similar mechanisms to those which are useful in diabetes treatment – the slowing of gastric emptying, increased insulin resistance and glucose regulation.

However, importantly, results also showed a significant reduction in energy intake due to decreased appetite, which the authors stipulated was a result of GLP-1RA interacting with those receptors which are present not just in the gut, but also in the brain, which are associated with appetite regulation and reward recognition.

The magnitude of these results fuelled public enthusiasm. By June 2021, Novo Nordisk received FDA approval for Wegovy (Semaglutide), as a weekly injection for chronic weight management solution for adults with obesity or overweight with related conditions. Almost immediately, Wegovy was in global shortage, driven by extreme demand, and supply shortages driven by issues such as COVID-19, the Suez Canal blockage, limited raw materials and insufficient manufacturing capacity. In addition, Ozempic, a lower-dosage Semaglutide formulation designed for diabetes, also faced shortages as individuals increasingly sought off-label[8] alternatives. Novo has rapidly sought to rectify the issue through controlling demand through measures such as patient prioritisation, prescription limitations, restriction of off-label use, allocating quotas to different markets, and aggressive investment into additional production capacity. The business has also engaged a second Contract Manufacturing Organisation to initiate production[9]. At time of publication, all Novo Nordisk GLP-1RA formulations are in shortage, with the supply issues expected to last until mid-2024[10].

Market reaction

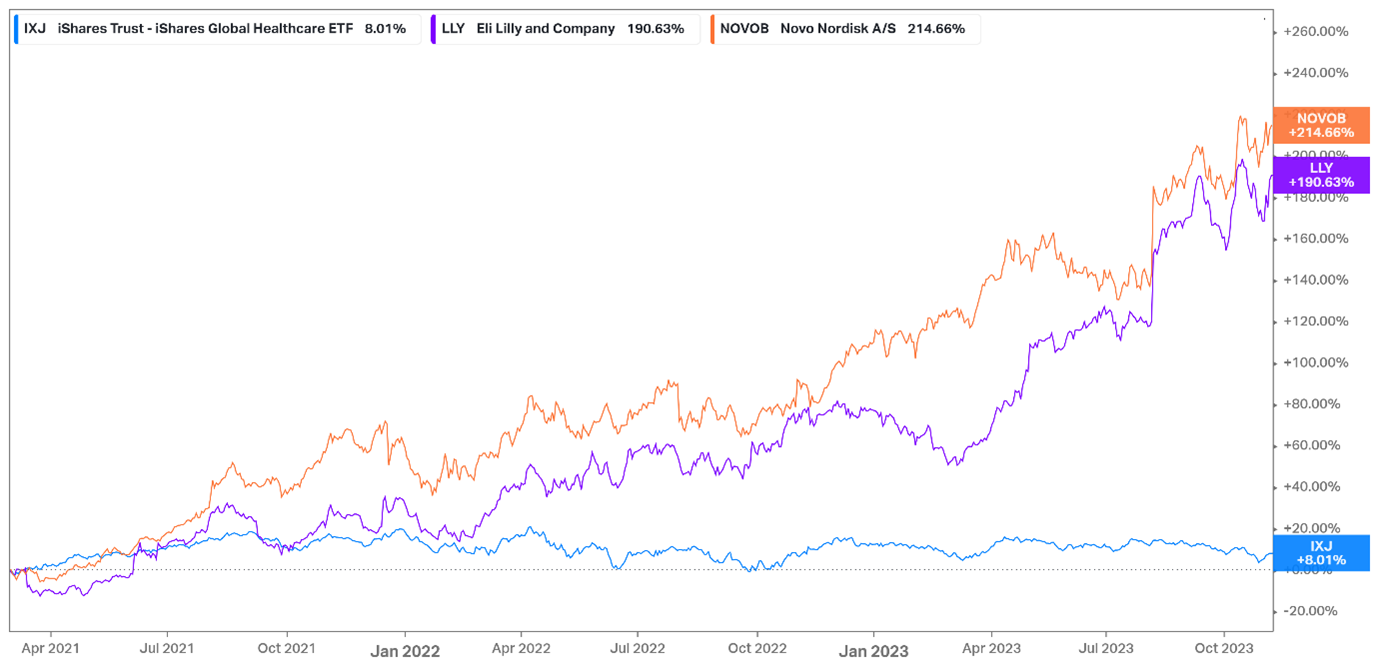

GLP-1 producer outperformance over global healthcare: March 21 – November 23

GLP-1 producer outperformance over global healthcare: March 21 – November 23

The public fervour around and extensive press coverage of these new drugs has been well observed by Cerno Capital. Primary beneficiaries have been Novo Nordisk, producer of Semaglutide-based Ozempic and Wegovy, and Eli Lilly, producer of Tirzeptide-based Mounjaro. Mouranjo, is a dual-action formulation, containing GLP-1RA, as well as gastric inhibitory peptides. Whilst it has already received FDA approval for Diabetes treatment, recent trial results indicate superior performance to Wegovy in both weight loss and blood sugar control[11].

Since the publication of the Semaglutide study in March 2021, Novo Nordisk’s share price has risen 192% and Eli Lily’s 174% with their Price-to-earnings ratios expanding from 24.9x to 42.2x (69.5%) and 32.3x to 68.2x (111%) respectively. Their combined market capitalisations have grown during that time from US$355bn to US$921bn, representing US$566bn in capital gain. Over the same period, the wider global healthcare industry has been relatively stagnant, as large-cap pharmaceutical businesses slowed post-COVID. Reverse DCF analysis suggests an expected EPS CAGR of 18% for Novo Nordisk over five years. for Novo Nordisk and Eli Lilly to be fairly valued at these levels, they would need to register revenue CAGRs of 24.7% and 32.4% respectively over the next 10 years.

