By MICHAEL FLITTON

By MICHAEL FLITTON

Since 2022, the Federal Reserve has embarked upon the fastest rate hiking cycle since Paul Volcker sat down as Fed Chair in the late 1970s. In just over a year the Federal Funds Rate rose more than 5 percentage points, from 0.25% in February 2022 to 5.5% in July 2023. Reaching such a cost of debt, at such a pace, without instigating an economic crisis came as somewhat of a surprise for many commentators, the prevailing view being that an economy institutionalised since the financial crisis on artificially low rates could no longer stomach historically ‘normal’ levels.

Partly as a result of this view, it took Chair Powell, and his predecessor, years of incrementalist nudging to exit zero interest rates. The first attempt to normalise policy, beginning in 2015, was aborted in the face of investor concerns of what rates in excess of 2% rates might do to businesses.

In this context, the scale and rate of change of interest rates in the current cycle is all the more remarkable. It is easy to see why investors have been bamboozled by the apparent ease with which the US economy has coped.

Source: Bloomberg

Source: Bloomberg

The question of when elevated interest rates meaningfully bite is a consequential one for global asset markets. US economic exceptionalism has kept upward pressure on the US dollar, tightening global liquidity, and funnelling capital into US capital markets.

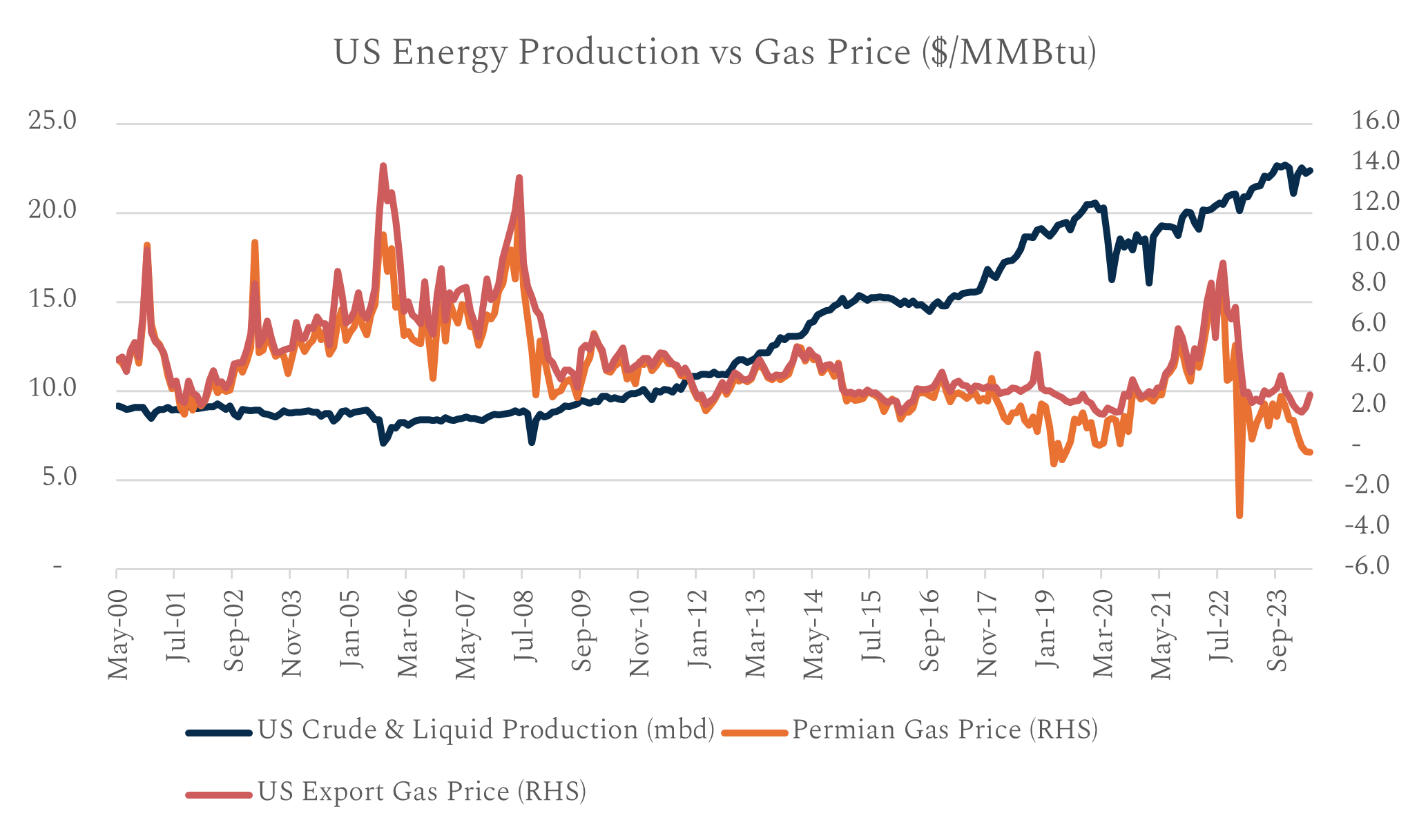

One way to understand US exceptionalism is through energy. Energy is the lifeblood of economic activity. Cheaper and more plentiful energy results in stronger growth, all else being equal. The impact of the Shale Revolution on the US energy position is hard to understate. In just over 10 years, the US has moved from a large net importer of primary energy to the largest energy producer in the world, and a net exporter.

Insufficient infrastructure and regulation continue to limit the true potential of US exports of energy. As a result, much of this surplus is locked in the country resulting in a drastic reduction in the cost of energy, shown below in the cost of gas. In particular places, like the 75,000 square mile Permian Basin that extends from eastern New Mexico and occupies much of West Texas, where natural gas is produced as an associate of targeted oil production, the glut of unwanted gas has turned local pricing negative.

Source: Bloomberg

Source: Bloomberg

This context helps better to understand the relative strength of US economic growth. Even setting aside the localised cheap energy in Texas, comparing the aggregate US gas price with the cost of energy in Europe highlights the relative economic penalty paid by other economies.

Before the Shale Revolution, UK and US gas prices were similar. As shale production accelerated post the GFC the UK economy ended up paying 2-3x more for energy. This then spiked to 7x at the height of the supply chain disruption around the Ukraine war. The UK (and Europe) continues to pay 4x more for its energy inputs than the US.

Source: Bloomberg

Source: Bloomberg

This structural shift in the cost of the key component for growth helps explain the relative economic resilience of the US, in our view. This advantage appears sustainable, absent a change in policy in Europe with regards to exploiting its own, extensive unconventional reserves.