The economic burden of obesity

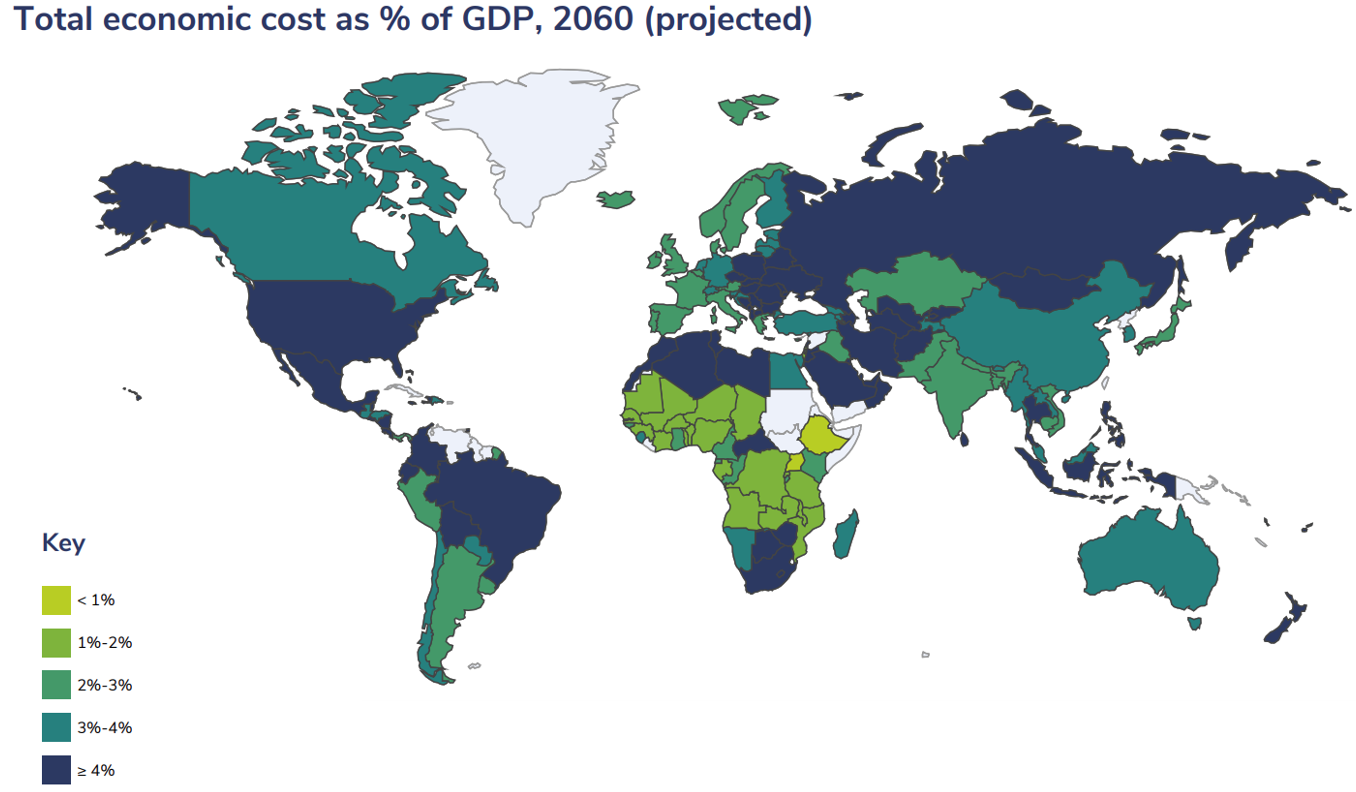

Total economic cost of obesity as % of GDP (2060 projected) [12]

Total economic cost of obesity as % of GDP (2060 projected) [12]

To consider the rationality of such aggressive forecasts, it is prudent to consider both the scale of the problem they propose a solution to, that being cases of obesity and weight-related health problems, as well as their ability to adequately address those issues.

The global impact of obesity and weight-related health implications are multifaceted and manifest in direct economic costs, secondary opportunity costs and social contexts. National economies are burdened through both escalating healthcare expenditure and productivity restrictions, creating drags for businesses and national economies alike. Moreover, the social experience of those burdened with such conditions is riddled with stigma and emotional strain.

As a result of the size of the issue, the global weight loss and management industry, which includes dietary, fitness and medical procedures and products was valued at US$224bn in 2021[13]. Yet, it is characterised by inefficiencies and has failed to offer enduring or efficacious solutions. The number of people suffering from obesity globally has risen by 929%, from 100 million in 1975 (2.5% of the global population)[14] to 1.03 billion in 2022 (13.0% of the global population)[15], resulting in a global cost of US$2 trillion per year, averaging at ~2.19% of GDP per country per year[16]. The number of people forecast to be obese by 2035 is 1.9 billion (21.4% of the global population), with related expenses projected to rise to 3.29% of GDP on average in 2060[17].

It is not that all weight reduction and management products and procedures are totally ineffective. Research has shown that rapid weight loss, utilising a variety of non-invasive approaches can be successful. However, over 80% of individuals who do succeed in initially reducing their body weight regain weight after 1 year, rising to 85% over 2 years and 95% over 3 years[18], with most regaining more weight than was initially lost[19]. However, those who successfully maintain weight loss over 2 years have a higher chance to maintain that weight loss over long time horizons[20]. This is likely due to the fact that long-term weight loss and maintenance require long-term behavioural changes in order to avoid falling into the historical behavioural patterns which caused the initial weight gain. Companies which offer services which target short-term results, such as calorie restriction plans and meal alternatives are as such, targeting temporary results. A lack of post-diet care means that as soon as the individual stops restricting their calorie intake, they will regain weight. As such, it is no surprise that every year, nearly 50% of American adults attempt to lose weight[21].

Against this backdrop, GLP-1RA drugs acquire significance. They have demonstrated substantial potential to disrupt these norms which are fraught with economic and social complexities. These drugs not only promote weight loss through slowing gastric emptying but encourage behavioural changes through inducing feelings of fullness and reducing appetite through interaction with neural reward systems. There are even early indicators that through interacting with brain-based GLP1 receptors, which are responsible for the signals which reward addictive behaviours, that these drugs could offer additional benefits to the 20% of adults who are addicted to food[22], or the ~40 million people dealing with some form of addiction[23].

Animal spirits

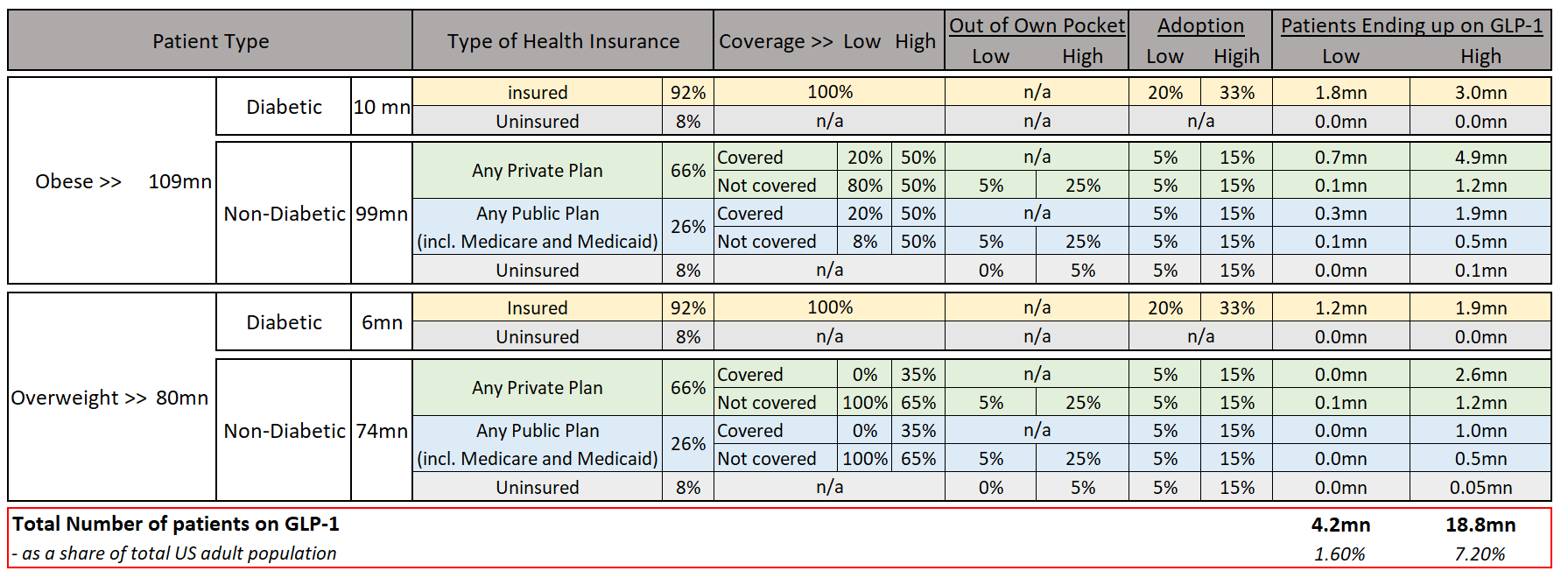

Nearly half of the US adult population technically qualify for GLP1s, according to Wegovy’s prescription guidance[24]. Unsurprisingly, optimism for the value-generation potential of these drugs within the healthcare space has been tangible with market participants simultaneously becoming acutely aware of their potential for disruption.