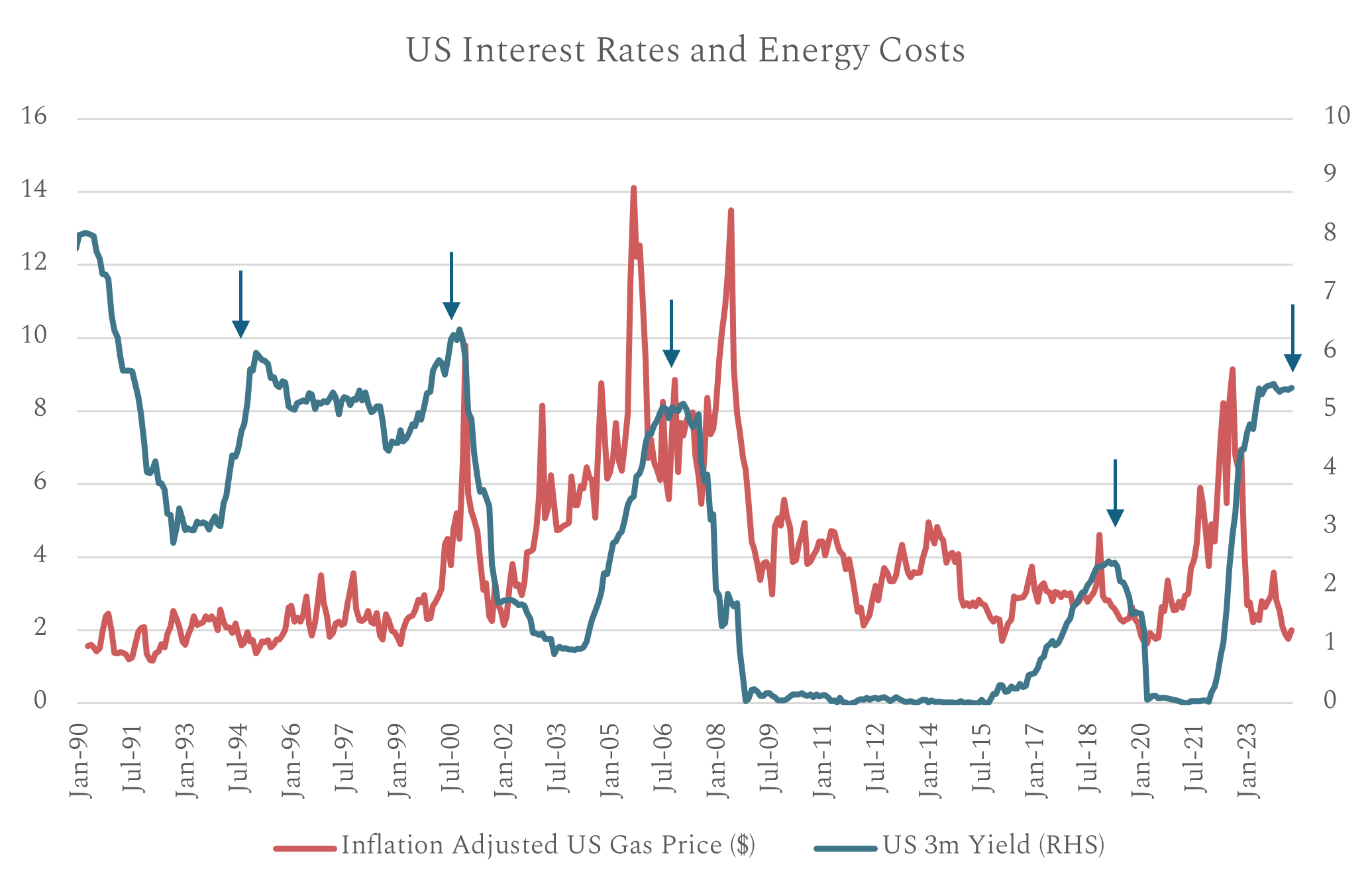

The dramatic change in the energy position of the US has established a much more robust foundation for American businesses than in prior cycles. This should give us pause when attempting to draw conclusions about the impact of current monetary policy from a comparison with the past.

The chart below shows US gas prices adjusted for inflation and short-term US interest rates. It shows that the end of the last three economic expansions saw monetary policy tighten while energy costs were also 2-5x higher than today. Businesses were being squeezed both on operating costs and financing costs. That is not the case today. The last period with a comparable dynamic between interest rates and energy was 1994-5. Interestingly, this period witnessed only a very shallow economic slowing despite a relatively sharp rate hiking cycle.

Source: Bloomberg

Source: Bloomberg

There are many factors influencing the dynamics of economic growth in the US relative to other nations, not least productivity, the terming out of private debt, and the approach to fiscal spending. Nevertheless, looking through the lens of energy offers one of the more helpful approaches, in our view.

We conclude that the relative strength of the US economy compared to other industrialised nations has a structural footing. If the US can sustain higher interest rates then the US dollar is likely to remain firm. While the low cost of energy today points towards a relatively benign path, even if the US economy were to slow, this may not be the case elsewhere.

There have been clear read throughs into equities and bonds. Energy pricing goes some way into explaining the strong performance in US equities versus the Rest of the World, a differential that is now well established in relative valuations. On the bond front, there is more reason to expect interest rate cuts and falling bond yields outside the US, hence favouring non US fixed income.