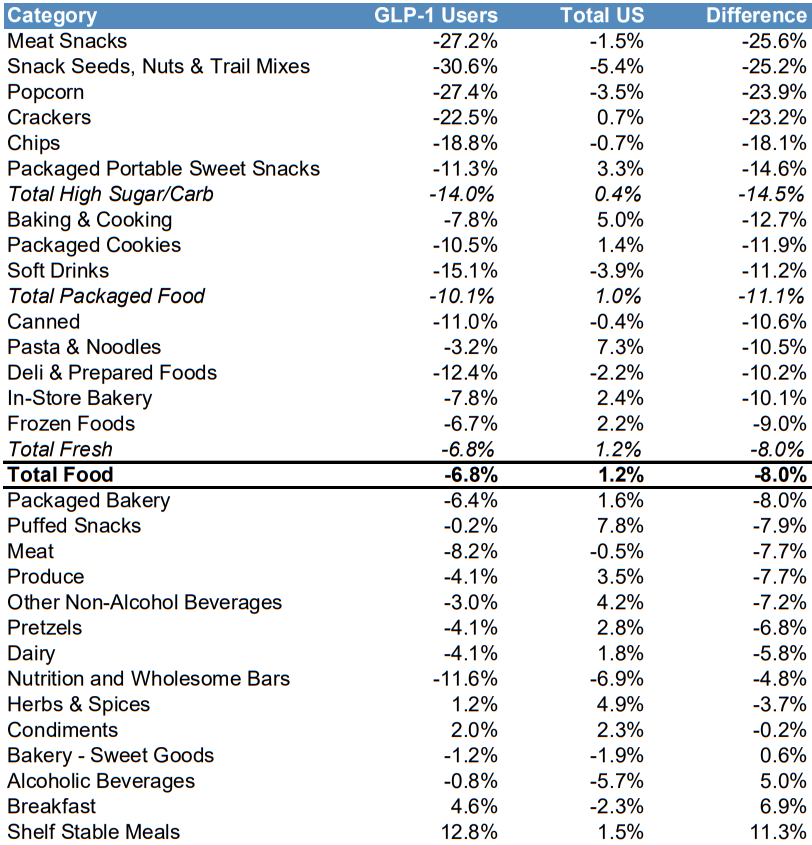

Alongside the clinical evidence presented by Novo & Lilly’s compound trials, evidence has been mounting of the real-world change in GLP1RA users, with data demonstrating a 6.8% reduction in total food consumption on average, compared to a 1.2% increase for the average American. This data has been widely reported, with major publications such as the Washington Post printing emotive headlines such as: ‘Food, clothing, airlines: Ozempic is coming for these industries and more’[25]

Unsurprisingly, these narratives have brought about a period of significant volatility across a range of industries, with related businesses pricing for the scenario of maximum GLP1RA adoption.

In this hypothetical future, GLP ‘losers’ of the first order will be those with products which will become less appealing to consumers through the pre-emptive stimulation of the GLP receptors. Thus, consumer discretionary and staples sectors, which include food, beverage and tobacco producers and retailers have performed poorly relative to local and global markets. For example, on the 17th of October 2023, Eli Lilly generated a flurry of headlines Tirzepatide met late-stage trial goals. The same day, analysts at Goldman Sachs forecast a 2030 GLP market value of US$100bn.

Consequentially, global hedge funds sold consumer staples in October at the fastest rate of the past five years, with short-sales outpacing long-buys in a ratio of 4:1[26]. In response, GLP drugs were referenced during earnings calls over 100% more during the quarter than the year prior[27]. By month end, several large cap U.S. consumer staple organisations, usually characterised as defensive, had fallen ~10%.

GLP ‘losers’ of the second order would be those companies whose products and services would reduce in value or necessity in a peak GLP1RA adoption scenarios. One example would be the MedTech sector, in which many participants offer products and services which treat both obesity and its related ailments. Despite a plethora of growth avenues which are unrelated to Obesity and generally strong fundamentals, the U.S. Med Tech sector has declined ~23% between August and November 2023, as markets priced in a worst-case scenario, defined by ‘fear and doubt’[28].

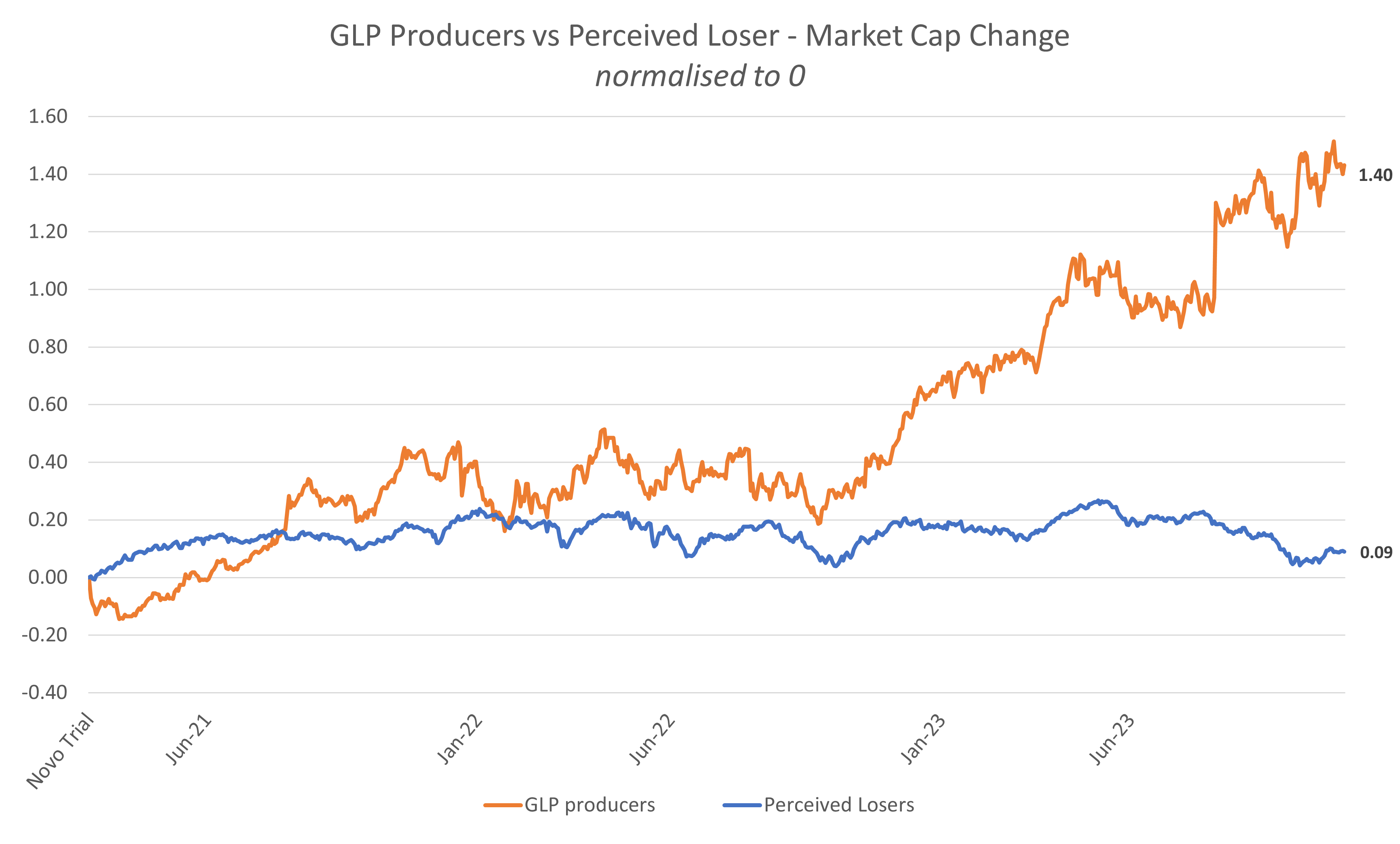

GLP-1 producers & perceived losers: Market Cap [29],[30]

GLP-1 producers & perceived losers: Market Cap [29],[30]

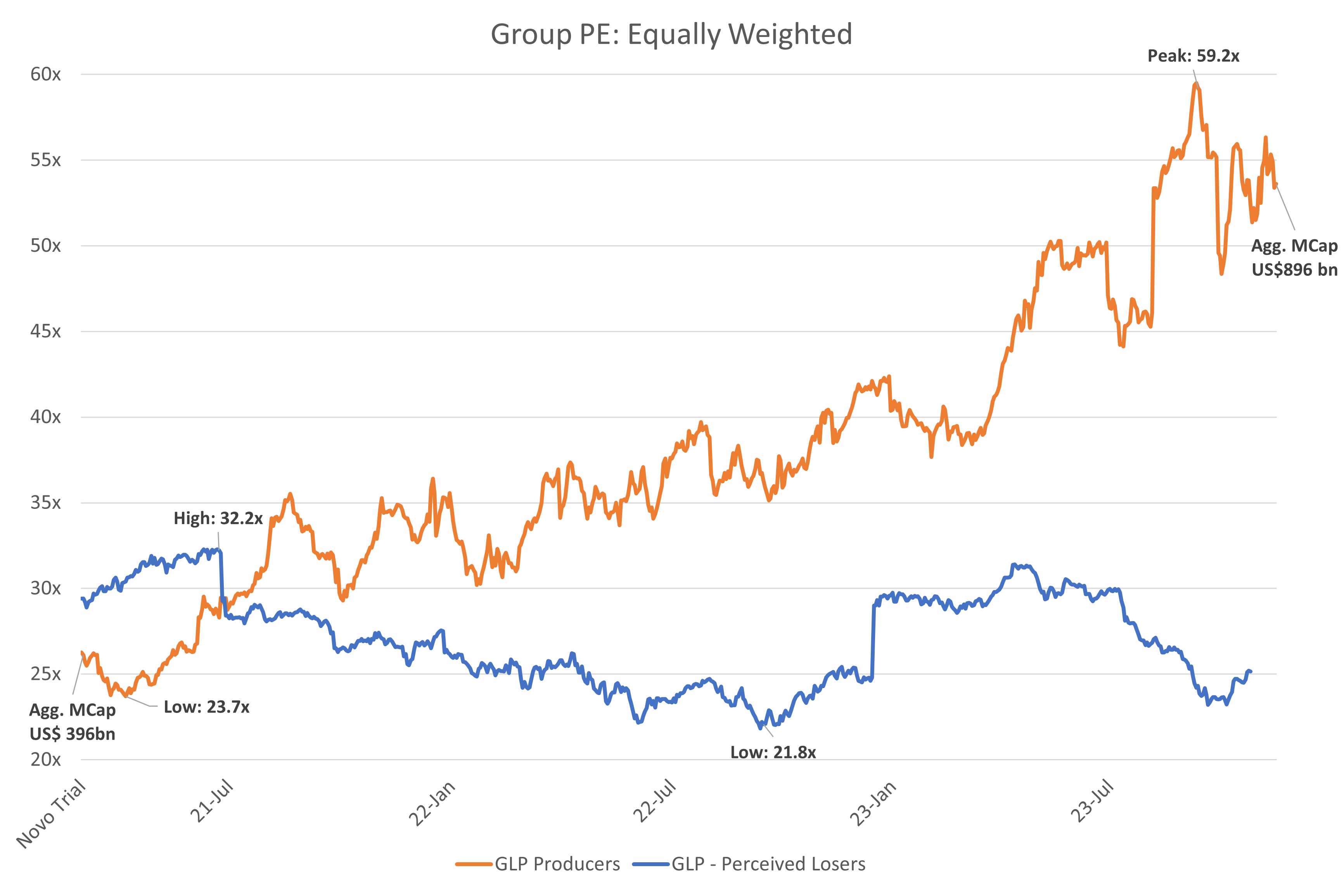

GLP-1 producers & perceived losers: PE progression

GLP-1 producers & perceived losers: PE progression

However, whilst the market response to GLP progression, demonstrated in the positive pricing action in the drug producers, as well as the negative in potentially disrupted industries was decisive, management responses have been far less clear. Responses ranged from refusal to speculate[31], speculation of mass savings[32], tangible shifts in consumer purchasing patterns[33] opportunities to develop companion products[34], and expanding TAMs[35].

Cerno opinion

The social and commercial consequences of these compounds clearly have vast potential. Market participants have congregated into a consensus opinion on the future of the healthcare sector defined by duopolistic perspectives. Primary GLP organisations (the drug producers) have been priced for the most optimistic outcome. At the same time, those businesses with secondary exposure have been priced for severe, immediate, and enduring disruption to the public demand profiles which fuel their long-term operational and financial profiles.

The rationality for such perspectives is not difficult to understand. Any national or international reduction in obesity rates will be positive for productivity levels, reduce weight-related burdens on the healthcare systems and government social spending requirements, and is likely to be of net benefit to the consumer’s quality of life. As such, it is easy and perhaps comforting to envisage a future defined by maximum consumption of these compounds, mass reduction of obesity and a severe reduction in demand for those businesses which supply obesity-facilitating goods and services which treat the symptoms.

Holdings in the Cerno portfolios have not been immune to such animal spirits. Nestlé[36] is trading near three-year lows as investors weigh the potential change in food consumption patterns for its frozen food and confectionary categories. Zimmer Biomet[37] is trading near one-year lows as investors articulate concerns over reduced demand for orthopaedic procedures, which are often related to obesity-related joint and bone conditions. Renishaw[38] is also trading at multi-year lows due to concerns over demand for sleep apnoea devices in a post-obesity world.

We believe that whilst these observations are valid and the GLP advent will certainly be relevant for these sectors, several factors will likely pose headwinds for some of the anticipated scenarios.

The primary counterfactual is that without maximum adoption of GLP-1RAs in their most efficacious long-term clinical doses, the impacts of the drugs will be less severe than forecast. The accessibility of these drugs is a key barrier to adoption, with the challenge coming down to two key factors.

Firstly, the sheer number of people who may benefit from them and who would pursue treatment. In the USA alone, 40% of adults are obese and may be eligible for a course of treatment, if current prescription eligibility remains in place. By the end of CY22, on-label prescriptions for GLP-1RA-derived obesity treatments hit 9 million[39] and excessive global supply and improper manufacturing processes[40] drove global supply chain issues which resulted in large proportions of diabetes patients being unable to fulfil their prescriptions.

Globally, Obesity affects more than 764 million people[41], exacerbating the issue once international penetration begins to accelerate. Secondly, is the issue of cost. Novo Nordisk’s Wegovy has a list price of over US$16,000 per year. Consequentially, should J.P. Morgan’s forecasts for GLP uptake materialise in the U.S., the total cost of the compounds would amount to roughly US$50bn or 10% of 2021 US outpatient drug spend[42]. Naturally, a broad-based reduction in obesity rates would drive greater savings in the long term, with estimates of US$700bn over 30 years[43]. However, due to the long-term nature of obesity-related ailments, it would be several iterations of clinical treatments before those savings could be realised. For example, if only 10% of USA’s Medicare participants took the medicine, it would cost ~US$27bn per year. Currently, Medicare is legally barred from paying for weight-loss drugs, under the proposition that obesity is a lifestyle choice, rather than a medical condition. Whether this and other insurance regimes will change, will likely depend on the ability of supporters to highlight the treatment reduction in weight adjacent ailments and the ability of those regimes to handle the short-term expenses for long-term benefit. The situation will likely change in the future, given investment into more robust supply chains, and a reduction in pharmaceutical costs due to operating leverage and greater competitive forces. However, without wider acceptance and coverage, full penetration is unlikely in the medium term.

Secondly, is the question of adherence, as much of the market analysis, including that done in this paper, works on the presumption of a supply deficit. In the clinical studies published by Novo Nordisk and Ely Lilly, discontinuation rates were largely driven by adverse gastrointestinal events, such as nausea, diarrhoea, vomiting and constipation, which led to discontinuation rates of 5.1% and 9.9% respectively. However, a recent meta-analysis[44] retroactively studied the real-world adherence[45] and persistence[46] of nearly 13,000 obese adults with type 2 diabetes who were prescribed GLP-1RA and reported poor persistence at 2 years, compared to other less invasive glucose-lowering agents (48.8% vs 72.7%). Type 2 Diabetes, unlike Obesity, requires permanent treatment after hypoglycaemia has been initially addressed, giving greater rationality to the persistence of these patients. Whilst no analysis on the causes of non-persistence or adherence was given, analysts have pointed to unpleasant side effects and formulations[47] as a likely cause. Therefore, it may be reasonable to assume similar or elevated levels of non-persistence in obese patients who are prescribed the drug. Given that most Semaglutide trial participants regained nearly two-thirds of weight lost the in the year after the conclusion of the trial[48], a high likelihood of non-adherence and persistence in obesity patients raises questions on the feasibility of a GLP-facilitated obesity-free future.

Secondly, is the question of adherence, as much of the market analysis, including that done in this paper, works on the presumption of a supply deficit. In the clinical studies published by Novo Nordisk and Ely Lilly, discontinuation rates were largely driven by adverse gastrointestinal events, such as nausea, diarrhoea, vomiting and constipation, which led to discontinuation rates of 5.1% and 9.9% respectively. However, a recent meta-analysis[44] retroactively studied the real-world adherence[45] and persistence[46] of nearly 13,000 obese adults with type 2 diabetes who were prescribed GLP-1RA and reported poor persistence at 2 years, compared to other less invasive glucose-lowering agents (48.8% vs 72.7%). Type 2 Diabetes, unlike Obesity, requires permanent treatment after hypoglycaemia has been initially addressed, giving greater rationality to the persistence of these patients. Whilst no analysis on the causes of non-persistence or adherence was given, analysts have pointed to unpleasant side effects and formulations[47] as a likely cause. Therefore, it may be reasonable to assume similar or elevated levels of non-persistence in obese patients who are prescribed the drug. Given that most Semaglutide trial participants regained nearly two-thirds of weight lost the in the year after the conclusion of the trial[48], a high likelihood of non-adherence and persistence in obesity patients raises questions on the feasibility of a GLP-facilitated obesity-free future.

The secondary counterfactual to consider is the likelihood that, even if a maximum adoption scenario materialises, one should expect quality companies and management teams, such as those found in Cerno’s Global Leader and Pacific portfolios to pre-emptively adjust to the parameters of the new consumption environment and capitalise on new avenues of growth. This can be demonstrated through each of the previously referenced holdings.

ResMed, the largest supplier of sleep apnoea devices, a holding in the Pacific portfolio, has derated near two standard deviations from its 5 year mean forward price-to-earnings ratio of 33.7x to a low of 18.3x, due to fears that approximately two-thirds of obstructive sleep apnoea sufferers are overweight or obese, with studies demonstrating a linear relationship between weight loss and symptom reduction. Thus, projections of a GLP-dominated future result in simple extrapolations of Sleep Apnoea equipment redundancies.

However, these expectations are hypothetical in nature. ResMed has reported little to no change in PAP adherence or resupply programs for those patients also undergoing GLP treatment, indicating a stable cohort of patients on combined therapies. Moreover, the sleep apnoea market remains largely unpenetrated, with 936 million sufferers estimated in 2015. Resmed, the global leader in Sleep Apnoea treatment, reports only 20 million users of its AirView System. Thus, in a hypothetical GLP1RA-driven eradication of the 2015 obese PAP base, the total number of global sufferers would still be 312 million, 15x more than ResMed’s current customer base. ResMed maintains a forward-looking epidemiology model for the core sleep apnoea market which, utilising aggressive GLP uptake scenarios, projects the number of sleep apnoea sufferers grow from ~900mn to 1.4 billion people in 2050. Thus, given the low penetration rates of the treatment currently, despite slowing condition growth due to potential obesity avoidance, ResMed and its peers still have ample opportunity to out-grow it’s TAM in the long term.

Similarly, Nestle, globally associated with confectionary items, such as KitKats, HotPockets and Haagen-Dazs Ice cream is trading near two-year lows as investors weigh the potential impact of GLP-1RAs on food spending patterns. Pricing has been particularly volatile after Walmart’s U.S. branch CEO noted a pullback in food consumption in GLP participants.

Goldman Sachs: Average changes in consumption patterns for GLP1RA users, vs USA average

Given that data has demonstrated a -14% reduction in high sugar/carb consumption from GLP-1 users and Nestle’s confectionary portfolio contributing ~9% of FY22 sales, the reaction is understandable. Other exposed segments include dairy and ice-cream, and convenience meals & cooking aids which represent a further 12% and 13% of FY22 revenue respectively. However, the impact is likely to be highly variable between product lines and with varying levels of drug uptake. For example, whilst ice cream consumption will likely decline with GLP users, research data has demonstrated a substantial increase in consumption of protein-rich foods, such as yoghurt, as people look to offset lost muscle mass[49]. Health-focused products such as Nature’s Bounty and Boost are likely to benefit as consumers look to offset lower calorie diets with a sufficient nutrient profile, likely achieved through a balance of dietary modification and supplementation.

In addition, Nestlé CEO Mark Schneider[50] recently noted that the group is working on developing additional ‘companion products’ for people who use weight loss drugs, to ensure a nutritionally complete diet, retain lean muscle mass and prevent immediate weight rebound in the likely scenario that they eventually stop their regular prescription. These may go to market as soon as CY24 and should offer additional growth avenues, alongside the tailwinds granted to existing lines such as the ‘Lean Cuisine’ frozen meal brand.

Finally, Zimmer Biomet, the global leading producer of orthopaedic reconstructive devices over the past year has been exploring the impact of GLP1RA compounds on medical device adoption, representing one of the first endeavours to do so outside of the diabetes sector. Four broad conclusions from the assessment[51] can be drawn. Firstly, whilst obesity is a causative factor for osteoarthritis, the two states do not have a linear correlation, meaning that osteoarthritic degradation is not reversed by weight loss. Consequently, there has been no attributable change in the current TAM with the recent uptake of Ozempic. Secondly, patients with a BMI of 40+, classified as severely obese, are at risk of post-operational complications, with ~400%, ~400% and ~200% increases in the probability of prosthetic joint infection, wound dehiscence, and revision surgery requirements respectively. Consequentially, many institutions require patients who have a BMI of less than 40 to proceed with large joint procedures, making a reliable methodology for treating severe obesity a growth vector for Zimmer Biomet’s addressable market. Thirdly, obesity is not the sole cause of osteoarthritis. Management has identified the prescription of increasing activity levels among GLP patients as a potential cause of more sports-related injuries. Small body size and improper nutrition as a result of excessive dieting are also causative for bone degradation, which may be exacerbated by GLP1RA mechanisms. Lastly, Zimmer Biomet points to the 500% increase in bariatric sleeve surgeries in the US between 2011 and 2021. The procedure is medial efficacious but has failed to slow the growth of obesity and joint replacement therapies, which have grown at ~2% and ~5% CAGR over the same period. Whilst bariatric surgeries are more invasive than GLP-1RAs, they similarly have significant label, cost, and side effects, require ongoing treatment to maintain weight loss, and have presented no evidence of OA reduction. As such, there is little historical evidence to suggest that a new methodology for obesity reduction will reverse net obesity rates and obfuscate Zimmer’s business. Counterintuitively, the evidence suggests a reduction in the most severe cases of obesity would be a net positive. Thus, GLPs will likely only impact the demand profile at a point of maximum adoption, at which they serve as a preventative measure for the broader population ever becoming overweight to the point of osteoporosis, rather than being used as a reactive treatment. Despite this, Zimmer Biomet’s share price declined 29% between July and October, evidencing the sentiment of ‘fear and doubt’ defining the market and any stocks associated with the GLP impacts.

As such, whilst these segments of the portfolio have been negatively impacted by speculation on the impact of GLP-1RA drugs, our conviction in the investment thesis remains the same. Market participants have priced these businesses through a lens of dependence on cyclical patterns of over-consumption and their treatment of the corresponding ailments for revenue generation.

Conversely, minimal consideration is being given to the multiple headwinds for GLP penetration. Despite the prevailing sentiment of fear and doubt, each of these case studies have demonstrated the benefits of a portfolio of quality equities. All are beneficiaries of deep growth trends which are structural in nature and unlikely to be derailed through new market forces. The companies are also generally sufficiently diversified in geography, product, and demand forces, that lessening demand in any one segment can be counteracted by increasing investment into others. Finally, and likely most importantly, quality businesses are led by forward-thinking and experienced management teams who can reliably guide their businesses through periods of market turbulence and identify new areas for future growth.

[1] https://www.multivu.com/assets/53897/documents/53897-Exenatide-History-FINAL-original.pdf

[2] https://www.diabetes.co.uk/diabetes-medication/diabetes-and-byetta.html

[3] https://www.diabetes.co.uk/diabetes-medication/bydureon.html

[4] https://www.sciencedirect.com/science/article/abs/pii/S0168827810009487

[5] https://www.bmj.com/content/344/bmj.d7771

[6] https://www.nejm.org/doi/full/10.1056/NEJMoa2032183

[7] https://i-base.info/ttfa/8-clinical-trials-and-research/8-7-randomised-double-blind-placebo-controlled-trials/

[8] Meaning outside of its approved license

[9] https://www.novonordisk-us.com/supply-update.html

[10] https://assets.publishing.service.gov.uk/media/651196ffbf7c1a0011bb46a0/Ozempic.pdf

[11] https://investor.lilly.com/news-releases/news-release-details/lillys-tirzepatide-achieved-157-weight-loss-adults-obesity-or

[12] https://data.worldobesity.org/economic-impact-new/?mapid=totgdp&year=2060

[13] https://www.globenewswire.com/en/news-release/2023/02/09/2604662/0/en/Latest-Global-Weight-Loss-and-Weight-Management-Market-Size-Share-Worth-USD-405-4-Billion-by-2030-at-a-6-84-CAGR-Growing-obesity-rate-to-propel-market-growth-Facts-Factors-Industry.html

[14] https://www.who.int/news/item/11-10-2017-tenfold-increase-in-childhood-and-adolescent-obesity-in-four-decades-new-study-by-imperial-college-london-and-who#:~:text=Global%20data%20for%20obesity%20and%20underweight&text=The%20number%20of%20obese%20adults,below%20the%20threshold%20for%20obesity.

[15] https://www.who.int/news/item/04-03-2022-world-obesity-day-2022-accelerating-action-to-stop-obesity

[16] https://gh.bmj.com/content/7/9/e009773

[17] https://gh.bmj.com/content/7/9/e009773

[18] https://pubmed.ncbi.nlm.nih.gov/23859104/

[19] https://pubmed.ncbi.nlm.nih.gov/22475574/

[20] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6022235/

[21] https://www.cdc.gov/nchs/data/databriefs/db313.pdf

[22] https://onlinelibrary.wiley.com/doi/epdf/10.1002/erv.2878

[23] https://fherehab.com/addiction-statistics/

[24] https://www.accessdata.fda.gov/drugsatfda_docs/label/2023/215256s007lbl.pdf

[25] https://www.washingtonpost.com/business/2023/10/09/ozempic-weight-loss-drugs-impact/

[26] Goldman Sachs Data

[27] Bloomberg Data

[28] https://www.medtechdive.com/news/medtech-glp-1-obesity-drugs-fear-stocks/696515/

[29]Perceived GLP Losers: Nestle, Mondelez International, Kraft Heinz, Pepsi, Cocoa Cola, Mc Donalds, Restaurant Brands International, ResMed, Zimmer Biomet, Smith and Nephew.

[30]GLP Producers: Novo Nordisk & Ely Lilly

[31] Philip Morris International

[32] Multiple Airline Operators

[33] Walmart

[34] Nestle SA.

[35] Zimmer Biomet

[36] Global Leaders

[37] Global Leaders

[38] Resmed

[39] https://www.trillianthealth.com/reports/2023-health-economy-trends

[40] https://www.pharmaceutical-technology.com/comment/novo-nordisks-wegovy-supply-challenges/

[41] https://investor.novonordisk.com/q2-2023-presentation/?page=21

[42] https://aspe.hhs.gov/sites/default/files/documents/88c547c976e915fc31fe2c6903ac0bc9/sdp-trends-prescription-drug-spending.pdf

[43] https://healthpolicy.usc.edu/research/benefits-of-medicare-coverage-for-weight-loss-drugs/

[44] https://link.springer.com/article/10.1007/s13300-023-01382-9

[45] The extent to which patients take their medication as instructed, such as dose, frequency, and timing.

[46] The duration between treatment initiation and discontinuation despite continuing to be prescribed the medication.

[47] Weekly subcutaneous injection

[48] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9542252/

[49] https://www.morningstar.com/news/marketwatch/2023101636/what-exactly-are-patients-taking-new-weight-loss-drugs-eating-and-what-are-they-avoiding-bernstein-asked-them

[50] https://www.bloomberg.com/news/articles/2023-10-19/nestle-s-sales-growth-slows-as-volumes-drops-again

[51] https://investor.zimmerbiomet.com/~/media/Files/Z/ZimmerBiomet-IR/reports-and-presentations/assessing-the-potential-impact-of-glp1s-final2.pdf